Most of Trump's charitable tax write-offs are reportedly for not developing property he owns

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

President Trump's tax records show he has classified his Seven Springs estate in Bedford, New York, as an investment property, The New York Times reports, but his son Eric Trump has described it as his family's "home base."

Seven Springs sits on 200 acres and boasts three pools and multiple carriage houses, according to the Trump Organization. Trump purchased the property in 1996 with the intention of building 15 private homes, a golf course, and a clubhouse on the land, but local residents were able to stop the development, citing concerns over traffic and pollution.

In 2014, Trump classified Seven Springs as an investment property rather than a personal residence, and since then he has written off $2.2 million in property taxes as a business expense, the Times reports. That same year, Eric Trump told Forbes Seven Springs is "really our compound," and served as "home base for us for a long, long time." The Trump Organization's website also says the property is currently "used as a retreat for the Trump family."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Trump also placed a conservation easement on the land in 2015, meaning he signed a deal with a land conservancy, agreeing to leave most of the property untouched. In exchange for this, Trump claimed a $21.1 million charitable tax donation, the Times reports. His tax records show that over the years, Trump has claimed four conservation easement deductions on his taxes, which represent about $119.3 million of the roughly $130 million in personal and corporate charitable contributions he has reported to the Internal Revenue Service, the Times reports. When asked for comment about Seven Springs, Alan Garten, a lawyer for the Trump Organization, did not respond.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Catherine Garcia has worked as a senior writer at The Week since 2014. Her writing and reporting have appeared in Entertainment Weekly, The New York Times, Wirecutter, NBC News and "The Book of Jezebel," among others. She's a graduate of the University of Redlands and the Columbia University Graduate School of Journalism.

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

‘One Battle After Another’ wins Critics Choice honors

‘One Battle After Another’ wins Critics Choice honorsSpeed Read Paul Thomas Anderson’s latest film, which stars Leonardo DiCaprio, won best picture at the 31st Critics Choice Awards

-

Son arrested over killing of Rob and Michele Reiner

Son arrested over killing of Rob and Michele ReinerSpeed Read Nick, the 32-year-old son of Hollywood director Rob Reiner, has been booked for the murder of his parents

-

Rob Reiner, wife dead in ‘apparent homicide’

Rob Reiner, wife dead in ‘apparent homicide’speed read The Reiners, found in their Los Angeles home, ‘had injuries consistent with being stabbed’

-

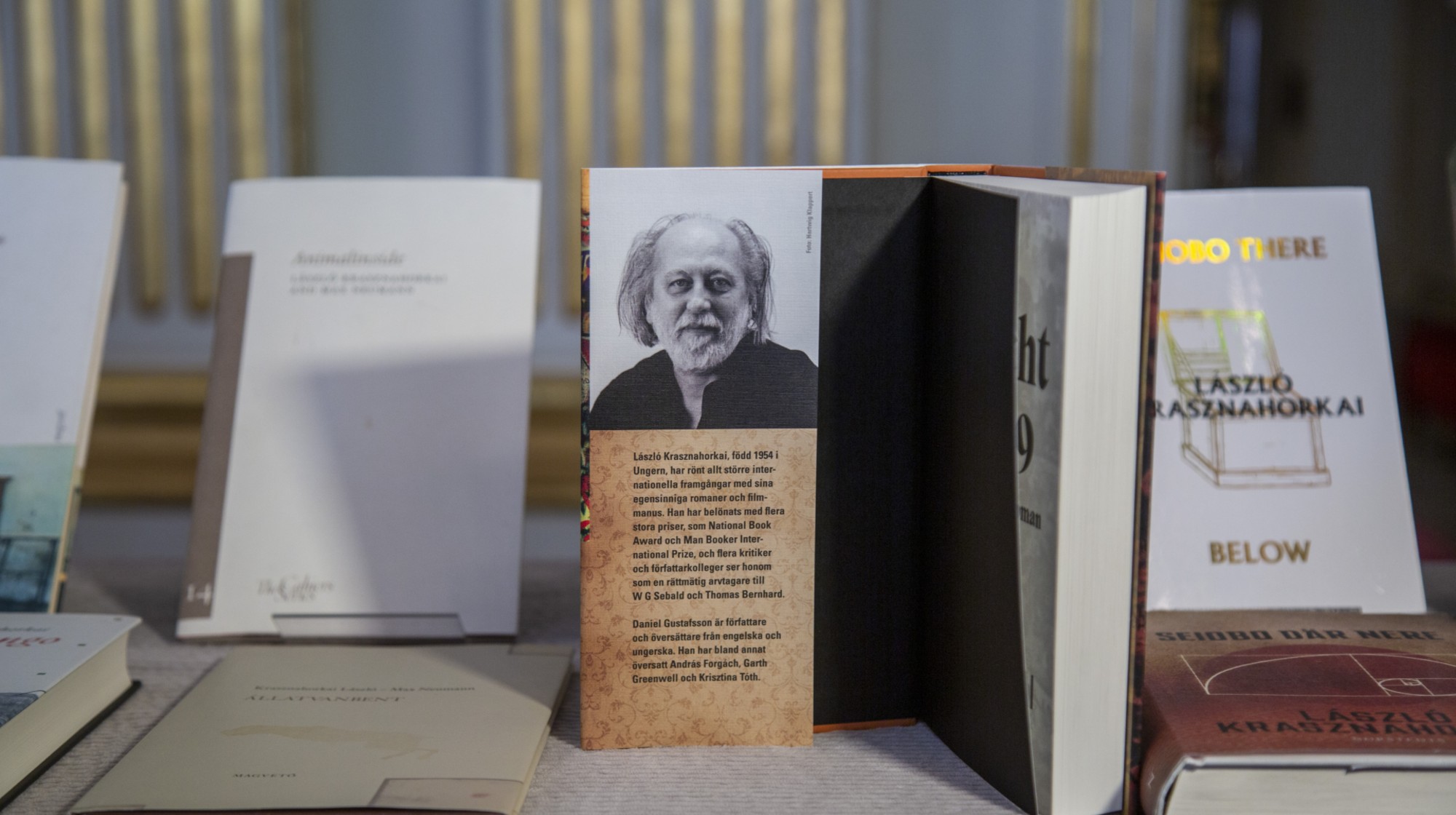

Hungary’s Krasznahorkai wins Nobel for literature

Hungary’s Krasznahorkai wins Nobel for literatureSpeed Read László Krasznahorkai is the author of acclaimed novels like ‘The Melancholy of Resistance’ and ‘Satantango’

-

Primatologist Jane Goodall dies at 91

Primatologist Jane Goodall dies at 91Speed Read She rose to fame following her groundbreaking field research with chimpanzees

-

Florida erases rainbow crosswalk at Pulse nightclub

Florida erases rainbow crosswalk at Pulse nightclubSpeed Read The colorful crosswalk was outside the former LGBTQ nightclub where 49 people were killed in a 2016 shooting

-

Trump says Smithsonian too focused on slavery's ills

Trump says Smithsonian too focused on slavery's illsSpeed Read The president would prefer the museum to highlight 'success,' 'brightness' and 'the future'

-

Trump to host Kennedy Honors for Kiss, Stallone

Trump to host Kennedy Honors for Kiss, StalloneSpeed Read Actor Sylvester Stallone and the glam-rock band Kiss were among those named as this year's inductees