How long should you hold on to tax documents?

Here is what you need to keep and how long to keep it

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

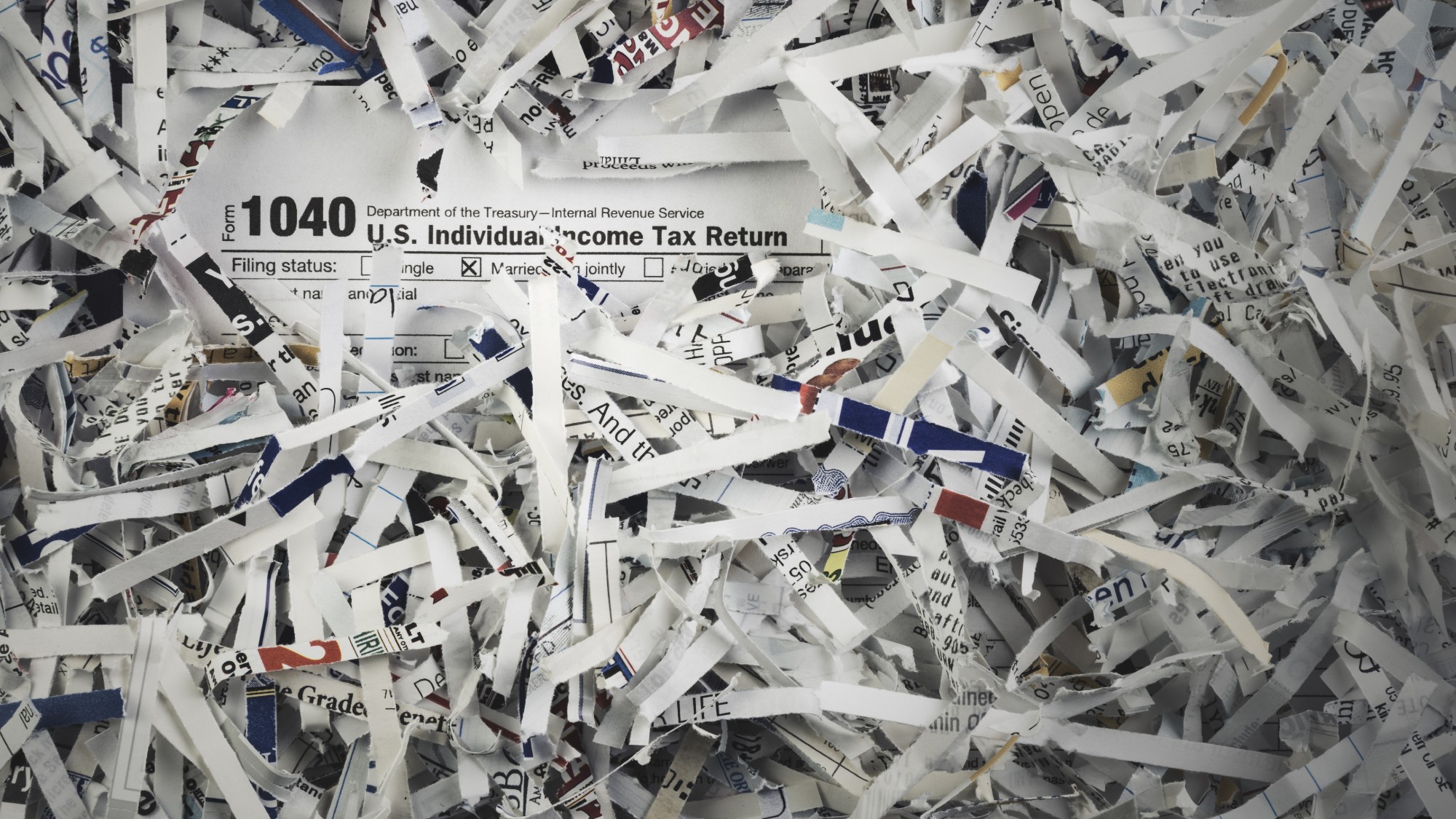

Even once your tax return is turned in, do not run any documents through the shredder just yet. You will want to hang on to certain items, such as tax forms and supporting paperwork, in case of an audit or another issue with your taxes.

