4 ways to brush up on your personal finance knowledge

It's never too late to improve your financial literacy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

For many people, figuring out finances is a learn-as-you-go experience. While school may have offered instruction on everything from math to grammar, there was likely a glaring hole in the curriculum when it came to Finance 101.

The good news is that kids these days may get a little more guidance with their finances. With Kentucky becoming the "latest state to codify financial literacy as a stand-alone class needed for high-schoolers to graduate," there are now a total of "36 states with some form of financial literacy requirement for high school graduation," said The Washington Post, citing the Council of Economic Education.

Even if you are long out of high school, it is not too late to improve your financial know-how. The best part? No grades involved.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

1. Do some reading

There are endless financial books out there covering just about any topic you may want to learn about, whether that be a basic brushup on budgeting or a deepdive into strategic investing. Consider building your financial foundation with some more beginner-friendly books, then move to the deeper cuts as your knowledge base broadens. It is wise to try reading a "variety" of different books "to get different perspectives on how to manage your money at different stages," said Fidelity.

2. Take advantage of online resources

The internet is a great place to look when it comes to sharpening your financial literacy (just make sure you are getting your information from a trustworthy source). YouTube, for example, "has content on virtually any financial topic you'd like to learn more about, from saving hacks for helping you buy your first car to the pros and cons of buy now, pay later (BNPL) credit services," said Investopedia. Plus, "the content is free and allows you to build upon your knowledge as you go."

Another good place to turn is the website of the Consumer Financial Protection Bureau (CFPB), which has a compilation of guides, worksheets and tools on topics ranging from auto loans and mortgages to credit cards and money management. The website is available in both English and Spanish.

3. Attend a seminar

Local financial planners and investment firms "regularly host free events on topics like insurance, investing and retirement planning," said Fidelity. While technically they are offering them "in hopes of recruiting new clients," you can show up just to learn. For more personalized advice, you might opt to work with a financial professional.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Your employer may also be a resource worth tapping, as some companies provide "seminars to explain employee benefits like health insurance and a 401(k)," said Fidelity.

4. Sign up for a course

Open to hitting the books again? You can always go back to school, this time for the finance basics. There are "thousands of in-person and online courses," and "many universities offer free or paid online courses that you can take at any time," said Investopedia.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

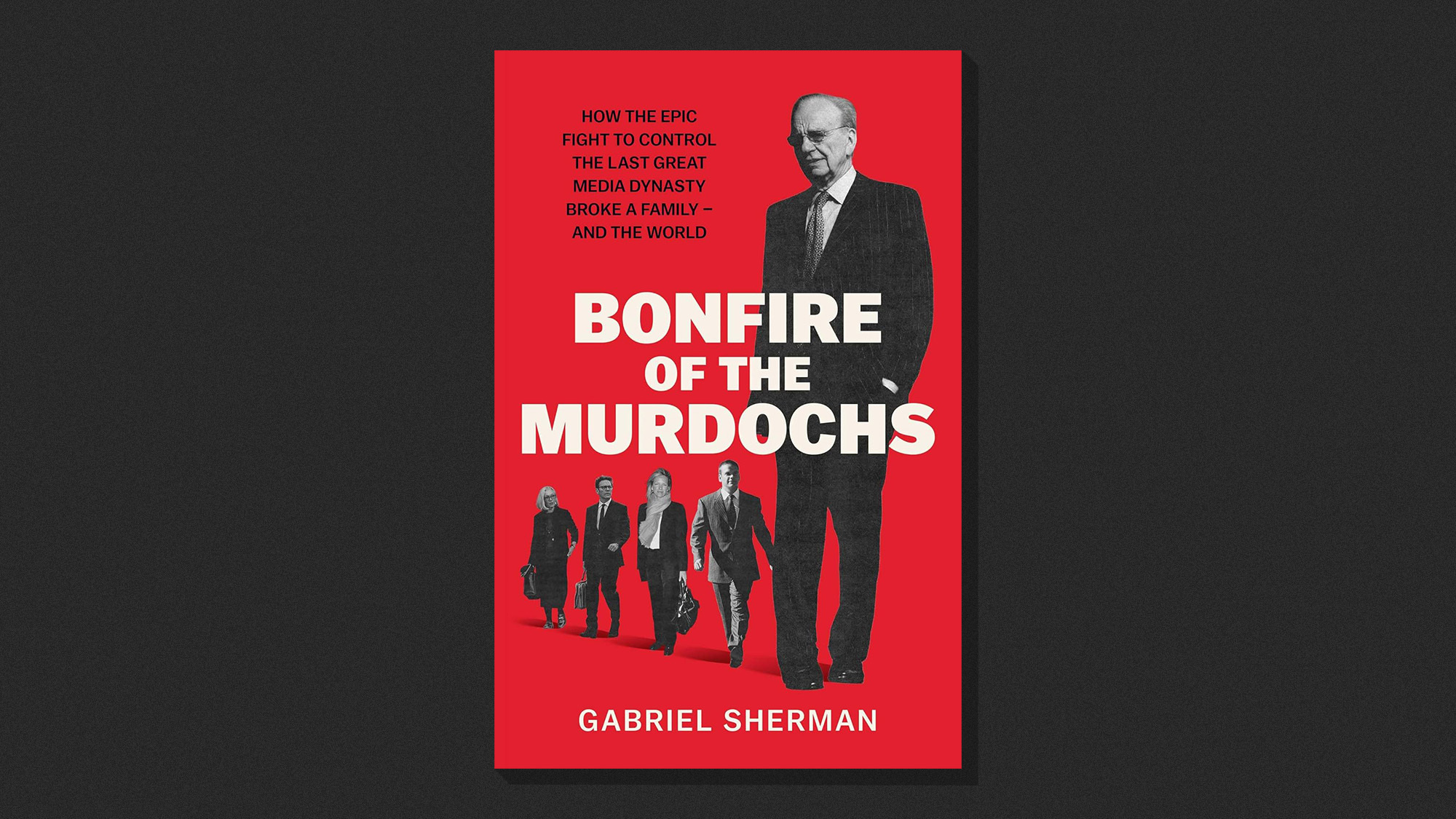

Bonfire of the Murdochs: an ‘utterly gripping’ book

Bonfire of the Murdochs: an ‘utterly gripping’ bookThe Week Recommends Gabriel Sherman examines Rupert Murdoch’s ‘war of succession’ over his media empire

-

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

What’s a good credit card APR?

What’s a good credit card APR?The Explainer They have gotten even steeper in recent years

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

Filing statuses: What they are and how to choose one for your taxes

Filing statuses: What they are and how to choose one for your taxesThe Explainer Your status will determine how much you pay, plus the tax credits and deductions you can claim

-

The pros and cons of tapping your 401(k) for a down payment

The pros and cons of tapping your 401(k) for a down paymentpros and cons Does it make good financial sense to raid your retirement for a home purchase?

-

3 tips to help protect older family members from financial scams

3 tips to help protect older family members from financial scamsthe explainer Prevent your aging relatives from losing their hard-earned money