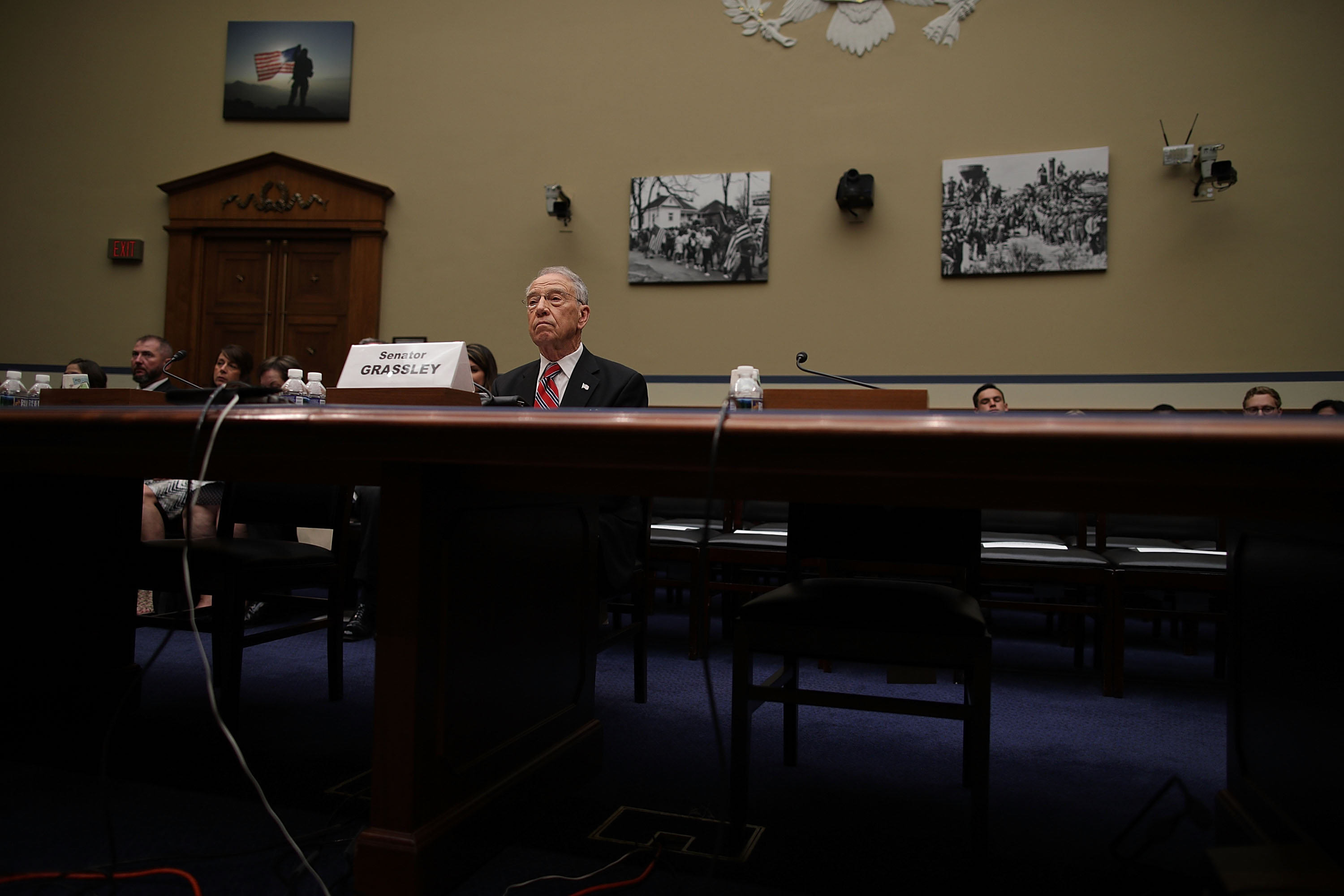

Sen. Grassley says the estate tax unfairly favors people who waste money on 'booze or women or movies'

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Senate and House versions of the Republican tax overhaul legislation both contain provisions that would double the exemption for the estate tax — to $11 million for the estates of individuals and $22 million for couples — and the House version ends the estate tax entirely after 2024. Iowa's GOP congressional delegation is thrilled with the provision, the Des Moines Register reports, with a typical response being Rep. Steve King's contention that the estate tax "often falls hardest on family-owned farms and small businesses."

That isn't true, the Register notes, citing IRS and Agriculture Department data showing that only a few dozen of the 5,000 Americans who pay the estate tax each year are family farmers or small-business owners, and almost none of them live in Iowa. Sen. Charles Grassley (R-Iowa), a member of the Senate Finance Committee, told the Register that regardless of the numbers for farmers, the estate tax is unfair philosophically, targeting savers instead of spenders. "I think not having the estate tax recognizes the people that are investing, as opposed to those that are just spending every darn penny they have, whether it's on booze or women or movies," he said.

The Senate version of the estate tax changes would cost the U.S. Treasury $83 billion over 10 years, according to the Joint Committee on Taxation, while the House version would cost $150.7 billion — which is a lot of booze, women, and movie tickets.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.