If you are the type that likes to declutter, you may wonder: Just how long do I need to keep those documents, anyway? "Generally, you should plan on keeping all tax documents for a minimum of three years in case you get audited," said Yahoo Finance. But you may want to hang on to certain documents for even longer than that.

Which tax documents do you need to keep?

While you will need to keep some tax-related documents in your possession, the good news is that you do not have to save absolutely everything. Rather, you can sort through your stack of paperwork and pull out specific items. In general, said Intuit TurboTax, it is "best practice to keep tax forms and supporting paperwork related to":

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

- Income, such as W-2s and 1099s

- Expenses and corresponding deductions, such as invoices, receipts and mileage logs

- Investments and retirement accounts, such as 401(k) statements and distribution statements

- Property, such as property tax assessments and purchase records

How long should you save different tax documents?

As mentioned, how long you need to keep saving tax-related papers varies depending on what type of document it is. As a general rule of thumb, though, you will want to hang on to most documents for at least three years, since the "IRS has three years to decide whether to audit" your return. Additionally, you "generally have three years from when you filed your return — or two years from the date the tax was paid, whichever is later — to claim a refund or credit from the IRS," said Nerdwallet.

However, that audit timeline shifts in certain circumstances. For instance, the statute of limitations is six years "if you have substantially underestimated your income," said AARP. Similarly, "the six-year rule also applies if you have substantially overstated the cost of property to minimize your taxable gain."

Meanwhile, the statute of limitations stretches to seven years if you "file a claim for a loss from worthless securities or bad-debt deduction," said AARP. Further, said Kiplinger, you typically have "up to 10 years to claim the Foreign Tax Credit, so you should save any tax records or documents related to foreign taxes paid for at least 10 years."

There are other documents you may want to hold on to indefinitely. If someone were to commit tax fraud, "there is no statute of limitations on tax fraud audits," said Nerdwallet. Additionally, if there was ever a year that you did not file a tax return, you also need to "keep documentation of why you didn't file a tax return."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Do you also need to hold on to state tax documents?

Put simply, yes. However, how long you will need to hang on to any paperwork related to your state tax return can also vary. "The tax agency in your state might have more time to audit your state tax return than the IRS has to audit your federal return," said Kiplinger.

For example, California and Arizona have a "four-year statute of limitations," while Montana's is five years, said Intuit TurboTax.

What is the best way to store tax documents?

"The best way to store hard copies of tax documents is in a fire-proof safe," said H&R Block, perhaps along with other important documents. Just make sure that you "tell one other person where you keep the key to the safe (e.g., a spouse or other trusted family member)," so in case of an emergency, "that individual will know how to access any documents they may need to keep your affairs in order."

Another option is to "make electronic backups by scanning these documents to a cloud-based storage system," said Yahoo Finance. Plus, "various companies offer first-class encryption and cloud security for your documents," so you do not have to worry about security. The IRS will accept digital versions of documents as long as they are "legible," said H&R Block.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

What’s a good credit card APR?

What’s a good credit card APR?The Explainer They have gotten even steeper in recent years

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

Filing statuses: What they are and how to choose one for your taxes

Filing statuses: What they are and how to choose one for your taxesThe Explainer Your status will determine how much you pay, plus the tax credits and deductions you can claim

-

The pros and cons of tapping your 401(k) for a down payment

The pros and cons of tapping your 401(k) for a down paymentpros and cons Does it make good financial sense to raid your retirement for a home purchase?

-

3 tips to help protect older family members from financial scams

3 tips to help protect older family members from financial scamsthe explainer Prevent your aging relatives from losing their hard-earned money