How would Rishi Sunak’s VAT cut on energy bills work?

Former chancellor’s latest promise sees him pivot away from his opposition to tax cuts

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In a move described as a “screeching U-turn” by his rival Liz Truss, Rishi Sunak has announced plans to scrap value added tax (VAT) on energy bills if he were to become prime minister. The measure would be implemented if the price cap rises to over £3,000 for a typical household.

Sunak said that his plans, which he called “targeted and temporary”, would last for a year and would save a typical household £160. The bills are part of a “winter plan” to ease the burden of the cost-of-living crisis.

Rising fuel costs

The VAT rate is 20% for most fuel and 5% for domestic heating fuel, according to the government website. Yet due to inflation, which is currently at 9.4%, fuel prices have been steadily rising.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The average price of petrol in June was 183p per litre, while the average price of diesel was 190p per litre. Both of these are the highest since records began.

Because of the rising prices, Sunak has said that VAT cuts will give people “the support they need”, while also “bearing down on price pressures”, reported Reuters.

‘Tax cuts disproportionately benefit the wealthy’

Some have criticised the move. The Resolution Foundation, a think tank focused on improving living standards for those on low to middle incomes, said that personal tax cuts, including the tax cuts proposed by Sunak and Truss, are “not a serious answer” to the cost-of-living crisis and that they would provide the most benefits to higher earners.

Sunak had previously opposed cutting the 5% VAT rate, which he said “would disproportionately benefit wealthier households”, as the cuts would mean that people who used the most energy would save the most money. The Mirror noted that while “Labour have been pushing for a cut to VAT on energy bills for months”, Sunak has stringently opposed it.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But now Sunak has described the VAT cut as “a tool that was always in our arsenal”, with a source close to the former chancellor describing his proposal as simply “a response to latest estimates”.

Cuts are ‘not inflationary’

In the past, Sunak has criticised tax cuts for causing inflation and “repeatedly stressed the risks of unfunded promises”, said The Guardian. However, his allies have made it clear that in this case the cut will not be inflationary.

“The thing is, with this particular cut, what it does not do is add to inflation”, Transport Secretary Grant Shapps told ITV’s Good Morning Britain. “In fact, in the short term it would be deflationary because people’s costs would reduce [and] in the medium term it would not have an impact on the consumer prices index.”

Bloomberg economist Dan Hanson, who has suggested that the VAT cuts could cost the government £4bn, said that the measure will actually lower inflation, reducing it by 0.4 percentage points by October. He added that this would then lead to a 0.4-point uptick in inflation after the tax holiday expires a year later.

‘Screeching U-turn’

Sunak’s critics have questioned why he has now introduced a pledge to cut VAT after spending most of his campaign so far refusing to promise immediate tax cuts.

The promised cuts were an “an apparent climb-down” from Sunak’s previous agenda, said The Telegraph, made after polling showed Liz Truss, who has an “unashamedly tax-cutting agenda,” in the lead among Conservative party members.

One YouGov poll showed that 50% of Conservative party members thought Truss outshone Sunak in Monday night’s BBC debate, while only 39% thought that Sunak outdid his rival.

Patrick O’Flynn of The Spectator agreed, saying that while Sunak had previously advocated for “hair-shirted fiscal responsibility”, he was now “trying to grab some of (Truss’s) tax-cutting brownie points” with his late-to-the-game VAT cuts.

Business Secretary Kwasi Kwarteng described the decision as “a screeching handbrake U-turn”. “[Sunak] was saying that tax cuts were a fairytale; now he is proposing an unfunded tax cut,” he said, adding that the move shows Sunak is under “a lot of pressure” from the Truss campaign.

-

NIH director Bhattacharya tapped as acting CDC head

NIH director Bhattacharya tapped as acting CDC headSpeed Read Jay Bhattacharya, a critic of the CDC’s Covid-19 response, will now lead the Centers for Disease Control and Prevention

-

Ex-South Korean leader gets life sentence for insurrection

Ex-South Korean leader gets life sentence for insurrectionSpeed Read South Korean President Yoon Suk Yeol was sentenced to life in prison over his declaration of martial law in 2024

-

At least 8 dead in California’s deadliest avalanche

At least 8 dead in California’s deadliest avalancheSpeed Read The avalanche near Lake Tahoe was the deadliest in modern California history and the worst in the US since 1981

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

How are Democrats turning DOJ lemons into partisan lemonade?

