Twitter: Musk digs himself into a deeper hole

Is Twitter being steered towards bankruptcy?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The smartest insight and analysis, from all perspectives, rounded up from around the web:

It's clear that Elon Musk has no idea what he's doing with Twitter, said Farhad Manjoo in The New York Times. Within days of taking over the social media giant he took private for $44 billion, he warned employees that "bankruptcy isn't out of the question." His reign "reached an absurdist peak" last week when he rolled out his Twitter Blue plan to allow anyone to buy a blue-and-white "verified" check mark for $8 a month. Musk had pitched his idea "as a way to add egalitarian sensibility to Twitter." But "if anyone could pay to be verified," wouldn't that mean "nobody was verified?" Musk apparently hadn't considered this. Within hours, pranksters had created "verified" accounts spoofing Donald Trump, Pope Francis, Tesla, and O.J. Simpson. A tweet sent by a verified — but fake — account impersonating pharmaceuticals giant Eli Lilly declared that "insulin is free now," sending Eli Lilly's stock plunging. Musk then suspended the Blue program and Twitter rolled out gray "Official" badges for "really authentic accounts." The new gray badges lasted just a few hours before Musk said he would kill those, too.

Turning Twitter into a subscription-dominated site was Musk's big idea for profitability, said Matt Ford in The New Republic. "What could go wrong?" Well, now we know. As much as Musk and conservatives loathed the blue check mark as a "status symbol," it "actually served an important verification service." Opening it up to anyone without requiring proof of their identity "has erased any trust or confidence" in the platform. What's to stop a person who realizes that he "can short a company's stock, impersonate a journalist, tweet that the Justice Department indicted that company's CEO for securities fraud, and reap the rewards of any price drop?" You almost wonder if he is "deliberately steering Twitter toward bankruptcy," said Parmy Olson in Bloomberg. This week, he cut "a large number of the company's contract workers without warning." Many of those workers were content moderators. So now advertisers have yet another reason to stay away.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Talk of bankruptcy is premature, said Paula Seligson and Lucca De Paoli, also in Bloomberg, but "his comments shouldn't be entirely discounted." Musk borrowed about $13 billion from banks; Twitter has to pay interest on that debt, and interest rates are rising. The company had $2.7 billion in cash as of June 30, which should keep it afloat "for a good amount of time." However, "Twitter reaps almost all its revenue from big brands," said Jennifer Saba in Reuters, "and those big advertisers are already looking for an excuse to put the brakes on spending" amid economic worries. Musk is giving them that excuse.

