How much should you spend on holiday gifts?

Let your personal budget be your guide

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

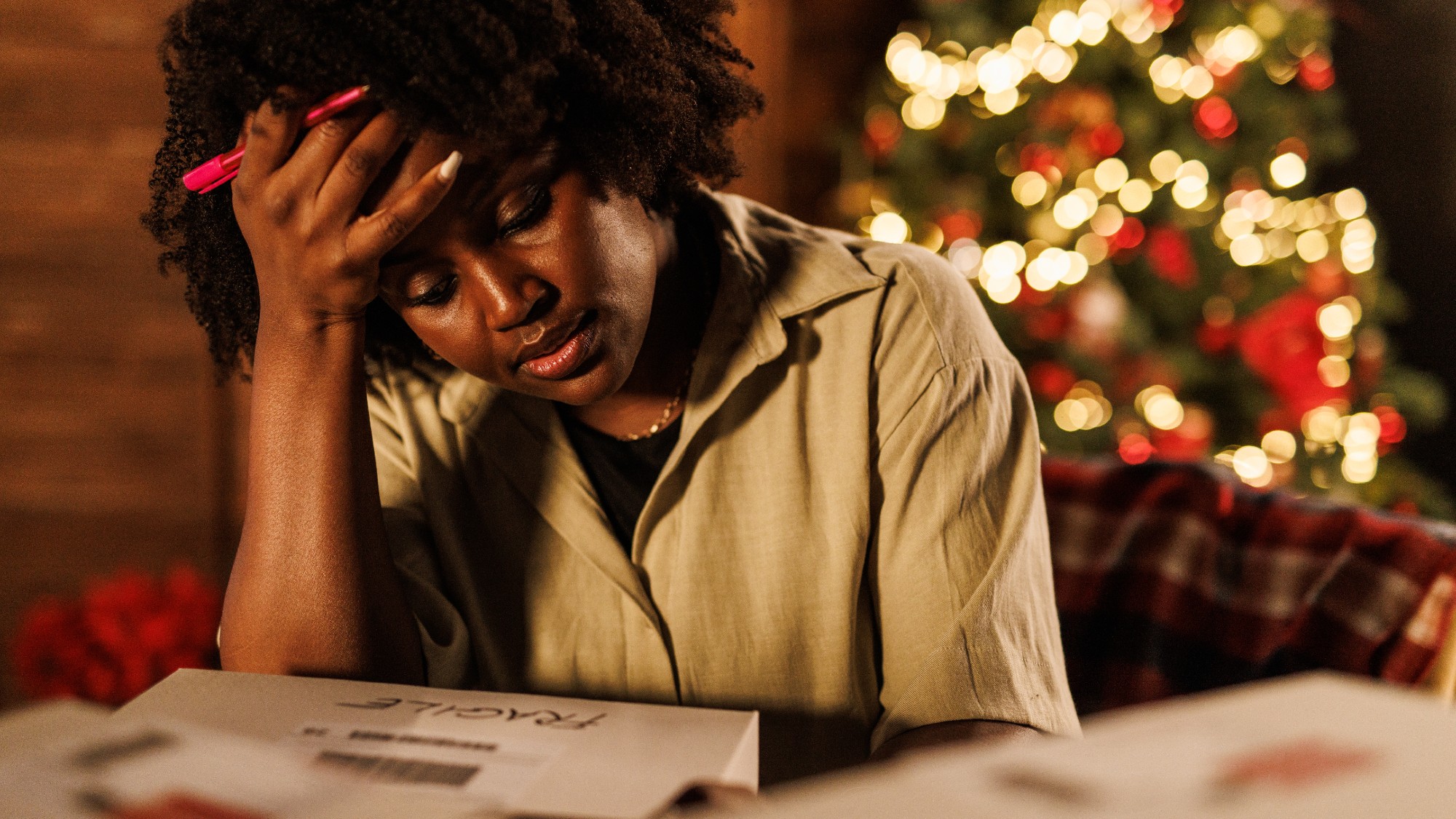

Gift-giving can feel like a difficult needle to thread. On the one hand, you want to be generous and give a gift you know the receiver will cherish. On the other, you have your own budget to contend with, along with any constraints that may bring.

In trying to find the right balance, many err on the side of overspending. "Roughly 10% of consumers expect to draw from their emergency fund to buy gifts, and 9% will prioritize gifts over household bills such as utilities and debt payments," said CNBC, citing a NerdWallet survey. "Almost half of shoppers will fund this year's spending with loans or credit cards," the outlet added, citing a recent survey by professional services firm EY.

No matter how good it feels to see a loved one's face light up after unwrapping a thoughtful present, it will probably not feel so good come January, when you are stuck with an even tighter budget and potentially a pile of debt. Read on for some guidance on how to make gifting a merry experience — for everyone involved.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What is an appropriate amount to spend on gifts?

Some people may want to take into account the amount of money etiquette dictates is appropriate to spend. But the truth is, "there's no universal standard for what to spend on a gift for a child, or a spouse or a houseload of in-laws," said USA Today.

In fact, said Ally Financial Inc., "the amount put toward a gift varies from person to person and the celebratory event being commemorated." While "sometimes, you want to give a little extra to your loved one," in other cases, you may not need to spend all that much.

If you are still feeling stuck on how much you should spend, think about how close you are to the intended gift receiver. "If your relationship is less defined, it may be more appropriate to opt for a more conservative amount when gifting," rather than going all out, said Ally.

How should your personal budget influence your gift spending?

Your budget should play a big role in how much you spend on gifts. "Looking at your budget and how much you can allocate to gift giving should be the first step in striking the right balance," said Ally. "If the gift will significantly impact your ability to pay for your monthly necessities, stick to giving a dollar amount that makes sense for you."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In an ideal world, you would have "set up a holiday savings account ahead of time," said CNBC Select, and already have the gifting funds. But that is not always possible, and "if you've had to tap into your savings account this year," then you should "adjust your budget accordingly" — perhaps considering what you could cut for the month to expand your gift-giving allowance. For instance, said USA Today, "consider cutting back on restaurant and concert outings over the next month, and budget the remaining funds for gifts."

How can you give a thoughtful gift without breaking the bank?

It may sound cliché, but "it really is the thought that counts" when it comes to gifting, rather than the dollar value of whatever you are wrapping up, said U.S. News & World Report. "In general, the best gifts are the ones that are thoughtful, not the ones that are expensive. I'd take a batch of your homemade brownies from a recipe that has been passed down in your family for generations over the $250 box of Swiss chocolate truffles any day," said Nick Leighton, the host of etiquette podcast "Were You Raised By Wolves?," to the outlet.

With Leighton's advice in mind, "consider what kind of holiday experiences would bring you cheer and delight," said CNBC Select. "Send [loved ones] a sweet note or a phone call and check in and see how they're doing," Brittney Castro, a certified financial planner, said to the outlet.

If you are worried you will look stingy, you might want to "have a conversation with your loved ones to set expectations around gift-giving," said USA Today. You can give them advance notice "if you plan to spend a little less this year," and "suggest they do the same."

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.