Trump and GOP promises about middle-class tax cuts were apparently swamped by ideology, lobbying, math

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

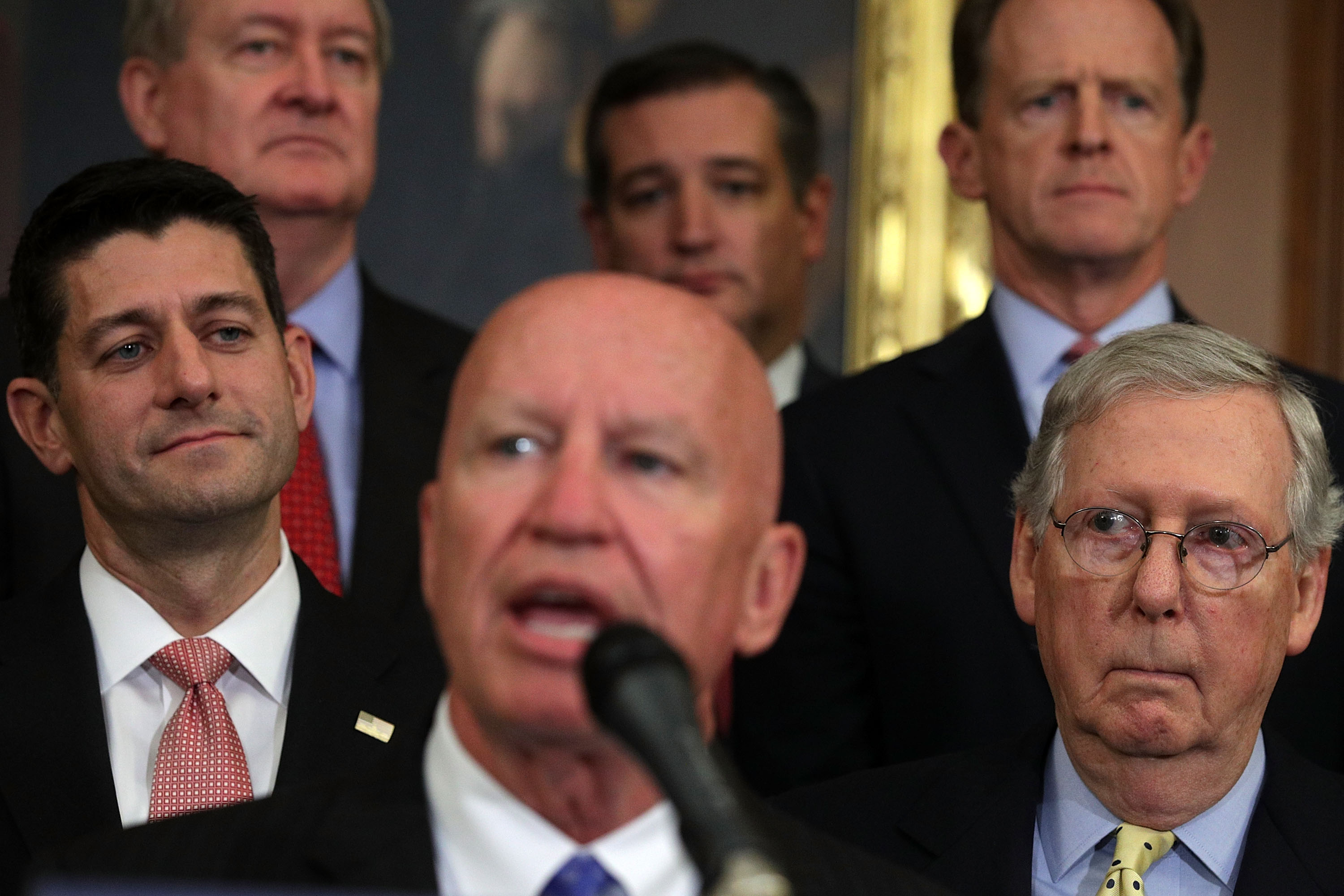

President Trump makes his final pitch for the Republican tax bill on Wednesday, with Senate and House Republicans aiming to have a final bill ready by Friday. But if Trump plans on touting a tax bill focused on the middle class, as he has been all year, the Republican plan isn't that. In all, The Washington Post says, the bill provides $1 trillion in tax cuts for businesses over 10 years, $100 billion in savings for estates worth $11 million or more, and $300 billion in temporary cuts for all households combined.

If Trump was serious about targeting the middle class and not the rich, he was ill-served by Republicans in Congress, the Post reports, though based on more than 40 public statements and interviews with top White House and congressional officials, "Trump and his top advisers have continuously prioritized corporate cuts." For many reasons — ideological, lobbying, and because Senate Republicans could lose only two votes — Republicans favored corporate tax cuts, too. There were extenuating circumstances, too, as when House Republicans planned to include a $300 "family flexibility credit," the Post reports:

But the night before they would release the bill, when top tax writer Kevin Brady (R-Texas) was trying to sort out the tax changes and monitor the performance of his Houston Astros in the final game of the World Series, they made a major change to this provision, according to a person briefed on the changes. ... Corporations were concerned their tax cut would last only eight years, a limitation that was necessary to keep the bill under the $1.5 trillion limit. Brady agreed. So in a last-minute decision, Republicans cut the duration of the family tax credit in half — ending it after only five years — to make the corporate tax cut permanent. In effect, Republicans handed $200 billion from families to corporations. [The Washington Post]

You can read more about how the stated middle-class goal became the GOP reality at The Washington Post.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Regent Hong Kong: a tranquil haven with a prime waterfront spot

Regent Hong Kong: a tranquil haven with a prime waterfront spotThe Week Recommends The trendy hotel recently underwent an extensive two-year revamp

-

The problem with diagnosing profound autism

The problem with diagnosing profound autismThe Explainer Experts are reconsidering the idea of autism as a spectrum, which could impact diagnoses and policy making for the condition

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting