Why are US markets hitting record highs?

Optimism over trade deal progress even took the Dow Jones up

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

US stock markets reached record highs in early trading yesterday, as optimism over the prospect of a US-China trade deal rose again.

On a historic day on the markets, the S&P 500 rose above 3,066.95 points and the Nasdaq also hit a new record of 8,444.99 points.

“That's nothing new,” says CNN. “Stocks hit new records last week. But this time the Dow is joining the record-setting club.” The Dow Jones was up 0.46% in early trading.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Fox News reports that the spikes came after the Chinese Foreign Ministry announced that Donald Trump and Xi Jinping have remained in contact while negotiators agree the final language for the “phase one” of the trade agreement between the two natios.

“Stock Market hits RECORD HIGH. Spend your money well!” tweeted Donald Trump.

Pierre Veyrett, technical analyst at ActivTrades, told The Guardian this optimism is “likely to keep on supporting stock prices around the globe this week, especially if US and Chinese data is in line with or continues to beat expectations like last week’s solid non-farm payroll reports”.

Markets around the world rose in response to the Wall Street lead. India’s stock market closed at a new record high, Britain’s FTSE 100 gained more than 1% and the pan-European Stoxx 600 index reached a 21-month high.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

However, less positive news for the US came in the form of factory orders data, which fell by 0.6% in September - worse than the 0.1% fall in August, and also worse than the 0.5% decline predicted by experts. The news dampened excitement among traders.

–––––––––––––––––––––––––––––––For a round-up of the most important stories from around the world - and a concise, refreshing and balanced take on the week’s news agenda - try The Week magazine. Get your first six issues for £6–––––––––––––––––––––––––––––––

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Why is crypto crashing?

Why is crypto crashing?Today's Big Question The sector has lost $1 trillion in value in a few weeks

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

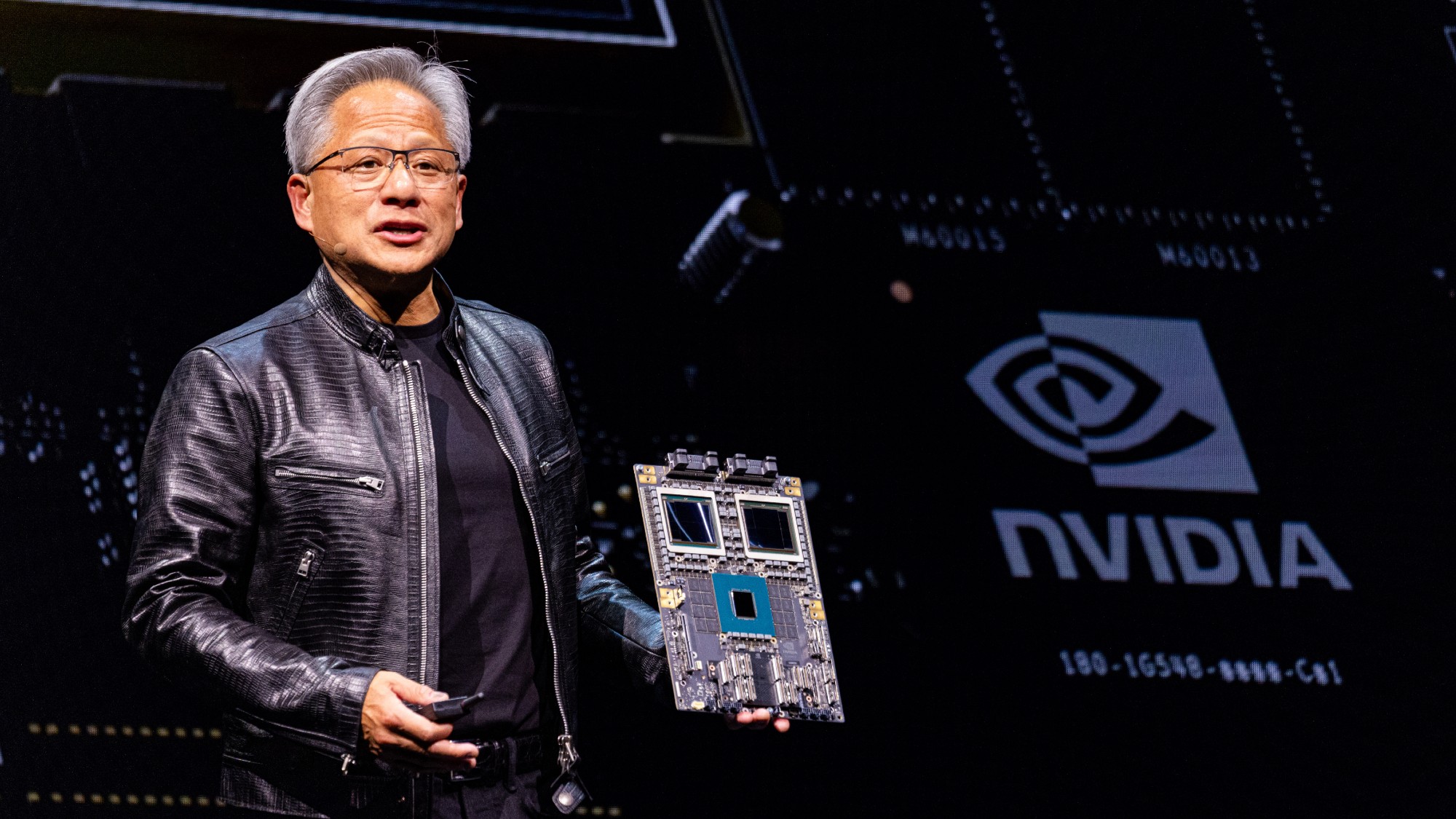

Nvidia: unstoppable force, or powering down?

Nvidia: unstoppable force, or powering down?Talking Point Sales of firm's AI-powering chips have surged above market expectations –but China is the elephant in the room

-

DORKs: The return of 'meme stock' mania

DORKs: The return of 'meme stock' maniaFeature Amateur investors are betting big on struggling brands in hopes of a revival

-

Tesla reports plummeting profits

Tesla reports plummeting profitsSpeed Read The company may soon face more problems with the expiration of federal electric vehicle tax credits

-

Trump's threats to fire Jerome Powell are unsettling the markets

Trump's threats to fire Jerome Powell are unsettling the marketsTalking Points Expect a 'period of volatility' if he follows through