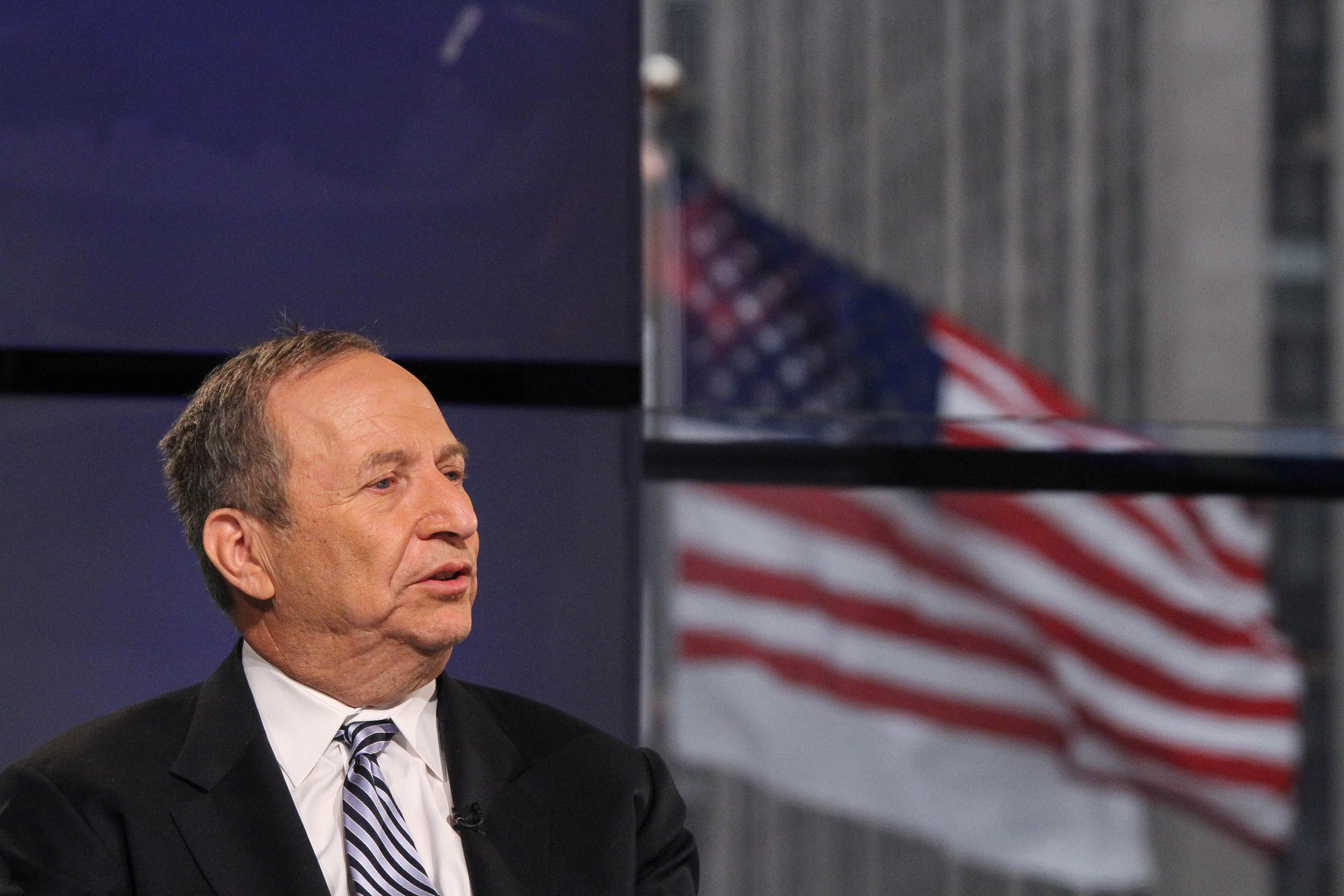

Clinton Treasury Secretary ups chances of recession before 2020

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The markets aren't looking good, but former Treasury Secretary Lawrence Summers says not to panic ... yet.

Amid a month of falling stocks, Summers cautioned that "weak markets" don't necessarily mean "economic disaster is around the corner." Still, he's increasing his prediction of a recession from "a bit less than 50 percent" to 60 percent, he tweeted Wednesday.

Summers served as former President Bill Clinton's Treasury Secretary and directed the National Economic Council under former President Barack Obama. In tweets Wednesday, he cited the assertion of Robert Rubin, his predecessor at the Treasury Department, that "markets go up, markets go down" to describe slumping stocks. President Trump shouldn't have claimed credit for August's roaring markets, Summers said. But seeing as "one can see essentially no trace of even the 1987 crash in economic data," Summers said we should remember "markets are noisy, flawed predictors of the economy."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Still, Summers went on to say that before December's tanking market he predicted a "bit less than 50 percent" chance of a recession starting next year. He's now increased those odds to 60 percent.

Stock markets are still on track for their worst December performance since the Great Depression, especially after an unprecedented Christmas Eve drop.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Kathryn is a graduate of Syracuse University, with degrees in magazine journalism and information technology, along with hours to earn another degree after working at SU's independent paper The Daily Orange. She's currently recovering from a horse addiction while living in New York City, and likes to share her extremely dry sense of humor on Twitter.