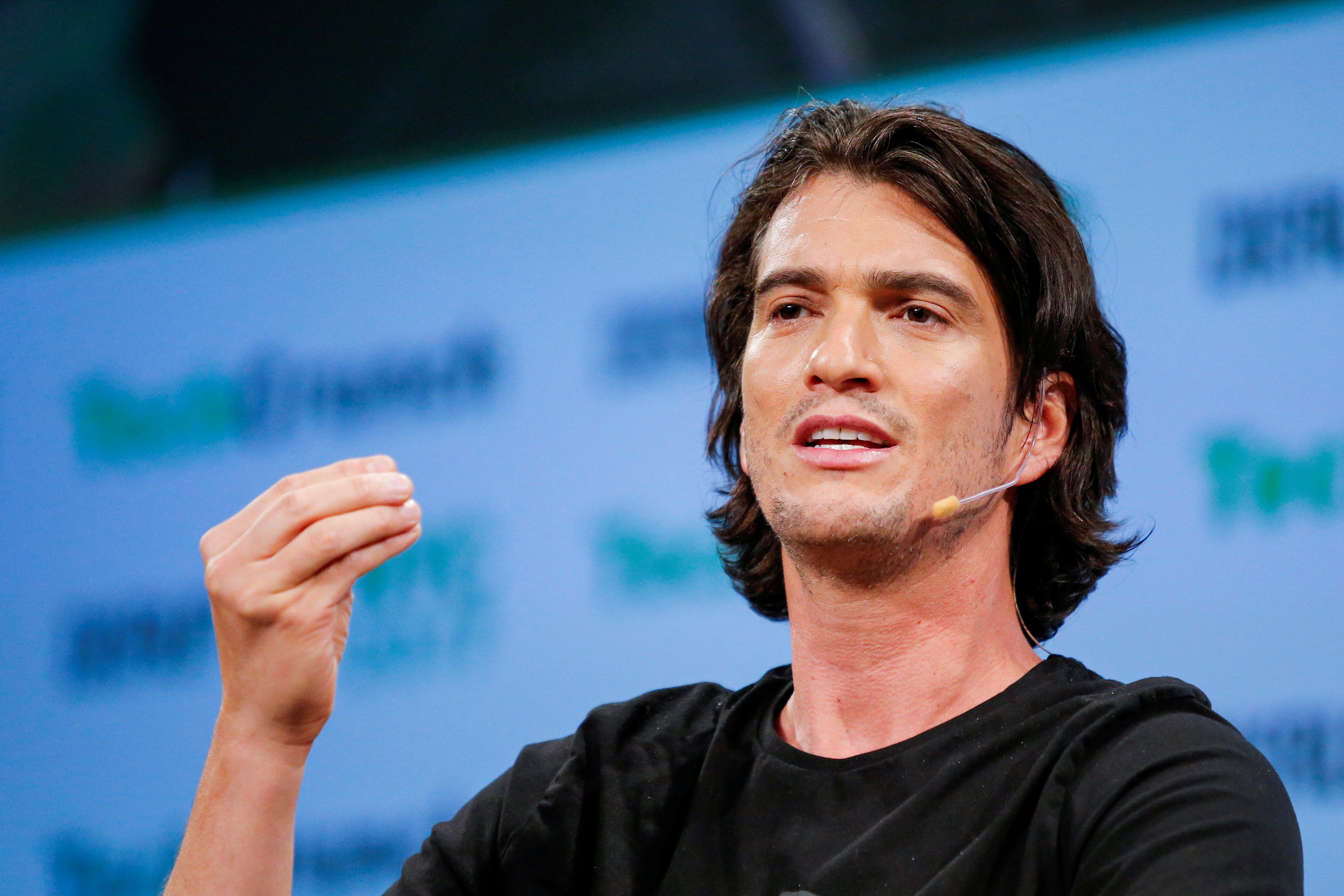

Adam Neumann is reportedly exiting WeWork with a $1.7 billion parachute

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

WeWork co-founder Adam Neumann looks set to exit the cash-strapped company with almost $2 billion.

SoftBank Group Corp. has earned approval to take control of WeWork in a deal that will see Neumann receive almost $1.7 billion, The Wall Street Journal reported Tuesday. The Japanese company will buy almost $1 billion worth of stock from Neumann as well as provide him with about $500 million in credit and a $185 million consulting fee as he steps down from the board, according to the report. He'll reportedly still have a stake in the company and be a board observer.

Bloomberg's Max Abelson points out the $185 million consulting fee alone is more than just about every CEO in the United States made last year.

Article continues belowThe Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Neumann stepped down as CEO of the workspace company last month amid mounting board pressure following an initial public offering delay. Shortly after, WeWork's IPO was withdrawn and reports emerged that the company was set to run out of money before the end of the year.

Now, SoftBank is taking control and valuing WeWork at $8 billion, which the Journal notes is a massive drop from the $47 billion it was valued at in January. SoftBank previously owned about a third of the We Company.

"SoftBank pumped more than $10b in WeWork because it believed in Adam Neumann," CNBC reporter Alex Sherman observed Tuesday. "Now it's paying him $1 billion for his equity and a $185 million consulting fee to go away. Art of the deal."

After the Journal reported Monday that WeWork had delayed layoffs because it couldn't afford to pay severance, The Atlantic's Derek Thompson also observed that Neumann will "have cashed out nearly $2 billion of a company that's literally too poor to fire thousands of employees."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Brendan worked as a culture writer at The Week from 2018 to 2023, covering the entertainment industry, including film reviews, television recaps, awards season, the box office, major movie franchises and Hollywood gossip. He has written about film and television for outlets including Bloody Disgusting, Showbiz Cheat Sheet, Heavy and The Celebrity Cafe.