How are Democrats turning DOJ lemons into partisan lemonade?TODAY’S BIG QUESTION As the Trump administration continues to try — and fail — at indicting its political enemies, Democratic lawmakers have begun seizing the moment for themselves

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

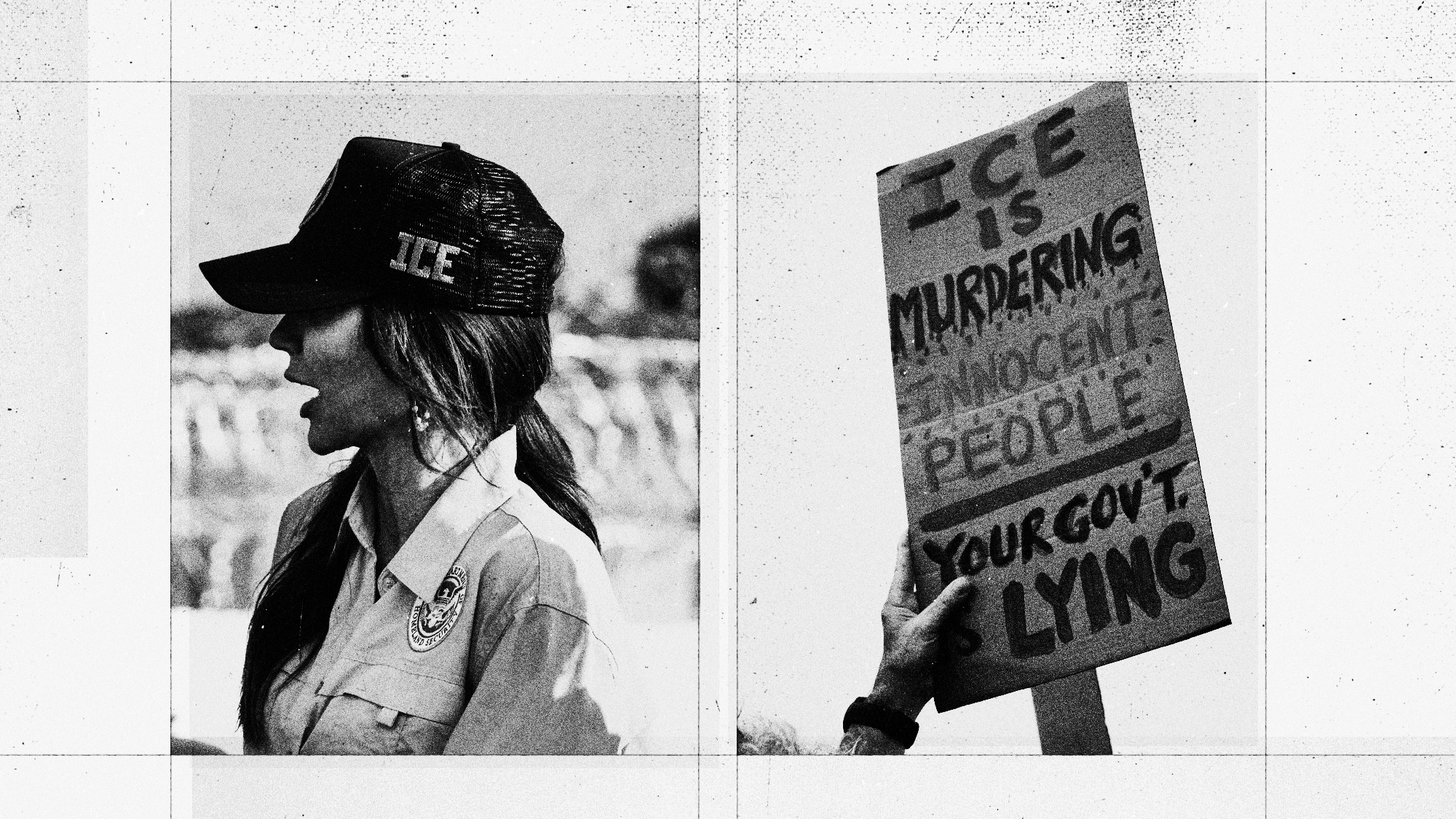

How did ‘wine moms’ become the face of anti-ICE protests?