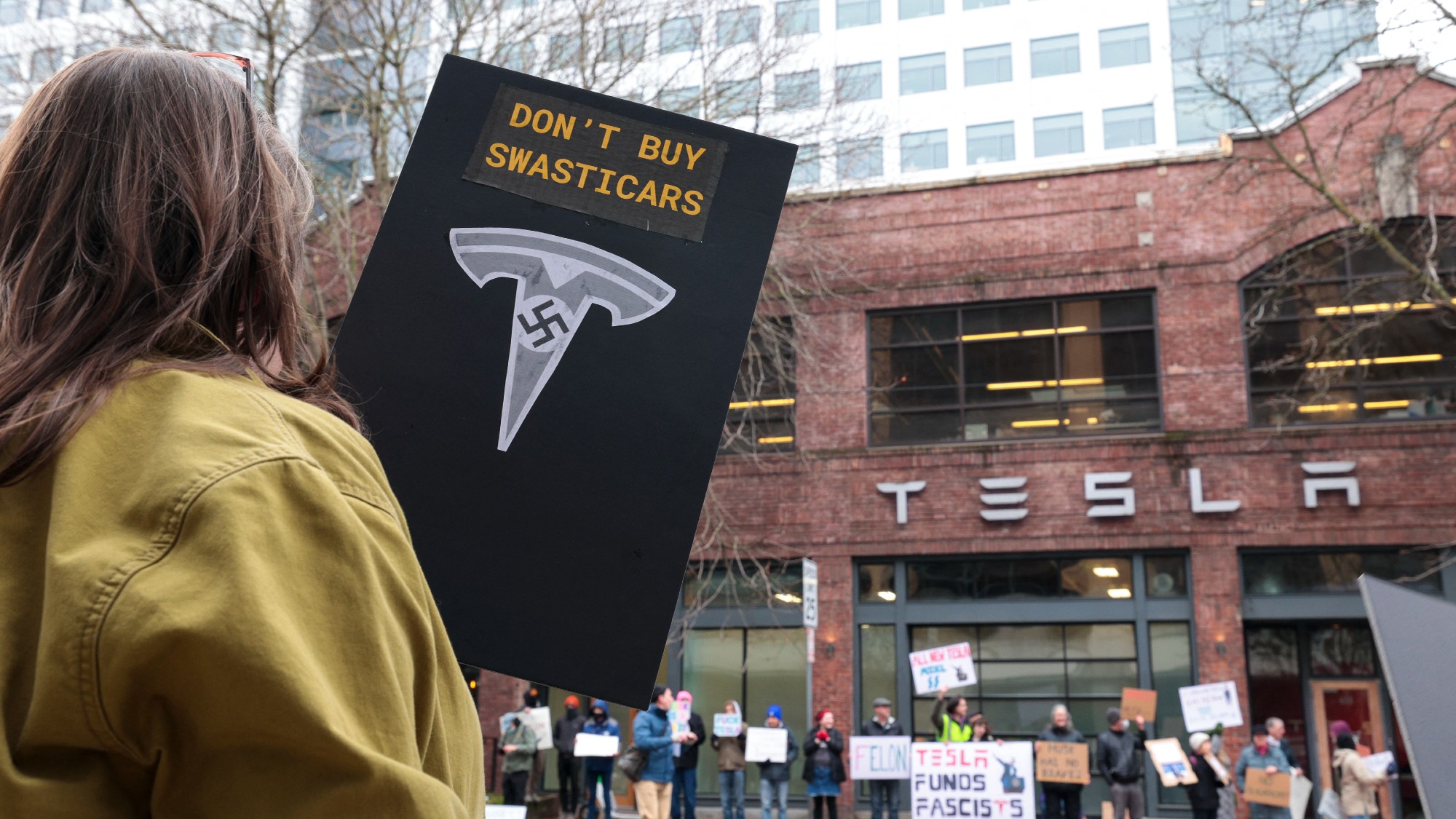

Tesla is becoming Twitter's collateral damage, said Therese Poletti in MarketWatch. Shares in the electric-car maker, which Musk also leads, are down 49.6 percent this year. The concerns for investors "go far beyond Musk selling stock" to finance his purchase. He has reportedly "pulled more than 50 Tesla engineers" to help run Twitter. Many people have "bought into the Tesla story because they believe Musk is a genius." The chaotic mess at Twitter is rapidly eroding that myth.

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Musk wins $1 trillion Tesla pay package

Musk wins $1 trillion Tesla pay packageSpeed Read The package would expand his stake in the company to 25%

-

How Tesla can make Elon Musk the world’s first trillionaire

How Tesla can make Elon Musk the world’s first trillionaireIn The Spotlight The package agreed by the Tesla board outlines several key milestones over a 10-year period

-

Tesla reports plummeting profits

Tesla reports plummeting profitsSpeed Read The company may soon face more problems with the expiration of federal electric vehicle tax credits

-

How could Tesla replace Elon Musk?

How could Tesla replace Elon Musk?Today's Big Question The company's CEO is its 'greatest asset and gravest risk'

-

Elon Musk: has he made Tesla toxic?

Elon Musk: has he made Tesla toxic?Talking Point Musk's political antics have given him the 'reverse Midas touch' when it comes to his EV empire