RBS smashes expectations with £940m profit

State-backed bank celebrates half-year success, but shadow hangs over rest of year

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

RBS should be sold at a loss to the taxpayer, says Treasury chief

14 April

Royal Bank of Scotland should be returned to the private sector even if it means the taxpayer making a hefty loss, according to the outgoing head of the Treasury.

In a valedictory interview with the Financial Times, Sir Nick Macpherson said it is "going to be tricky" for the state to sell its stake in the bank before the next election, as promised by Chancellor George Osborne.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Macpherson intimated this would especially be the case if the government insisted on not selling below the bailout share price of 502p.

Last year, the government crystallised an initial £2bn loss when it sold a five per cent tranche of shares at 330p. Shares across the banking sector have slumped since then and RBS has reported another year in the red. Even after a recent recovery, its stock is languishing at around 230p.

This means, Reuters notes, the taxpayer could lose more than half of its original £45.5bn investment.

But Macpherson said a judgement will have to be made and that getting the bank back into private hands would boost lending and the economy.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"My one experience of running banks is that the longer they stay in the public sector, the greater the likelihood that you will lose value," he said.

The Treasury did not comment on its plans, or on whether it was prepared to sell at such a large deficit, but said it was determined to return the bank to the private sector and that it would turn a profit in aggregate from all of its banking sector investments.

Fellow state-owned bank Lloyds is doing the heavy lifting in this regard and a successful drip-feed share sale has been paused during the sector's travails to ensure it continues to make a positive return.

Macpherson's intervention comes on the day RBS announced its latest round of cost cutting as it continues a protracted turnaround. It will cut 600 jobs in its retail division, part of previously announced plans to cut one in 12 retail banking jobs.

Sources told Reuters the bank is closing about 34 branches and reducing opening hours in hundreds more, across the north, south-east and east of England, as well as the Midlands and London. It will take the number of redundancies this year to 1,500.

RBS unveils £5.2bn bond buyback to meet new regulations

22 March

Royal Bank of Scotland has announced it will buy back another £5.2bn of its bonds, joining the trend among European lenders to meet new regulatory requirements.

Sold by banks to fund the loans they make, senior unsecured bonds are a form of corporate debt issued in sterling, euros and dollars. Bank buybacks have risen in recent months: in November Barclays and RBS bought back senior debt to meet regulatory requirements. Then last month, Deutsche Bank bought back some of its bonds to soothe investors after prices tumbled.

The offer comes in response to new rules that mean banks need to hold a certain amount of senior bonds that can absorb losses if the institution fails. It is part of a fundamental reform that seeks to shift the burden of bank risk away from the taxpaying public and onto capital market investors.

In the UK, these rules are met by issuing debt from a holding company, which is subordinated to its operating company – the trading bank – to "absorb" losses.

Announcing its offer, RBS said that it comes "with the intention of supporting the group's on-going transition to a holding company capital and term funding model in line with regulatory requirements".

The process is also a way to reduce overall debt and a cost-cutting exercise for the lender, as it reduces overall interest payments on debt. European bank bond issuance is tipped to stagnate this year, writes the Financial Times, with low expectations of future demand for loans.

Yahoo News says RBS is the global arranger and lead dealer manager, while Goldman Sachs is a dealer manager on the tenders.

All tender offers close on April 6.

RBS pays £1.2bn to reach 'milestone' in journey back to private hands

22 March

Royal Bank of Scotland has reached "another important milestone" on its journey back from the abyss and into private ownership, its chief executive Ross McEwan has said.

The loss-making bank, which is still 73 per cent owned by taxpayers, has paid the government £1.2bn to buy back a special share that prevented it from paying dividends to shareholders

The so-called "dividend access share", which was held by the government, meant the bank could not pay out any funds to private shareholders before it paid a certain amount to the Treasury, says the BBC, effectively blocking it distributing excess capital. An inability to pay dividends was seen as a major impediment to selling RBS shares to private investors.

"This is another important milestone in our plan to resume capital distributions to our shareholders and represents one less hurdle in our path to build the number one bank for customer service, trust and advocacy," McEwan said.

Poor results in recent stress tests, during which the bank hit regulatory minimum capital levels but not supplementary targets, and another set of poor results that revealed it is still facing huge costs for past misconduct will still prevent RBS shareholders receiving an income until after the first quarter of 2017 at the earliest.

The news comes after the Budget last week revealed that George Osborne is hoping to recoup £25bn from the return of RBS to private hands by the end of this parliament. This equates to a loss of as much as £20bn on the original bailout during the financial crisis.

RBS shares were down 1.5 per cent this afternoon to 232p in a flat market.

RBS shares sale to cost taxpayers £20bn

17 March

Taxpayers could lose more than £20bn if George Osborne goes ahead with the sale of the government's remaining stake in Royal Bank of Scotland, according to an official forecast published alongside the Budget yesterday.

Sky News claims figures published by the Office for Budget Responsibility suggest the Treasury could recoup a total of just £23.6bn from a sale, scarcely 50 per cent of the £45.5bn poured into the lender to prevent its collapse in 2008.

Shares in the bank closed on Wednesday at 234.3p, a stark contrast to the 502p average cost of the holding bought by the then-Labour government during the financial crisis.

However, Royal Bank of Scotland received a welcome boost when Goldman Sachs upgraded it to a "buy", amid hopes the lender can win a bigger slice of the mortgage market.

Cheaper mortgage rates will be a long-term drag on margins for retail-focused British banks, conceded Goldman Sachs, but it argued that RBS's market share of just 8.6 per cent means it can more than offset the pressure with volume growth.

It can also call on structurally cheaper funding than its peers thanks to a market-leading 18 per cent share of current accounts, added the investment bank.

RBS shares currently trade at a 50 per cent discount to rival Lloyds, but Goldman Sachs believes that valuation gap that will narrow as it builds its mortgage book and dumps legacy investment bank assets. The Chancellor will hope all of this can begin to boost the share price above current estimates, limiting the losses now being forecast.

RBS shares slump after yet another poor set of results

22 February

Another year, another big loss for Royal Bank of Scotland. There have been eight of them in a row now and this one was expected, although that hasn't stopped investors selling off shares liberally this morning.

Full-year results for 2015 published today showed RBS ended the year around £2bn in the red, the Financial Times notes. This was in line with its previous guidance and was an improvement on the £3.5bn loss for 2014, but scratch beneath the surface and there are plenty of reasons not to be cheerful about the bank's underlying position.

Pre-tax, RBS actually saw a huge turnaround from a £3.5bn profit to a £2.7bn loss last year. This was primarily the result of a massive £6.5bn of charges, writedowns and restructuring costs as it continues to count the costs of past wrongdoing and, adds the BBC, pull out of as many as "25 of the 38 countries it still operates in".

Foremost among the extraneous expenses was £2.5bn of conduct and litigation provisions, including what will be a huge settlement for the mis-selling of the mortgage-backed debt securities that was at the heart of the financial crisis. "Unfortunately," said RBS chief executive Ross McEwan, when this will be settled is "not in our gift time-wise".

Operating profits stripping out all of these costs also fell from £6.1bn in the preceding year to £4.4bn, which was partly the result of lower interest margins on its lending in the ultra-low interest-rate environment.

Rubbing salt in the wound for investors is the prospect of dividend payouts being kicked further into the long grass. Hargreaves Lansdown, the Bristol-based financial service company, says the results revealed another payment to a government preference share, which must be repaid £1.5bn before private shareholder distributions can resume. This figure will be reached in the first half of this year.

But with the spin-off of retail bank business Williams & Glyn, mandated as a condition for receiving government support, and the US litigation hanging over its head, RBS admitted it will not be able to resume shareholder dividends until after the first quarter of 2017 at the earliest.

The bank's position contrasts sharply with that of Lloyds, which was able to up its dividend yesterday despite a conduct charges-related hit to profits. Lloyds's shares rose 13 per cent yesterday and were up 2.5 per cent again today to 72.4p, while RBS's fell by more than eight per cent to 223.4p this morning, well below the 330p at which the government sold a tranche of shares last year.

Lloyds is now just a little more than 1p below its bailout break-even price that would allow the government to resume selling its nine per cent shareholding. RBS remains 72 per cent owned by the taxpayer.

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

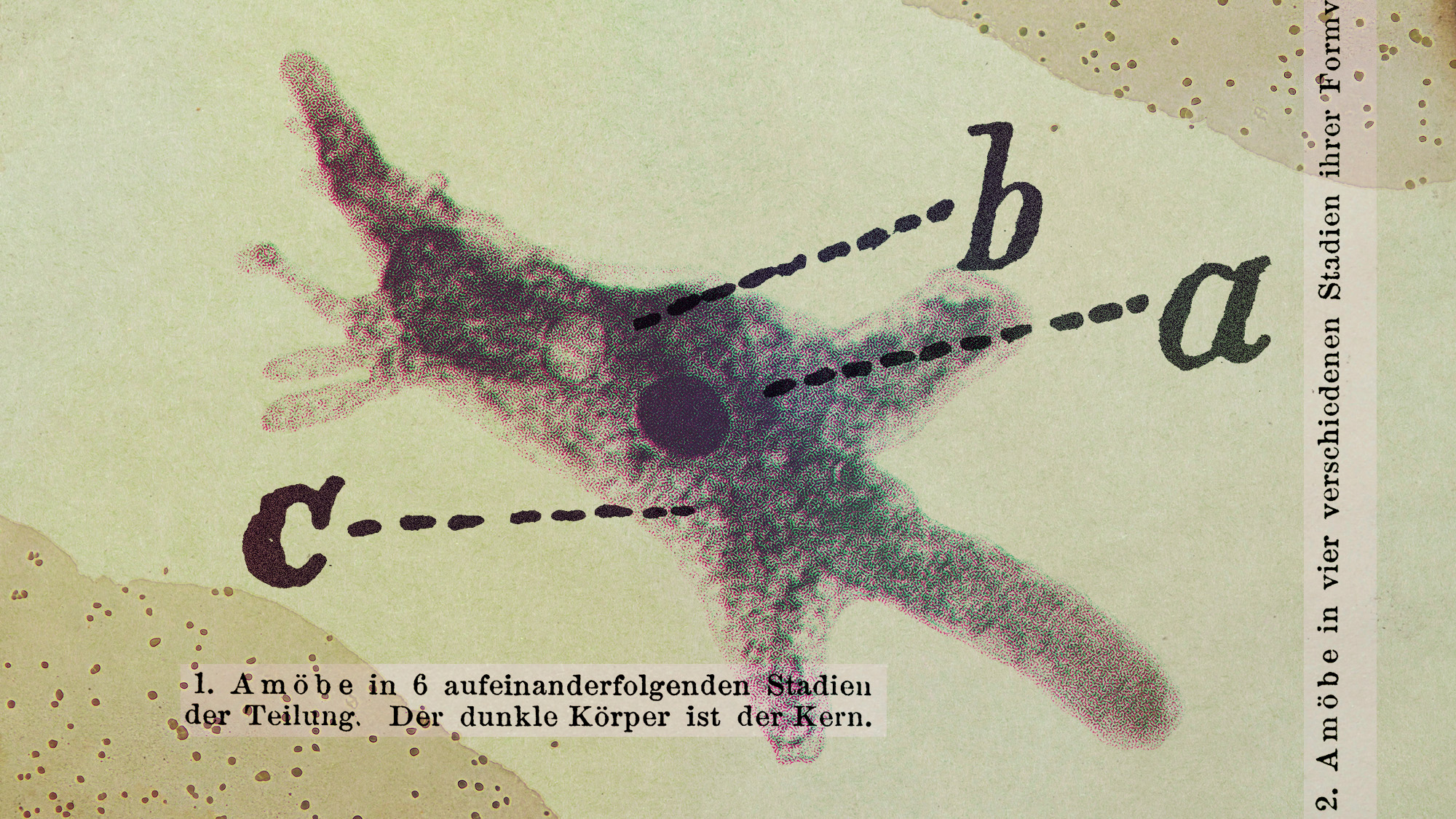

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’

-

What does the FDIC do?

What does the FDIC do?In the Spotlight The Federal Deposit Insurance Corporation is now a 'Trump target'

-

TD Bank accepts $3B fine over money laundering

TD Bank accepts $3B fine over money launderingSpeed Read The US retail bank pleaded guilty to multiple criminal charges

-

FDIC chair out after toxic work culture report

FDIC chair out after toxic work culture reportSpeed Read The report revealed a trend of sexual harassment and discrimination at the Federal Deposit Insurance Corporation

-

Citibank to cut off online access for customers who don't go paperless

Citibank to cut off online access for customers who don't go paperlessSpeed Read The bank will shut off the customer's access to both their online website and mobile app

-

First Republic: will UK banks survive unscathed?

First Republic: will UK banks survive unscathed?Under the Radar US shares dip after collapse of third regional bank, but experts say contagion to the UK is unlikely

-

Banking crisis: has the city weathered the financial storm?

Banking crisis: has the city weathered the financial storm?Talking Point The financial storm appears to have abated, but no one’s ruling out more squalls along the way

-

Should the UK relax bank ring-fencing rules?

Should the UK relax bank ring-fencing rules?Talking Point Treasury minister said he hopes to ‘boost competitiveness’ in the City with easing of regulations

-

Should caps on bankers’ bonuses be scrapped?

Should caps on bankers’ bonuses be scrapped?Talking Point New chancellor Kwasi Kwarteng believed to be planning contentious move to ‘boost the City’