Interest rates rise for first time in a decade to 0.5%

Almost four million households face higher mortgage payments

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Bank of England has raised interest rates from 0.25% to 0.5% - dealing a major blow to millions of homeowners.

The Monetary Policy Committee voted 7-2 to increase the benchmark rate, and signalled that two more rate increases are likely before the end of 2020, The Wall Street Journal reports.

How the rate rise affects mortgages

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“If you have a fixed-rate mortgage (currently in high demand), you have nothing to worry about - yet. Your rate is guaranteed for the life of your current deal, so there will be no extra cost,” Sky News reports.

However, the website points out that lenders are expected to increase the cost of new fixed-rate mortgages to reflect the Bank of England’s decision, making remortgaging more expensive.

The biggest losers will be households with a variable rate mortgage, the BBC says. Of the 8.1 million households with a mortgage, 3.7 million have either a standard variable rate or a tracker rate.

The average outstanding balance is £89,000, for which payments will increase by about £12 a month, according to trade association UK Finance. Homeowners owing £250,000 with 25 years left on their mortgage can expect to pay an extra £32 per month, or about £384 a year, reports the BBC, citing UK Finance figures.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

How the rate rise affects savers

The rise is good news for savers, who will see higher rates of interest on their current accounts. Money expert Andrew Hagger told the The Sun that the benefits won’t be particularly significant - a rise of 0.25% on a balance of £2,000 will result in a gain of just £5 in interest a year - it is a step in the right direction.

“The average easy-access savings account is currently paying 0.35% in annual interest,” adds the BBC. “Some banks accounts are paying as little as 0.01%. So any rise in base rates could be a welcome boost for savers, even though any increase would be small.”

-

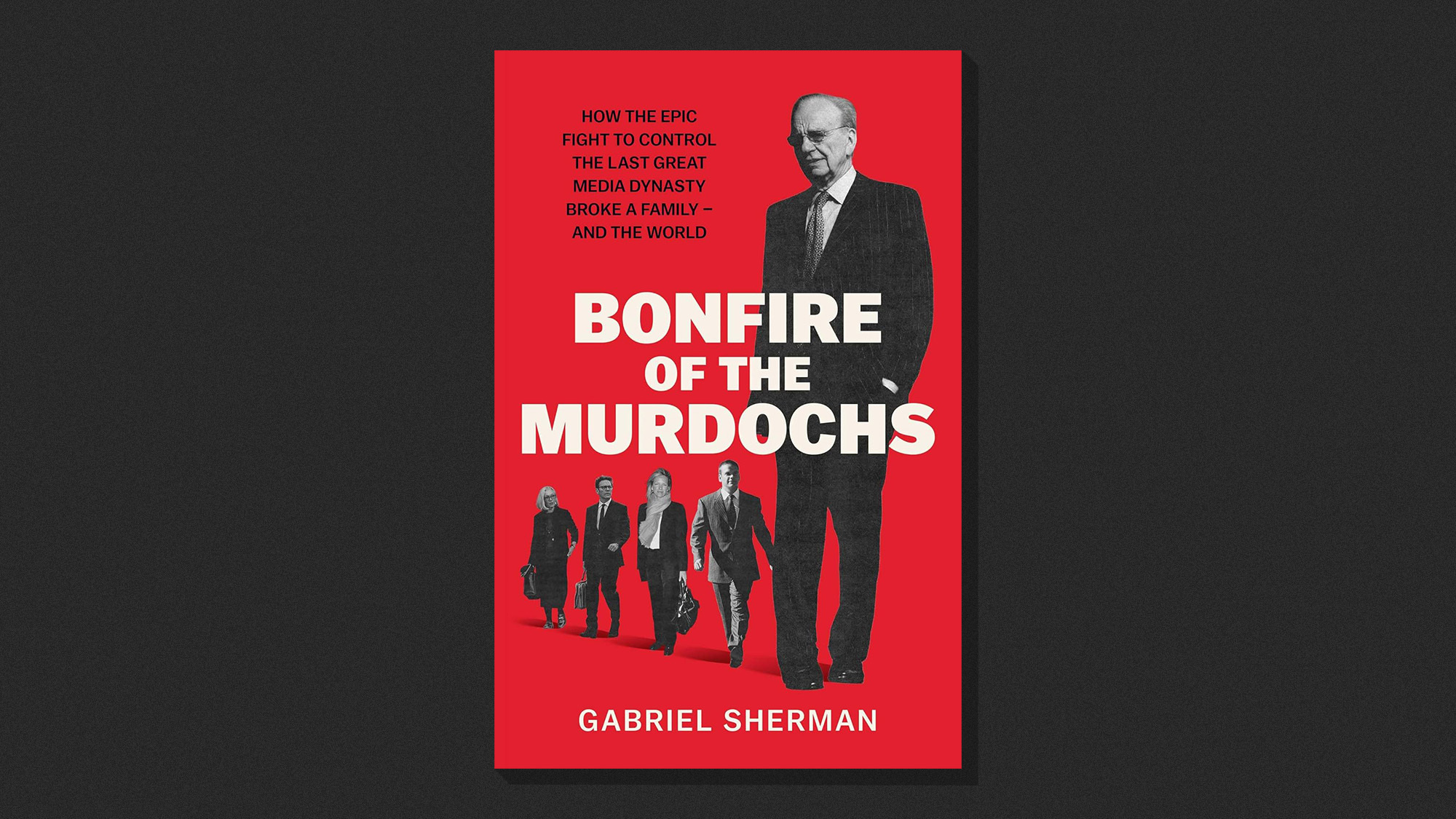

Bonfire of the Murdochs: an ‘utterly gripping’ book

Bonfire of the Murdochs: an ‘utterly gripping’ bookThe Week Recommends Gabriel Sherman examines Rupert Murdoch’s ‘war of succession’ over his media empire

