Inflation is high in most advanced economies. Economists say that's probably a good sign.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

"Price gains are shooting higher across many advanced economies as consumer demand, shortages, and other pandemic-related factors combine to fuel a burst of inflation," The New York Times reports. But the fact that "many economies are experiencing a price pop in tandem, even though they used vastly different policies to cushion the blow of pandemic lockdowns," is a hopeful sign that today's above-target inflation numbers won't last.

The U.S., Britain, Canada, New Zealand, South Korea, and Australia don't just have higher-than-wanted inflation, they also share labor shortages and other "oddities of the current economic moment," the Times explains. "Commerce came to a sudden stop and then abruptly restarted when government relief payments padded consumers' wallets, making people eager to spend even as manufacturers struggled to get back to full production and restaurants scrambled to staff back up."

While the police responses differ, G-20 countries collectively pumped about $8.7 trillion worth of government spending into their economies since January 2020. "There is a lot of stimulus in the system, and it is pushing up demand and that's driving higher inflation," Kristin Forbes, an MIT economist, tells the Times. "Some of these big global moves do tend to pass through and prove temporary," but "the big question is: How long will these supply chain pressures last?"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Read more about how this "shared inflation experience" is probably a good omen for each individual country's inflation picture, and why the jolt of inflation may even be a good corrective to years of undesirably low inflation, at The New York Times.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Fine food on a budget

Fine food on a budgetThe Week Recommends Excellent value eateries with the Michelin inspectors’ seal of approval

-

Where to go for the 2027 total solar eclipse

Where to go for the 2027 total solar eclipseThe Week Recommends Look to the skies in Egypt, Spain and Morocco

-

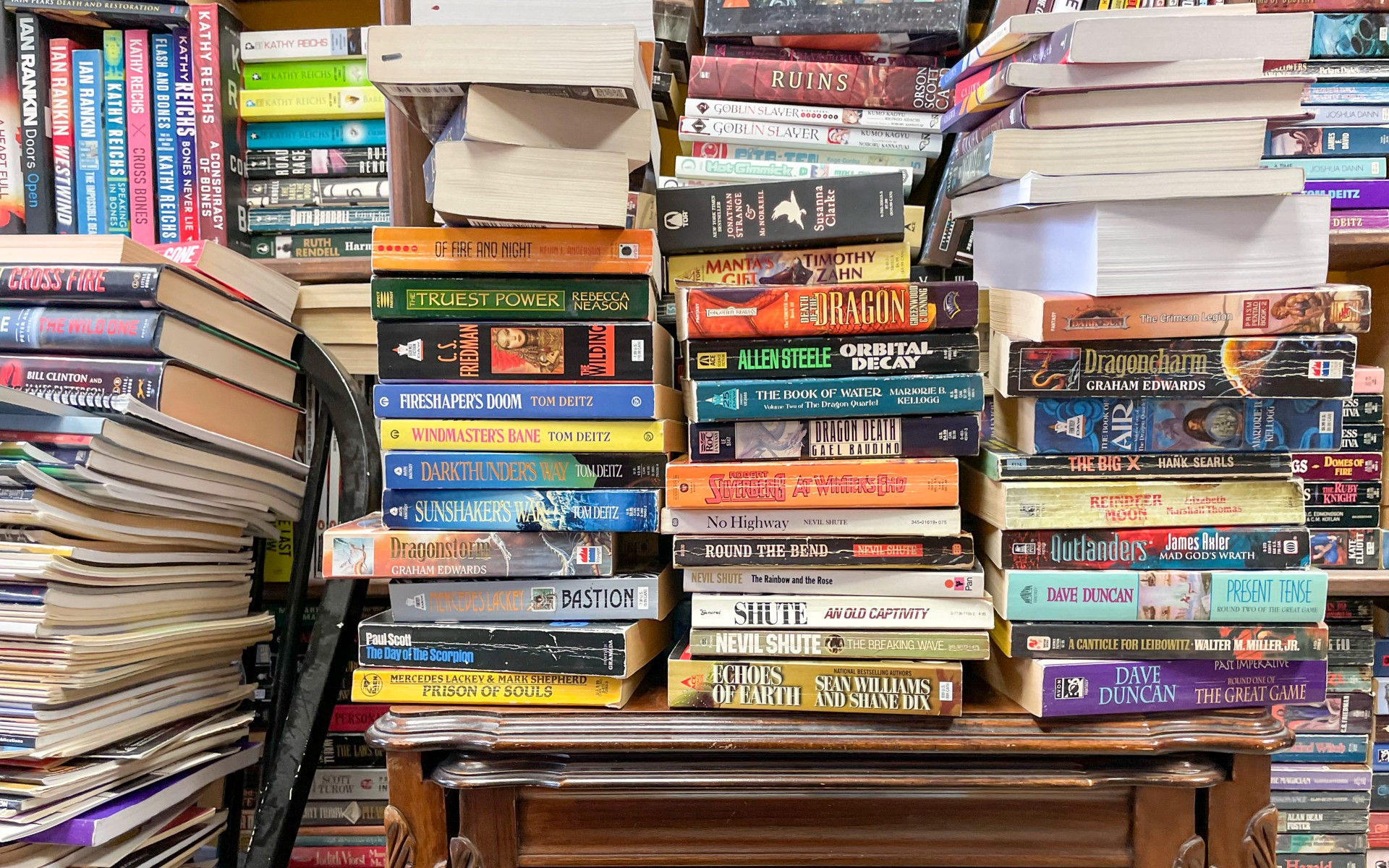

The end of mass-market paperbacks

The end of mass-market paperbacksUnder the Radar The diminutive cheap books are phasing out of existence

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting