The Senate GOP's tax bill is coming for your lunch

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

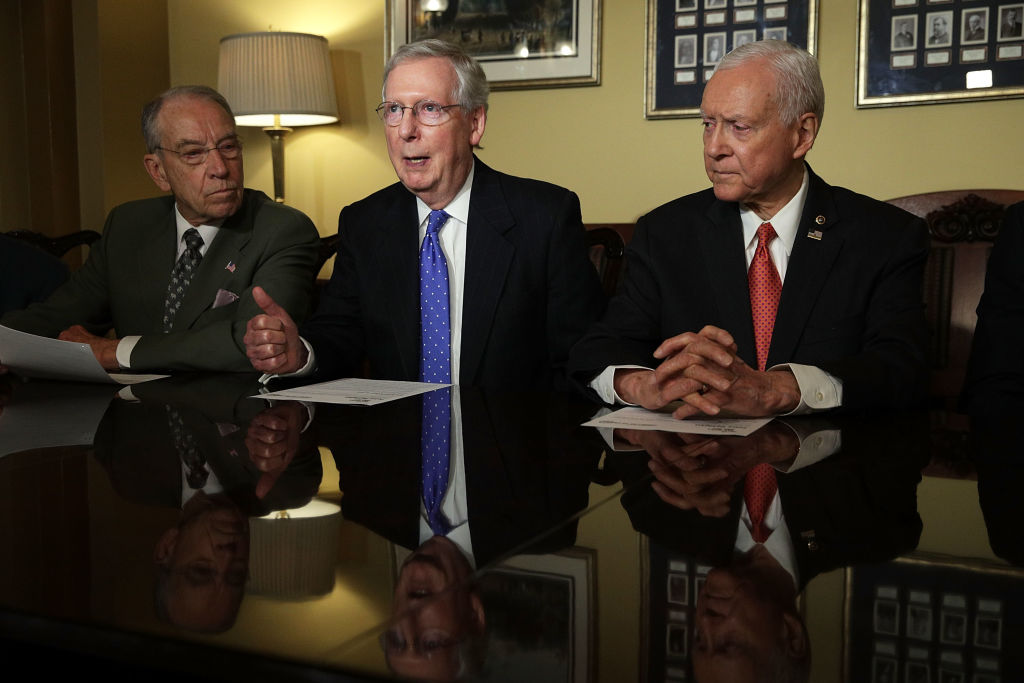

In their quest to cut taxes while not running up huge deficits, Senate Republicans have had to find creative ways to save money in their forthcoming tax reform bill. Although some estimates say that the Republican tax bill would add $1.8 trillion to the federal debt over 10 years, you can rest assured that the Republican Party is committed to cutting irresponsible spending: In an effort to save money, the new plan will prevent your employer from being able to write off lunches purchased for workers or workplace entertainment, HuffPost reported Wednesday.

The move would save $23 billion over 10 years, HuffPost reported — or just 1.3 percent of the total expected deficit increase. Under the current tax code, employers who give the majority of their workers free lunches can deduct 50 percent of the cost. The House version of the bill does not touch free workplace lunch, but it would eliminate tax breaks for employer-paid day care assistance programs, as well as employee-sponsored moving expenses and achievement awards, all for the sake of saving $12 billion.

But the Senate tax bill isn't all bad news! The exemption for the estate tax will be doubled, so if you happen to inherit less than $10 million from a dead relative, you won't have to pay any taxes on the money — which should definitely help you pay for lunch if your employer won't give it to you.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Kelly O'Meara Morales is a staff writer at The Week. He graduated from Sarah Lawrence College and studied Middle Eastern history and nonfiction writing amongst other esoteric subjects. When not compulsively checking Twitter, he writes and records music, subsists on tacos, and watches basketball.