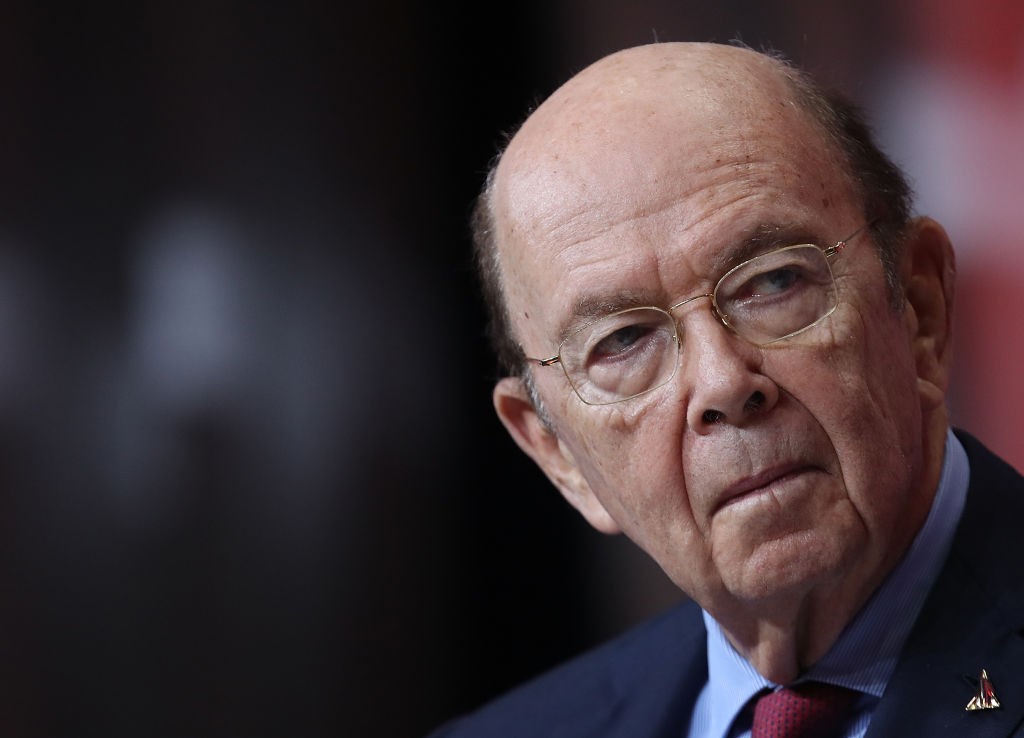

Commerce Secretary Wilbur Ross made over $1 million by failing to follow ethics laws

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Commerce Secretary Wilbur Ross didn't divest stock holdings until months after the deadline imposed by his new federal position. During that time, his stock's value increased by more than $1 million, a Center for Public Integrity investigation found on Thursday.

Ross "mistakenly believed that all of my previously held Invesco stock was sold" before he took office, he wrote in a filing update. "In December 2017, I discovered that the previously held stock had not been sold. I then promptly sold these shares." It's unclear how many shares Ross owned, but the investigation estimates that he could have earned up to $6 million after failing to meet the deadline.

The Invesco Ltd. stock, valued at $10 million to $50 million, would have earned Ross a substantial amount even if he had sold it on time, the secretary's lawyer said. Even so, Ross' financial dealings have been under close scrutiny after a Forbes investigation found that he also kept his stakes in a company co-owned by the Chinese government, a shipping firm linked to the Kremlin, and a Cyprus bank that is entangled in the investigation led by Special Counsel Robert Mueller. While Ross would have profited from his stock holdings no matter when he divested, the Center for Public Integrity notes that his updated filings contradict previous sworn statements in which he said he had divested of all holdings as required by federal ethics laws. Read more at The Center for Public Integrity.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Update July 5, 4:55 p.m.: The Commerce Department reiterated in a statement to The Week the "inadvertent error" that caused the delay in divestment, explaining that Ross "promptly took action" as soon as he learned of the problem. A spokesperson additionally noted that "the secretary has consistently disqualified himself from participating in any matters involving companies on which he formerly held a position, including Invesco."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Summer Meza has worked at The Week since 2018, serving as a staff writer, a news writer and currently the deputy editor. As a proud news generalist, she edits everything from political punditry and science news to personal finance advice and film reviews. Summer has previously written for Newsweek and the Seattle Post-Intelligencer, covering national politics, transportation and the cannabis industry.

-

Why is Prince William in Saudi Arabia?

