From Nando’s chicken to microchips: why pandemic shortages are hard to predict

Fast-food chain’s recent problems highlight weaknesses in how businesses forecast supply and demand

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Lancaster University professor of business analytics John Boylan on how retailers worldwide could avoid future disruptions to supply chains like those triggered by the Covid-19 crisis

Peri-peri chicken fans were disappointed and frustrated when Nando’s announced the temporary closure of nearly 50 restaurants. A chicken shortage has been blamed, and while reactions to the closures were satirised on social media, the problem is a serious challenge for the company.

Hungry customers will no doubt be asking whether the supply could have been better managed. Similar questions were more widely raised at the beginning of the pandemic when supermarkets ran out of toilet roll and flour.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Some blamed poor planning by retailers, but spikes of demand like this had not been seen before. And the pandemic continues to disrupt established supply chains.

A recent shortage of microchips for example is partly due to increased demand for appliances such as phones and games consoles, and a resurgence of coronavirus cases in Asia (where most microchips are made). The situation is so serious that Toyota is being forced to temporarily cut vehicle production by 40%.

Pandemics aside, patterns in demand for goods generally show fluctuations from day to day and from week to week. Some of these are explainable and predictable, for example because of known periods of high demand, like Bank Holiday weekends.

Other changes defy explanation or prediction and are described in statistical forecasting models as “noise”. And although the nature of the next “noise disturbance” is not known, its impact can be measured and taken into account when setting stock levels. But even this careful approach breaks down when there is a sudden spike in demand, unlike anything that has previously occurred.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The current shortages of chicken at Nando’s are due to disruptions in supply, rather than demand, which could not necessarily have been expected.

From a forecasting perspective, sudden changes in supply are similar to sudden changes in demand. Inventory control systems usually base their stock calculations on a regular lead time (the length of time from placing an order to when the product arrives and is ready for the customer).

If there are occasional minor variations in the lead time, the calculations can be adjusted accordingly. But again, such an approach breaks down if there is a sudden major problem unlike any others that have gone before.

In this situation, we should have some sympathy for Nando’s. It would be incredibly wasteful of them to carry large stocks of raw chicken in anticipation of a possible major disruption.

Chicken out

If they were to do this in normal times, a significant proportion of meat would be unused and go off. Clearly, this is not a viable solution.

Instead, the problem of major disruptions calls for a different approach to forecasting, known as scenario planning. The problem at Nando’s seems to have been caused by labour shortages at their suppliers. And while the timing of labour shortages could not have been anticipated, their occurrence - at some point - could have been foreseen.

In a scenario planning exercise, managers imagine major causes of disruption that could happen in the future. This sort of exercise will never be perfect, and some events will remain uncovered, but this should not deter progress being made by thinking through potential supply chain problems and the company’s response.

For example, if an organisation is reliant on a single supplier for a product then they may consider introducing a second supplier, who will also receive regular orders and can flex to respond to higher order volumes if there are problems at the first supplier.

This can also help to address responses to unexpected spikes in demand. And if a problem affects all suppliers, then plans can be put in place to order larger quantities of substitute products.

As a general rule though, the demand forecasting methods embedded in supply chain software should work well in normal times and can be used with confidence as the basis for stock replenishment planning. To anticipate extraordinary times, forecasting needs to shift from a system-based to a human-based activity.

Managers should attempt to foresee the major causes of shocks to their supply chains and put in place policies that will mitigate their effect. This will be beneficial not only to restaurant chains in developed economies, but also to humanitarian supply chains in which food, clothing and medicines are desperately needed.

John Boylan, professor of business analytics, Lancaster University.

This article is republished from The Conversation under a Creative Commons licence. Read the original article.

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What's Jeff Bezos' net worth?

What's Jeff Bezos' net worth?In Depth The Amazon tycoon and third richest person in the world made his fortune pioneering online retail

-

'Brain drain' fear as record numbers leave New Zealand

'Brain drain' fear as record numbers leave New ZealandUnder The Radar Neighbouring Australia is luring young workers with prospect of better jobs

-

Ghost kitchens are pulling a disappearing act

Ghost kitchens are pulling a disappearing actunder the radar The delivery-only trend is failing to live up to the hype built up during the pandemic

-

The birth of the weekend: how workers won two days off

The birth of the weekend: how workers won two days offThe Explainer Since the 1960s, there has been talk of a four-day-week, and post-pandemic work patterns have strengthened those calls

-

Why household wealth took off during the pandemic

Why household wealth took off during the pandemicUnder The Radar The Covid-19 pandemic caused a lot of pain and hardship, but new research shows it also left most Americans wealthier

-

Empty office buildings are blank slates to improve cities

Empty office buildings are blank slates to improve citiesSpeed Read The pandemic kept people home and now city buildings are vacant

-

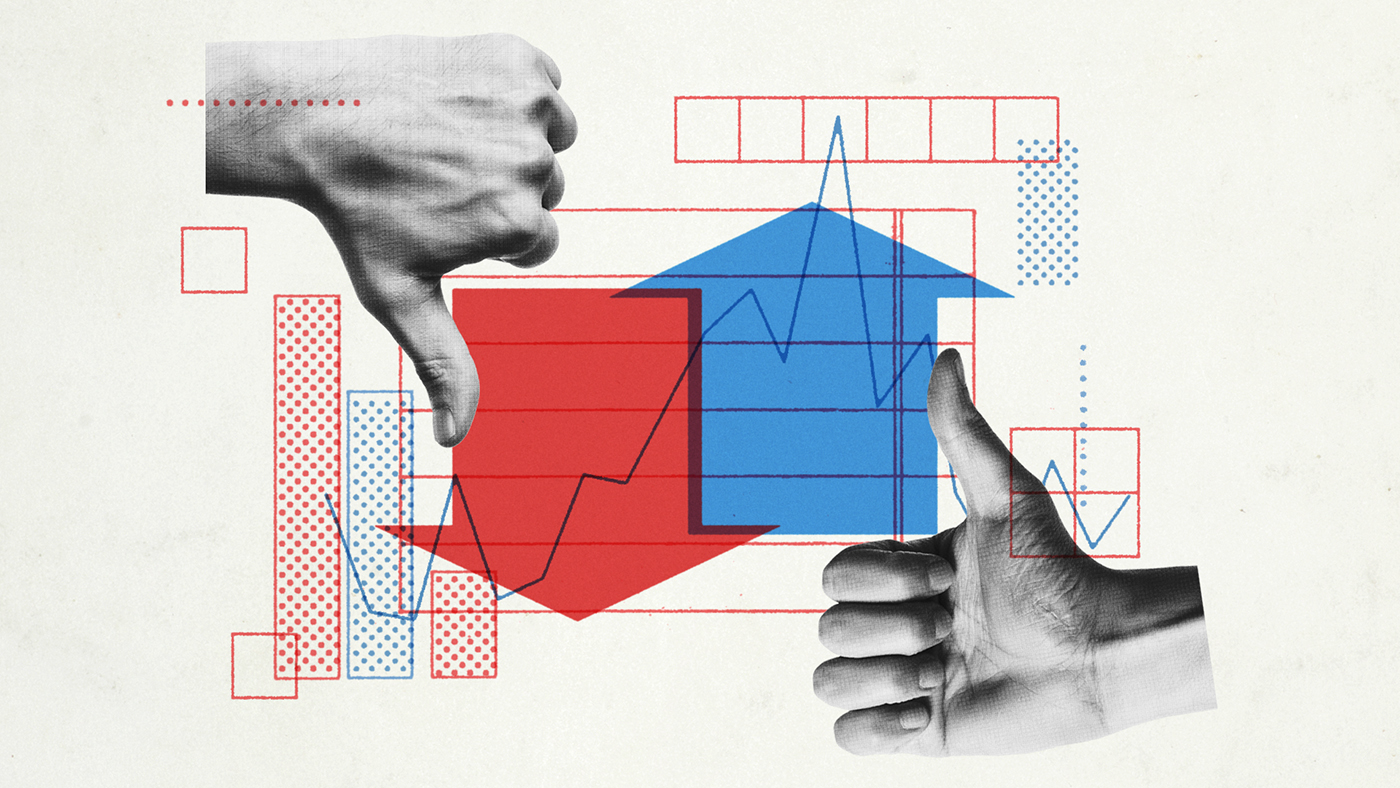

Inflation vs. deflation: which is worse for national economies?

Inflation vs. deflation: which is worse for national economies?Today's Big Question Lower prices may be good news for households but prolonged deflation is ‘terrible for the economy’

-

America's 'cataclysmic' drop in college enrollment

America's 'cataclysmic' drop in college enrollmentToday's Big Question "The slide in the college-going rate since 2018 is the steepest on record"