Apple Pay is the future: just look at Starbucks experience

Another step forward in the payments revolution – will the banks ever manage to keep up?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

I have been waiting for the Apple iPhone 6 launch all summer. As my iPhone 4 crashes more often than I have patience for, I’ve been investigating second mortgages so that I can acquire Apple’s latest, shiniest object. So I was surprised that it wasn’t the phone that stole the show for me this week, but rather the Apple Watch and Apple Pay.

Aesthetically, the watch is just fine. Is it an item of great fashion significance? Meh. Suzy Menkes at Vogue put it best: "From a fashion point of view, the external aesthetic seemed neutral: neither super-stylish nor repellent. I would imagine that geeks would love it more than aesthetes.”

And there is a certain “anti-status” attraction that it provides for those who’ve been quantifying themselves with step trackers like Jawbone’s Up band and Nike’s Fitbit. Using the GPS & accelerometer and biometric sensors, the Apple Watch can provide real-time feedback of all your physical movement - telling me, for instance, how many calories I’m burning writing this column.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

I’m not alone in accepting geek chic. As Daniel Gross at the Daily Beast puts it, “For men of a certain age, who are serious about exercise and staying in shape, a training watch with GPS and a heart-rate monitor is more of a status symbol than a Patek Phillippe: I might be middle-aged and bald, it says, but I could still dust you in a half-marathon.”

More excitingly, lurking behind the watch is the next step in a quiet and ongoing payments revolution. Apple has signed deals with Visa, American Express and Mastercard as well as most US banks to create a way to pay via the watch.

You hold it over a standard credit card reader, and the payment is processed once you pass some biometric sensor tests. What these exact tests are is not clear but they’ll likely involve the four heart-rate sensors contained within the watch.

Mastercard’s mobile payments exec Ed McLaughlin says the watch “will able to know you are you… the watch is a very, very sophisticated monitor. There are more ways to fingerprint you without a fingerprint.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

(Alternatively if you would rather use your fingerprint, then use the iPhone 6 or the iPhone 6 Plus instead).

Some say Apple Pay won’t catch on. People understand and like plastic credit cards - they don’t need technology for technology’s sake. Business owners aren’t going to be leaping to replace a system that already works. Lots of people have tried it and failed (including notably the regrettably named ISIS - a joint venture in the US between Visa, Amex, Mastercard, Verizon and AT&T wireless which thus far hasn’t taken off). Security concerns are so great that people won’t leap to this new technology - iCloud hackers lurk everywhere!

But here’s why I believe it will work. It’ll make paying for stuff easier and better. Take Starbucks. It already has 10 million people paying via its app - i.e. one in 15 customers in every American Starbucks is paying via their phone. It is the most used digital payment app in the US. And once you use it, you realise how easy it is. It is faster, less hassle, and after 15 skinny cappuccinos, you get a free one. Would paying via your wrist be even simpler? Yes.

And while iCloud hacking exists, card fraud is a bigger problem. Last year, the British banking industry lost more than £450 million in card fraud, most of it online. Banks realise they have to deal with this: Barclays has just introduced biometric vein-reading technology to tackle exactly this problem. But while the technology is cool, my response to it remains, why isn’t the scanner on your phone? Mobile banking isn’t quite so mobile when you have to carry extra bits of kit to make it work.

The question is whether banks will be able to keep up with the innovation Apple is offering. It is more than a little ironic that as Apple Pay is launched Barclays should introduce another bit of kit that will only work when you plug it into your computer.

As I’ve argued before, banks risk becoming obsolete if they don’t keep up with the payments revolution. If I trust Apple to hold my cards, might I trust them to hold my money too? Think that’s a crazy idea? Then why has Amazon just hired Visa’s Nick Talwar to run its three-year old lending division?

Perhaps Apple’s formal entry to the payments world will be a wake-up call to banks. Julia Streets, CEO and founder of Streets Consulting, tells me: “Bank customers want new and sexy applications which are fast, easy-to-use and highly-intuitive to their needs. The winners will be the ones who will find smart ways to integrate their data, messages and processes and offer appealing user applications, without ever compromising customer or bank security."

I’m not chucking out my cards just yet, not least because Apple Pay won’t launch in the UK until next year. But I know I’ll use Apple payments, just as soon as I decide whether I'm using that second mortgage to buy the iPhone 6 or the Apple Watch.

-

The mystery of flight MH370

The mystery of flight MH370The Explainer In 2014, the passenger plane vanished without trace. Twelve years on, a new operation is under way to find the wreckage of the doomed airliner

-

5 royally funny cartoons about the former prince Andrew’s arrest

5 royally funny cartoons about the former prince Andrew’s arrestCartoons Artists take on falling from grace, kingly manners, and more

-

The identical twins derailing a French murder trial

The identical twins derailing a French murder trialUnder The Radar Police are unable to tell which suspect’s DNA is on the weapon

-

Will AI kill the smartphone?

Will AI kill the smartphone?In The Spotlight OpenAI and Meta want to unseat the ‘Lennon and McCartney’ of the gadget era

-

Is Apple’s Tim Cook about to retire?

Is Apple’s Tim Cook about to retire?Today's Big Question A departure could come early next year

-

iPhone Air: Thinness comes at a high price

iPhone Air: Thinness comes at a high priceFeature Apple’s new iPhone is its thinnest yet but is it worth the higher price and weaker battery life?

-

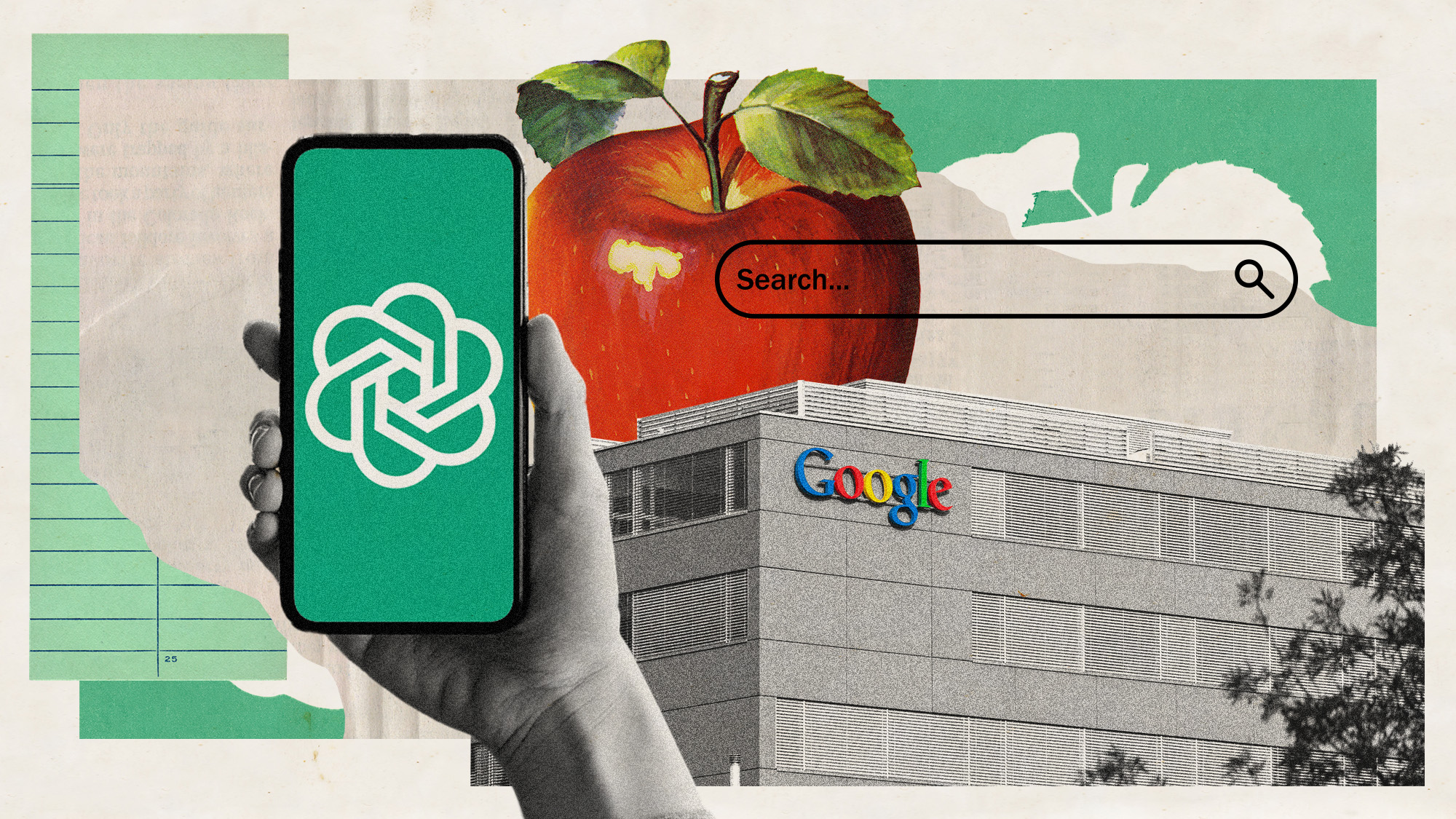

Is Apple breaking up with Google?

Is Apple breaking up with Google?Today's Big Question Google is the default search engine in the Safari browser. The emergence of artificial intelligence could change that.

-

Why won't Apple make iPhones in America?

Why won't Apple make iPhones in America?Today's Big Question Trump offers a reprieve on tariffs, for now

-

Not there yet: The frustrations of the pocket AI

Not there yet: The frustrations of the pocket AIFeature Apple rushes to roll out its ‘Apple Intelligence’ features but fails to deliver on promises

-

Space-age living: The race for robot servants

Space-age living: The race for robot servantsFeature Meta and Apple compete to bring humanoid robots to market

-

Apple pledges $500B in US spending over 4 years

Apple pledges $500B in US spending over 4 yearsSpeed Read This is a win for Trump, who has pushed to move manufacturing back to the US