Why is Prince William in Saudi Arabia?Today’s Big Question Government requested royal visit to boost trade and ties with Middle East powerhouse, but critics balk at kingdom’s human rights record

-

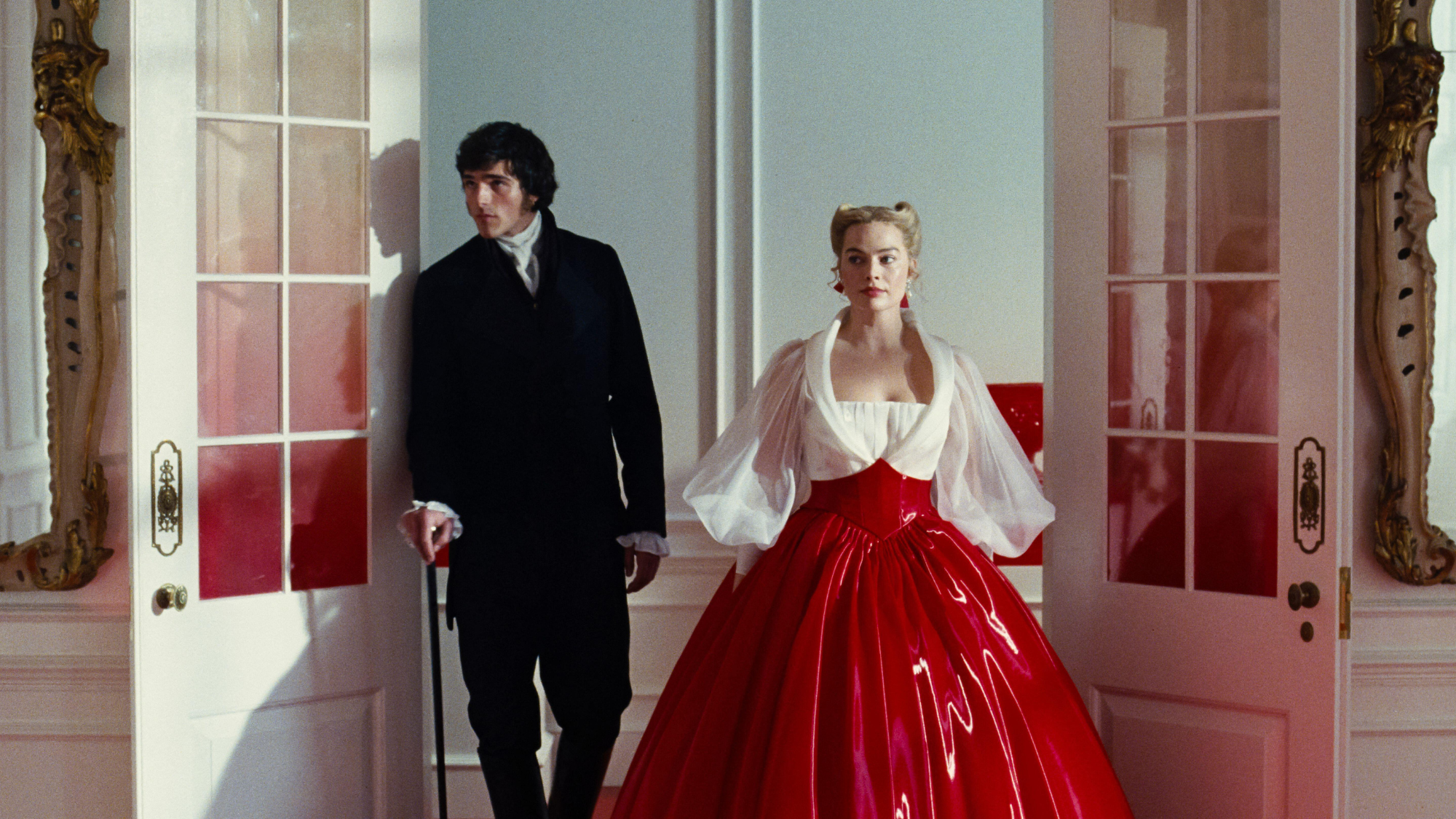

Wuthering Heights: ‘wildly fun’ reinvention of the classic novel lacks depth

Wuthering Heights: ‘wildly fun’ reinvention of the classic novel lacks depthTalking Point Emerald Fennell splits the critics with her sizzling spin on Emily Brontë’s gothic tale

-

Why the Bangladesh election is one to watch

Why the Bangladesh election is one to watchThe Explainer Opposition party has claimed the void left by Sheikh Hasina’s Awami League but Islamist party could yet have a say

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting