How Hurricane Katrina was like the Great Recession

On an economic level, the hurricane remade New Orleans — and not for the better

This Saturday, Aug. 29, marks the 10th anniversary of Hurricane Katrina. President Obama headed to New Orleans on Thursday to herald the city's recovery and to call for continued government support of the rebuilding effort.

Unfortunately, digging beneath New Orleans' topline figures reveals a disturbing post-Katrina trend. An assessment in The Wall Street Journal showed that while the city has recovered much of its population, wages are stagnating and job growth is clustering in low-wage employment. Gentrification is taking over in many neighborhoods, and New Orleans is slowly being remade: whiter overall, and more unequal, with the unique artistic and working class culture the city nurtured for decades fading to its sidelines.

What's interesting, in a morbid way, is how this shift mirrors the transition of America as a whole in the aftermath of the Great Recession.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

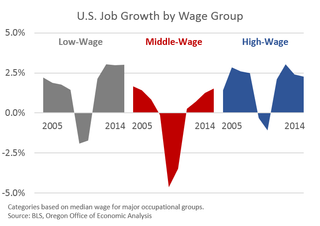

Since 2008, jobs have slowly returned nationally. But they're clustering in the top and bottom echelons of the economy, resulting in overall lower levels of pay for Americans. From the start of the recovery in 2010 until 2013, roughly half of all jobs created in the private sector paid $16 an hour or less. The average national wage at the time was $20.04 an hour, giving you an idea of how much clustering there was at the top and bottom of the pay scale.

The situation has gotten better. The degree of polarization between high- and low-paying jobs slowed down in 2014 from its 2010-2013 trend. But "while high- and low-wage jobs have fully regained their recessionary losses and never been more plentiful, middle-wage jobs have regained just 43 percent of their losses and remain 4.6 percent below their peak levels," according to the Oregon Office of Economic Analysis.

(Graph courtesy of the Oregon Office of Economic Analysis.)

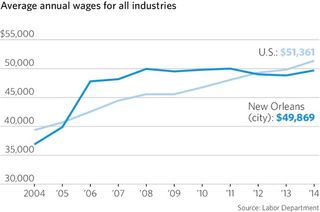

This is what's been termed the "hourglass economy," and in the aftermath of Katrina, much the same story is playing out in the microcosm of New Orleans itself. Raymond Brady, an economist and vice president of the New Orleans Regional Council of Business Economics, told the Journal that of the 10 biggest job sectors in the city — areas like education, retail, food and beverage distribution, government employment, and health services — only one pays as much or more than the area's average pay of $48,437 a year.

A study by the Brookings Institution the Journal also cited found that 70 percent of the 50,000 new jobs the city added from 2010 to 2014 were in industries that paid less than the city's average annual wage. On top of it all, that average has essentially flatlined since Katrina's arrival:

(Graph courtesy of The Wall Street Journal.)

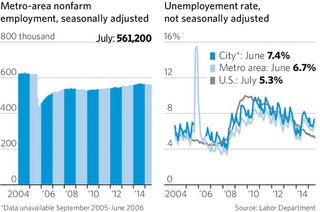

Though masked for a while in New Orleans by the boom in construction after the hurricane, the city's overall supply of jobs has been declining as well. Employment in the region peaked in 2001 at just below 635,000, and has been on a slow downslope ever since. The post-Katrina recovery has simply brought the supply of employment back on course for that downward trend:

(Graph courtesy of the Wall Street Journal.)

The national situation is slightly different, but tells a similar story. The percentage of prime-age working adults (ages 25 to 54) who have a job peaked in 2000 at nearly 82 percent. Then the 2001 recession drove it below 79 percent, and it had only recovered to 80 percent when the 2008 collapse sent it nosediving to 75 percent — its lowest level since the early 1980s, before the entrance of women into the workforce had completed itself:

[[{"type":"media","view_mode":"media_large","fid":"127340","attributes":{"alt":"","class":"media-image","height":"399","style":"display: block; margin-left: auto; margin-right: auto;","typeof":"foaf:Image","width":"600"}}]]

It's gotten a little above 77 percent at this point, but if history is any gauge, the country is about due for another downturn. Accounting for the growth in population, America still has a ways to go before it gets back to the same level of employment it had before the Great Recession, and at the rate we're going it will be at least the summer of 2017 before we get there.

So at the national level what you're seeing is a shock followed by a genuine resurgence, but with the next shock coming well before the damage from the old shock has been repaired.

This gets to where the "shock" that was the Great Recession and the "shock" that was Hurricane Katrina really begin to converge in their respective natures.

For one thing, employers took the shocks as an opportunity to bring in new efficiencies and automate. Hotels in New Orleans, for example, are now handling as big a flow of guests as ever, but with a smaller workforce than what they employed before Katrina. Improvements in productivity certainly aren't a bad thing on their face. But without the bottom-up pressure of worker bargaining power and wage growth, these shocks become an opportunity for employers to downsize their workforce and shift more of the flow of their revenue towards the top of their business model.

Another thing that happens from shocks like these is they take people already on the fringes of the social fabric — with the least power and the most vulnerability — and shove them off the twig entirely. After which come the populations with more power and wealth to throw around. The percentage of people in New Orleans paying 50 percent of their income for housing jumped from under 25 percent in 2004 to over 35 percent in 2013. (Thirty percent is considered a dangerous burden by housing experts.)

This is while upper class professionals are actually driving a mini-boom in the city: The New Orleans metro area saw 471 company start-ups per 100,000 adults in 2012, versus 288 nationally. There's a similar countrywide trend as booms in tech and other sectors have turned cities into hubs of economic vibrancy, but at the same time housing prices have shot through the roof, driving out everyone who isn't in the upper tiers of the economy.

New Orleans' overall population has recovered to 90 percent of what it was pre-Katrina, but African Americans are down to 59 percent of the population, versus 67 percent before the hurricane. Meanwhile, the portion of black households with income below $21,000 is on the uptick.

At the national level, we should eventually be able to bring these people back into the workforce. But only if we can avoid another major recession, and only if policymakers allow the recovery to continue at full strength for a long time to come. As for New Orleans, who knows?

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Musk vs. Altman: The fight over OpenAI

Musk vs. Altman: The fight over OpenAIFeature Elon Musk has launched a $97.4 billion takeover bid for OpenAI

By The Week US Published

-

'There is no actor who comes close to conveying authority with such humanity'

'There is no actor who comes close to conveying authority with such humanity'Instant Opinion Opinion, comment and editorials of the day

By Justin Klawans, The Week US Published

-

6 excellent sleeping bags for campers seeking comfort

6 excellent sleeping bags for campers seeking comfortThe Week Recommends Have sweet dreams in these snug bags

By Catherine Garcia, The Week US Published

-

Late night hosts joke about Trump's forced exodus from Facebook to blog

Late night hosts joke about Trump's forced exodus from Facebook to blogSpeed Read

By Peter Weber Published

-

Fox News admits Biden doesn't actually want to cancel meat. Late night hosts pounce anyway.

Fox News admits Biden doesn't actually want to cancel meat. Late night hosts pounce anyway.Speed Read

By Peter Weber Published

-

Manhattan D.A. will stop prosecuting sex workers, not their clients, pimps, or sex traffickers

Manhattan D.A. will stop prosecuting sex workers, not their clients, pimps, or sex traffickersSpeed Read

By Peter Weber Published

-

John Oliver explains personal bankruptcy, how credit card lobbyists and lawyers make it much worse

John Oliver explains personal bankruptcy, how credit card lobbyists and lawyers make it much worseSpeed Read

By Peter Weber Published

-

John Oliver explores problems with U.S. nursing homes and long-term care, suggests you pay attention

John Oliver explores problems with U.S. nursing homes and long-term care, suggests you pay attentionSpeed Read

By Peter Weber Last updated

-

John Oliver tries to explain whether you should worry about the enormous U.S. national debt

John Oliver tries to explain whether you should worry about the enormous U.S. national debtSpeed Read

By Peter Weber Last updated

-

Late night hosts laugh at the giant ship blocking the Suez Canal, chide Fox News for fake Kamala Harris scandal

Late night hosts laugh at the giant ship blocking the Suez Canal, chide Fox News for fake Kamala Harris scandalSpeed Read

By Peter Weber Published

-

Utah governor signs bill requiring porn blocking on all new smartphones and tablets

Utah governor signs bill requiring porn blocking on all new smartphones and tabletsSpeed Read

By Peter Weber Published