-

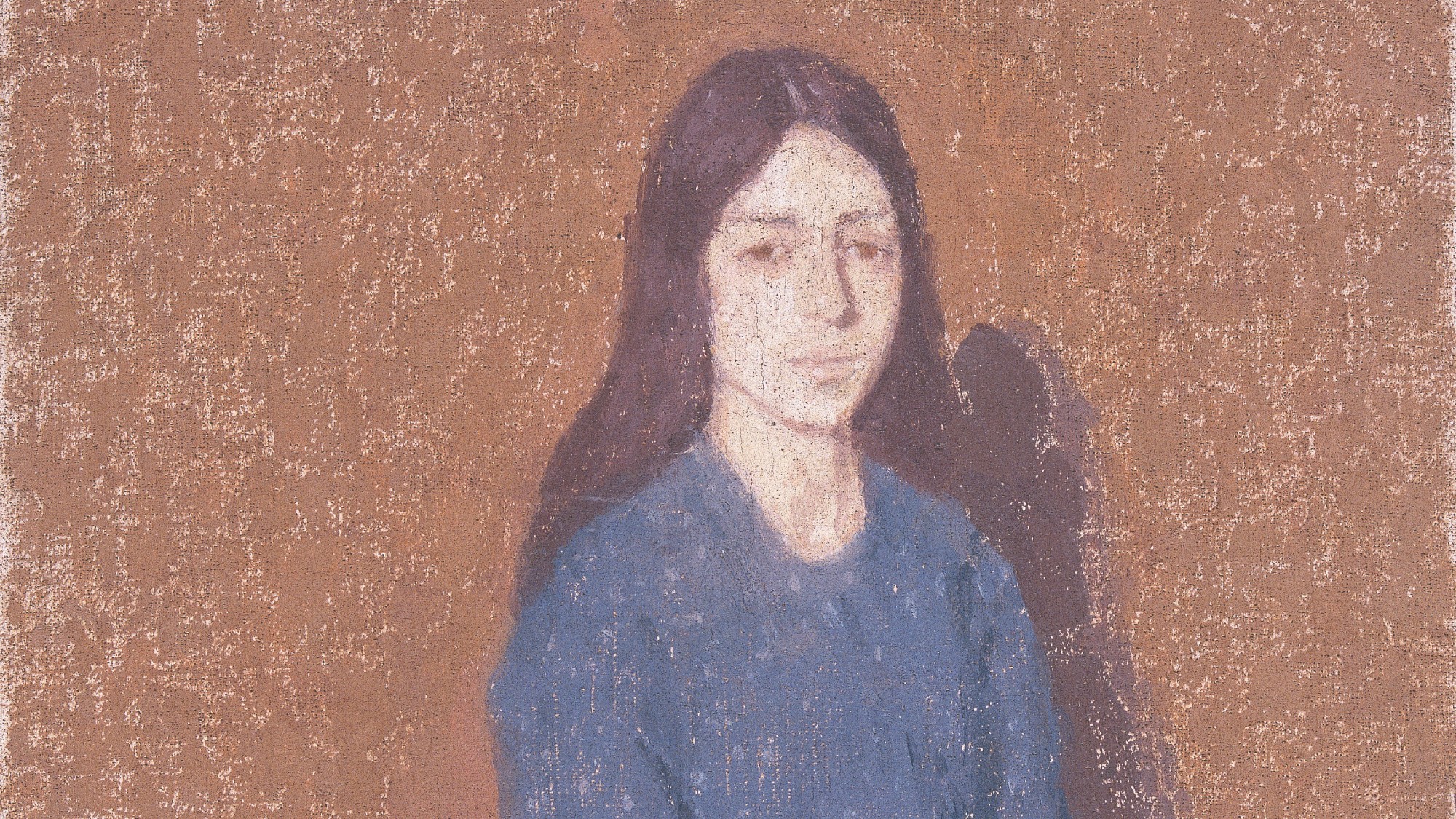

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Should Labour break manifesto pledge and raise taxes?

Should Labour break manifesto pledge and raise taxes?Today's Big Question There are ‘powerful’ fiscal arguments for an income tax rise but it could mean ‘game over’ for the government

-

What are stablecoins, and why is the government so interested in them?

What are stablecoins, and why is the government so interested in them?The Explainer With the government backing calls for the regulation of certain cryptocurrencies, are stablecoins the future?

-

Fed cuts interest rates a quarter point

Fed cuts interest rates a quarter pointSpeed Read ‘The cut suggests a broader shift toward concern about cracks forming in the job market’

-

How will Wall Street react to the Trump-Powell showdown?

How will Wall Street react to the Trump-Powell showdown?Today's Big Question 'Market turmoil' seems likely

-

Will Rachel Reeves have to raise taxes again?

Will Rachel Reeves have to raise taxes again?Today's Big Question Rising gilt yields and higher debt interest sound warning that Chancellor may miss her Budget borrowing targets

-

Fed cuts rates half a point, hinting victory on inflation

Fed cuts rates half a point, hinting victory on inflationSpeed Read This is the Fed's first cut in two years

-

US job growth revised downward

US job growth revised downwardSpeed Read The US economy added 818,000 fewer jobs than first reported