After another cordial White House infrastructure meeting, GOP is still a no on raising corporate taxes

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

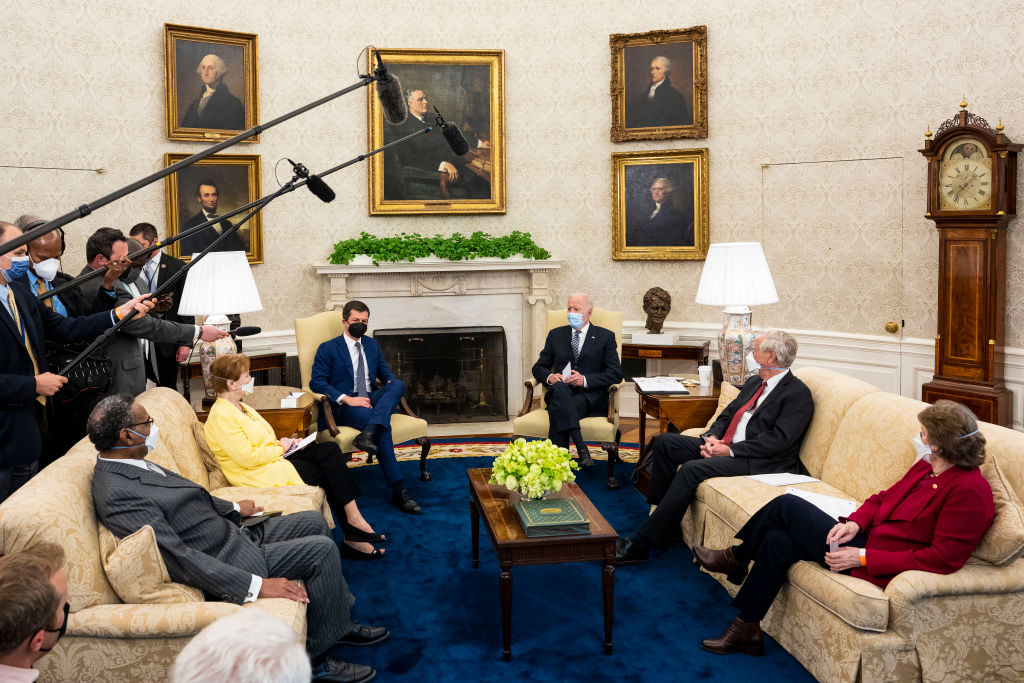

President Biden hosted another bipartisan group of 10 lawmakers on Monday to discuss his infrastructure proposal, and once again everyone said the meeting was cordial and respectful, Biden and his guests expressed a willingness to compromise on the size and scope of the bill, and the Republicans said they won't support raising the corporate tax rate to pay for the package.

Biden wants to raise the corporate tax rate to 28 percent, from 21 percent, to fund $2.25 trillion in spending. Sen. Joe Manchin (D-W.Va.) has suggested a 25 percent rate, and there's speculation Democrats will settle around that number. "You could see a 2 or 3 percent increase — maybe not all the way to 28 but 25," Rep. Charlie Crist (D-Fla.), who was at Monday's meeting, told The Wall Street Journal. GOP lawmakers were "more in favor of user fees so that whoever was benefiting from that particular infrastructure project would be paying for it in the long run," said Rep. Carlos Giménez (R-Fla.), another participant.

Sens. Mitt Romney (R-Utah) and John Hoeven (R-N.D.) both said after the meeting they favor paying for new infrastructure with gas taxes, user fees, and other mechanisms that don't hit corporations. "There is broad support for infrastructure, and I believe a bipartisan bill is possible, but we need to find agreement to make these updates in a targeted way that doesn't raise taxes," Hoeven said.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Biden opposes user fees, gas taxes, or any other funding mechanism that hits the middle class, and the opposition from Romney and Hoeven suggests he'll get no GOP support for raising corporate taxes, Axios says. Biden told Republicans he won't wait forever for a counteroffer. "He'd like for the Republicans to, you know, for us to come back with some kind of proposal on infrastructure by about mid-May," Giménez said.

Meanwhile, "progressives are warning the president not to get too attached to his GOP friends," Politico reports. Biden "should approach the negotiations with an open mind and an open heart, but he should not delay," Sen. Elizabeth Warren (D-Mass.) said. "We can't end up months from now with no real progress and no real infrastructure bill."

"I personally don't think the Republicans are serious about addressing the major crises facing this country," added Sen. Bernie Sanders (I-Vt.). "Maybe I'm wrong, but we're certainly not going to wait for an indefinite period of time. ... They have something to say? Now is the time to say it."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Film reviews: ‘Send Help’ and ‘Private Life’

Film reviews: ‘Send Help’ and ‘Private Life’Feature An office doormat is stranded alone with her awful boss and a frazzled therapist turns amateur murder investigator

-

Movies to watch in February

Movies to watch in Februarythe week recommends Time travelers, multiverse hoppers and an Iraqi parable highlight this month’s offerings during the depths of winter

-

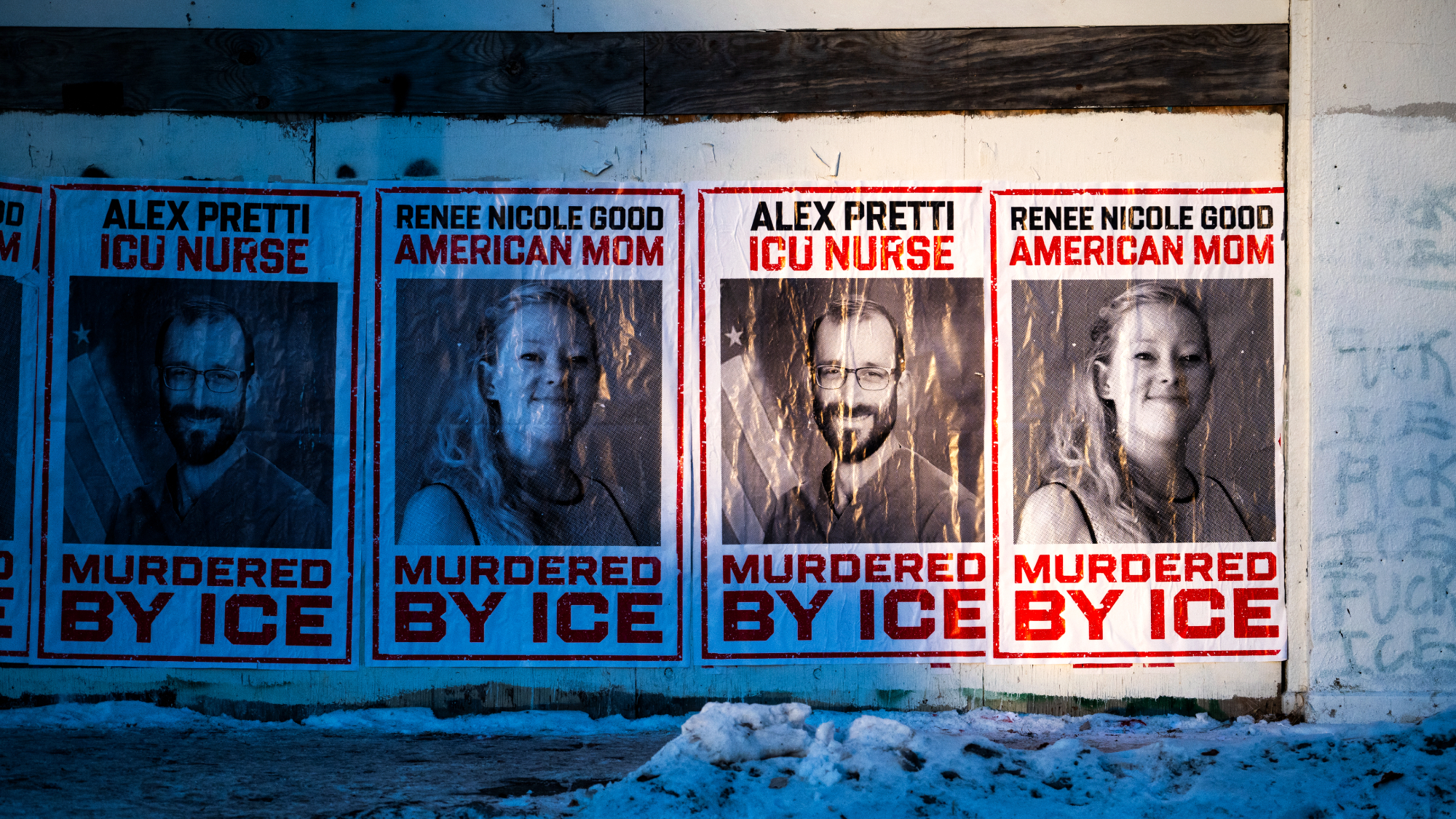

ICE’s facial scanning is the tip of the surveillance iceberg

ICE’s facial scanning is the tip of the surveillance icebergIN THE SPOTLIGHT Federal troops are increasingly turning to high-tech tracking tools that push the boundaries of personal privacy

-

Trump sues IRS for $10B over tax record leaks

Trump sues IRS for $10B over tax record leaksSpeed Read The president is claiming ‘reputational and financial harm’ from leaks of his tax information between 2018 and 2020

-

Trump, Senate Democrats reach DHS funding deal

Trump, Senate Democrats reach DHS funding dealSpeed Read The deal will fund most of the government through September and the Department of Homeland Security for two weeks

-

Fed holds rates steady, bucking Trump pressure

Fed holds rates steady, bucking Trump pressureSpeed Read The Federal Reserve voted to keep its benchmark interest rate unchanged

-

Judge slams ICE violations amid growing backlash

Judge slams ICE violations amid growing backlashSpeed Read ‘ICE is not a law unto itself,’ said a federal judge after the agency violated at least 96 court orders

-

Rep. Ilhan Omar attacked with unknown liquid

Rep. Ilhan Omar attacked with unknown liquidSpeed Read This ‘small agitator isn’t going to intimidate me from doing my work’

-

Democrats pledge Noem impeachment if not fired

Democrats pledge Noem impeachment if not firedSpeed Read Trump is publicly defending the Homeland Security secretary

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Hegseth moves to demote Sen. Kelly over video

Hegseth moves to demote Sen. Kelly over videospeed read Retired Navy fighter pilot Mark Kelly appeared in a video reminding military service members that they can ‘refuse illegal orders’