How did ‘wine moms’ become the face of anti-ICE protests?Today’s Big Question Women lead the resistance to Trump’s deportations

-

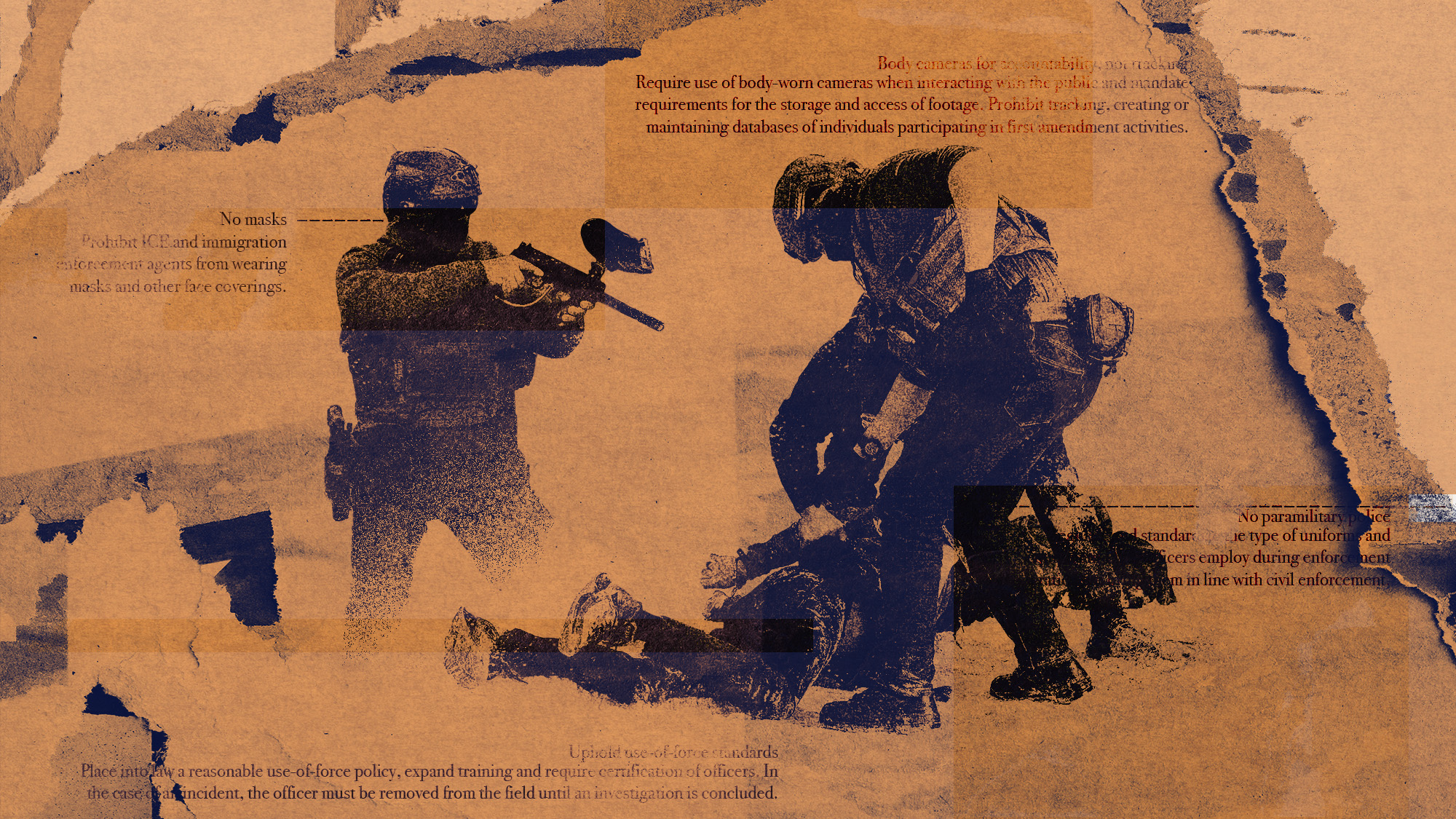

How are Democrats trying to reform ICE?

How are Democrats trying to reform ICE?Today’s Big Question Democratic leadership has put forth several demands for the agency

-

The Mandelson files: Labour Svengali’s parting gift to Starmer

The Mandelson files: Labour Svengali’s parting gift to StarmerThe Explainer Texts and emails about Mandelson’s appointment as US ambassador could fuel biggest political scandal ‘for a generation’

-

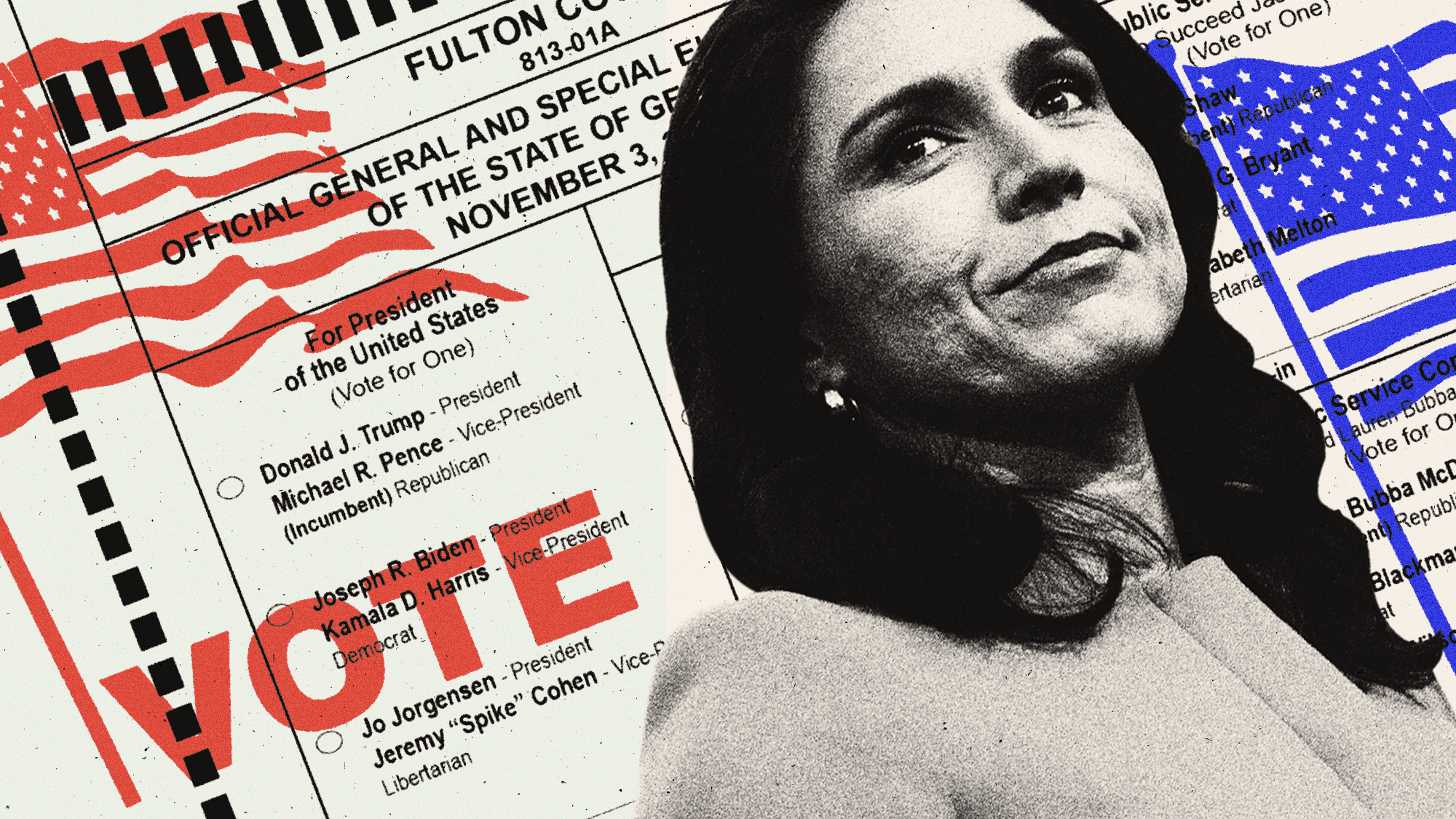

Why is Tulsi Gabbard trying to relitigate the 2020 election now?

Why is Tulsi Gabbard trying to relitigate the 2020 election now?Today's Big Question Trump has never conceded his loss that year

-

Will Democrats impeach Kristi Noem?

Will Democrats impeach Kristi Noem?Today’s Big Question Centrists, lefty activists also debate abolishing ICE