What to do if you're worried about running out of money in retirement

Inflation is putting more retirees at risk

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Persistent inflation is making the already common fear of running out of money in retirement much more real. A recent study from Boston College revealed that inflation is putting "more retirees at risk of running out of money," as "rising prices require bigger withdrawals from retirement savings," said The Wall Street Journal.

This is likely to hit less wealthy retirees harder. "The study projects that inflation will reduce the financial wealth of retirees in the top third of the wealth distribution by an average of 4.3% by 2025," said the Journal, whereas "those in the bottom third, who rely more heavily on cash and bonds in their retirement savings, are likely to experience an 18.8% reduction by 2025 due to inflation."

While this can become an understandably stressful financial situation, there are steps you can take to better ensure your retirement funds see you through.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Reassess how much retirement income you really need

Whether you are still in the planning phase or have already retired, it is never too late to take a second look at your retirement budget (or make one, if you have not already). "Financial experts agree: There's no way to stretch money in retirement if you don’t know your income and expenses," said U.S. News & World Report.

Determine how much you actually need to withdraw each month to cover necessary expenses while keeping a lid on other spending, without draining your savings too quickly. Keep an eye out for any debt balances that start growing, as this is "a huge red flag," said SmartAsset, and "a sign that you need more money than you have and that debt service will only grow as you age."

If your debt is growing, figure out how you can adjust accordingly, whether by cutting back or finding an additional source of income.

Reinvest some of your funds

Even though "the rule of thumb is often to shift your assets to an 80/20 mix between safe investments, like bonds and growth investments, like an equity index fund" as you near retirement, what experts "do not recommend is that you take your money out of the market entirely," said SmartAsset.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

If concerns about running low on money are cropping up, consider reinvesting some of your funds to try to capture potential returns. Just make sure to be measured about any risks you end up taking — otherwise, you could end up in an even worse situation.

For instance, you might tie "essential living expenses" to "'guaranteed income sources, such as Social Security, pensions, and annuities," while "for more discretionary expenses, such as travel and entertainment, you can withdraw from money you're willing to take more risk with," Clay Hessel, the vice president of wealth management at Alera Wealth Services, said to CNBC Make It.

Be strategic about tapping Social Security and retirement accounts

Another way to secure some more retirement income for yourself is to hold off on taking Social Security. While "you're entitled to your complete Social Security benefit, based on your personal wage history, once you reach full retirement age," you can "give your monthly benefit a boost of 8% per year if you hold off on claiming it, up until age 70," said The Motley Fool.

Tapping other retirement accounts should involve some careful consideration, too. As it turns out, "tapping your IRA or 401(k) whenever you want money could put you at risk of depleting those funds sooner than expected," said The Motley Fool, "so rather than take your withdrawals at random, have a plan" for when you'll make withdrawals and how much you'll take out.

Consider some part-time work

While many people associate retirement with the end of their working days, sometimes income needs stipulate otherwise. "As much as you may dread this, it's important that you remember that work in retirement can be redefined," said USA Today — now, "you only need to work enough to supplement the other income sources that you have."

This can mean doing a role that is radically different from what you did throughout your career, or a little more of the same, depending on what you prefer. For example, "seniors could pursue traditional part-time jobs or work as a consultant in their former field," or they may consider "renting rooms out or finding a position within the emerging sharing economy," said U.S. News & World Report.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

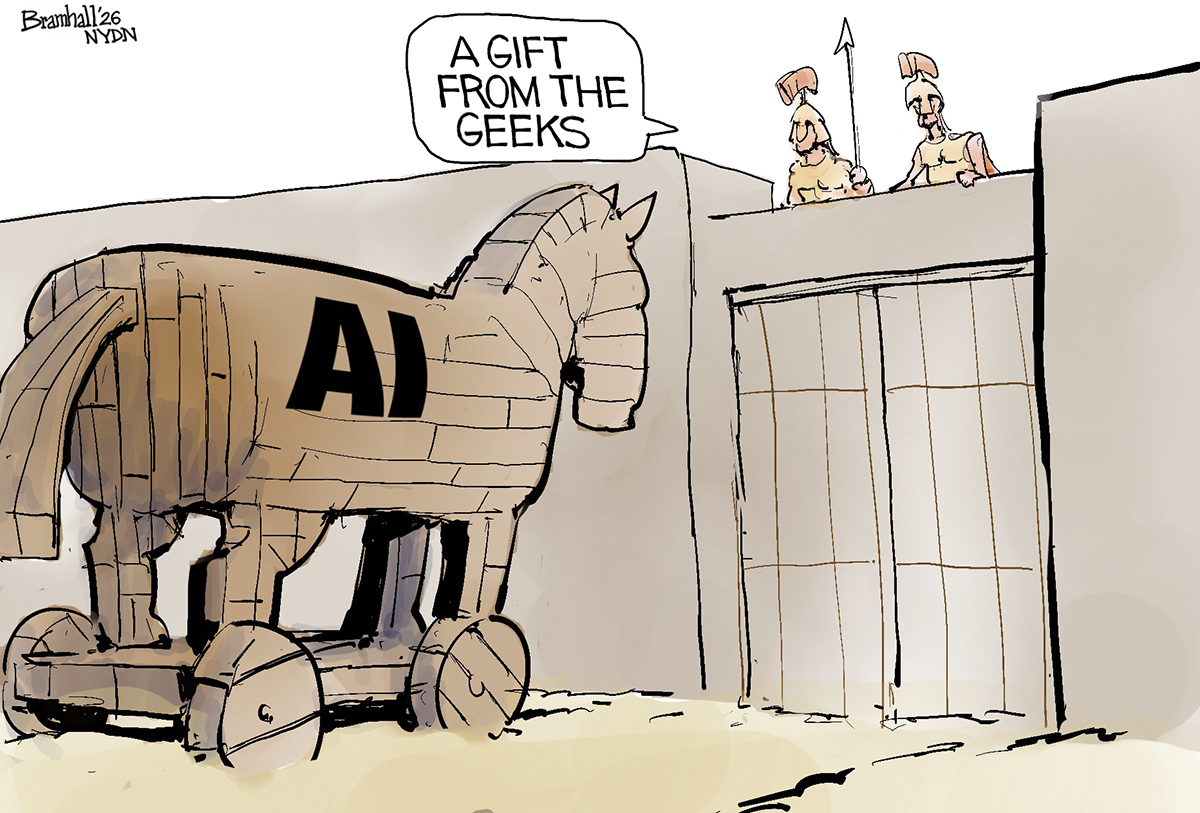

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

What’s a good credit card APR?

What’s a good credit card APR?The Explainer They have gotten even steeper in recent years

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

Filing statuses: What they are and how to choose one for your taxes

Filing statuses: What they are and how to choose one for your taxesThe Explainer Your status will determine how much you pay, plus the tax credits and deductions you can claim

-

The pros and cons of tapping your 401(k) for a down payment

The pros and cons of tapping your 401(k) for a down paymentpros and cons Does it make good financial sense to raid your retirement for a home purchase?

-

3 tips to help protect older family members from financial scams

3 tips to help protect older family members from financial scamsthe explainer Prevent your aging relatives from losing their hard-earned money

-

Saving for a down payment on a house? Here is how and where to save.

Saving for a down payment on a house? Here is how and where to save.the explainer The first step of the homebuying process can be one of the hardest