Treasury Department takes down an economic analysis that undermines a key GOP tax-cut argument

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

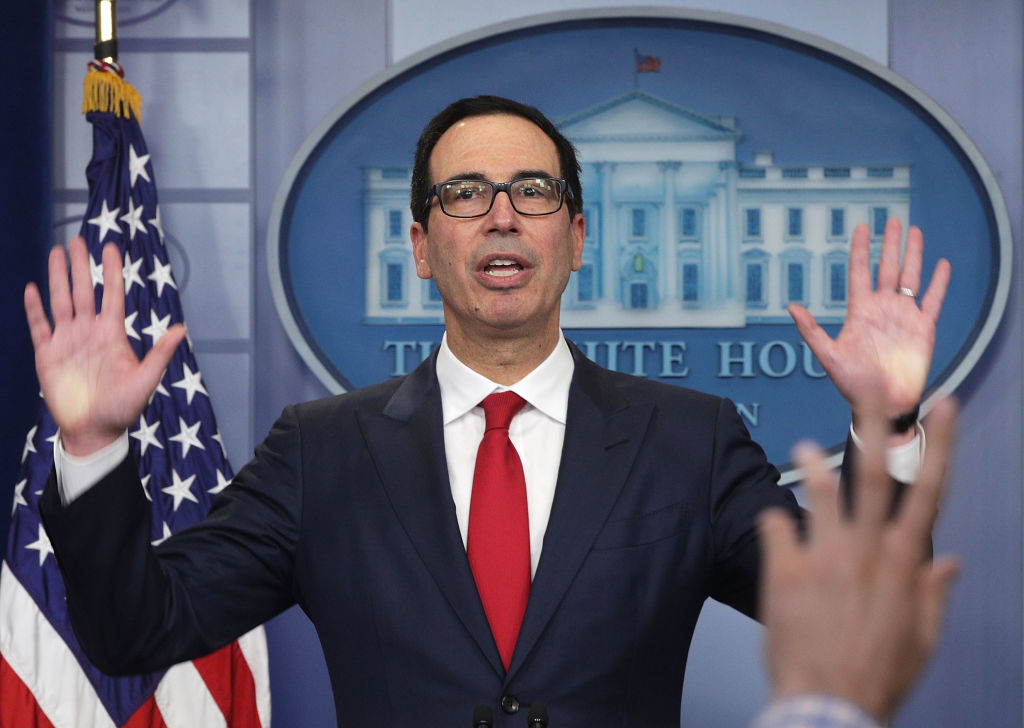

The Treasury Department has removed from its website a 2012 economic analysis that found the burden of corporate taxes primarily falls on business owners and shareholders, not workers, undermining a key argument Treasury Secretary Steven Mnuchin has been making to promote the Republicans' plans to cut the corporate tax rate, The Wall Street Journal reports. Mnuchin and other Trump administration officials argue that workers would be the big beneficiary of cutting the tax on corporate profits to 20 percent, from 35 percent, but the 2012 paper from the Office of Tax Analysis shows that workers only bear 18 percent of the cost of corporate taxes, versus 82 percent for corporate owners.

Most mainstream economists broadly agree with that analysis — the nonpartisan Joint Committee on Taxation and Congressional Budget Office, for example, found that capital's corporate tax burden is 75 percent, versus 25 percent for workers, WSJ notes. (The Week's Jeff Spross has a good explainer on the theory and realities of corporate tax burdens.) "The paper was a dated staff analysis from the previous administration," a Treasury spokeswoman told The Wall Street Journal. "It does not represent our current thinking and analysis." The newspaper noted that the Treasury site still has up other technical papers from the Obama administration and working papers dating back to 1974.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting