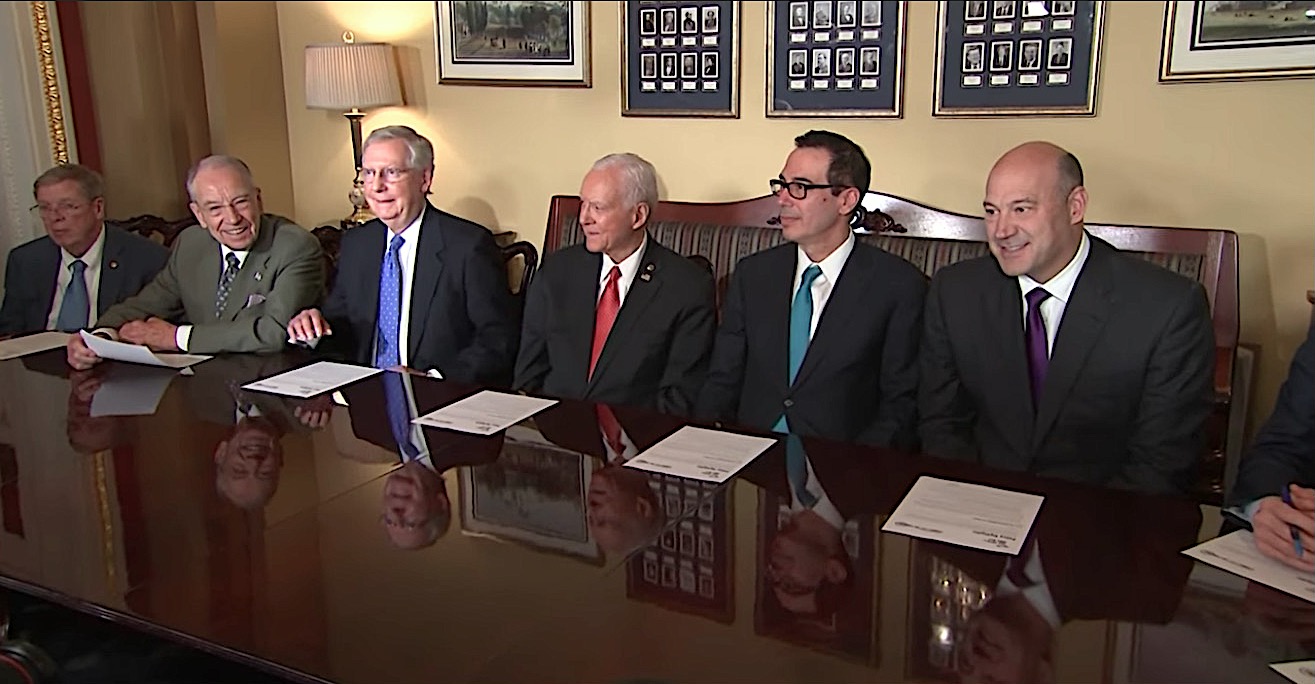

Senate Republicans unveil tax proposal, House GOP passes its plan out of committee

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

On Thursday afternoon, Senate Republicans released the framework for their tax overhaul, delaying a steep cut in corporate taxes for a year and eliminating deductions for state and local taxes — for individuals, not businesses — among other differences with the House bill. The Senate version also leaves seven tax brackets, versus the House proposal's four brackets, lowering the top rate for wealthy individuals to 38.5 percent from 39.6 percent. Also on Thursday, the House Ways and Means Committee approved an amended version of their tax plan, sending it to the House floor.

According to the Joint Committee on Taxation, which analyzes congressional tax plans, the Senate bill would add $1.495 trillion to the federal deficit over 10 years while the latest House version would add $1.457 trillion. The plans can add no more than $1.5 trillion under rules Senate Republicans passed to allow them to approve the bill with just 50 votes.

On the other differences, "as leaders in each chamber grapple with difficult trade-offs on tax rates, deductions, and deficits, the House is making decisions the Senate won't accept and the Senate is doing the same to the House," The Washington Post reports. Among those differences, the Senate would narrow the pool of multimillionaires who would have to pay the estate tax while the House phases the tax out entirely, and the Senate retains deductions for medical expenses and mortgage interest. Both versions would nearly double the child tax credit and keep the adoption credit. The Senate's decision to cut the top corporate tax rate to 20 percent, from 35 percent, in 2019 instead of next year sent the stock market lower.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Senate leaders and White House officials called the plan historic and necessary, but as you can see below, reporters were mostly interested in what Senate Republicans thought about the allegations that Alabama Senate nominee Roy Moore fondled a 14-year-old girl when he was 32. Peter Weber

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting