Can corporations be coaxed into saving America?

This new report on jobs is smart, optimistic, and bipartisan. It's also wrong.

One problem bedeviling American capitalism is what's called the "fissured workplace."

Decades ago, large companies offered secure jobs with good pay and benefits that lasted a lifetime. Today, Americans flit between short-stint jobs and contract work that doesn't offer minimum wage or overtime protections, much less long-term benefits. So if you want to know why the economy doesn't seem to work for so many Americans, the fissured workplace is one of the prime culprits.

A new proposal from the Aspen Institute's Future of Work Initiative, entitled "Toward a New Capitalism," aims to help. It features 25 policy ideas that are genuinely new and creative — a handful I'd go so far as to call genuinely ambitious. But by implication of what it doesn't address, the report also reveals how hard fixing the U.S. economy really is.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The report lays out a lucid narrative for how we got to this impasse. The rise of global trade and modern communication technology upended the logic by which businesses are organized, fracturing the social compact and undermining unions. Business owners demanded bigger profit payouts at faster rates, so payouts to shareholders now routinely chew up all profits and then some. In 1960, the average time an investor held a stock before selling it off was eight years, while today it's a mere four months. This all drove businesses away from investing in their employees: Since 1996, employers paying for training or providing on-the-job training has fallen 42 percent and 36 percent, respectively.

So the "New Capitalism" proposal calls for a few fixes to make work "a mutual enterprise," as Ethan Pollack, the research manager at the Future of Work Initiative, told The Week. (Full disclosure: Pollack is a personal friend.) The proposal recommends giving more company equity to workers, so that shareholder payouts equal payouts to employees. To foster democracy in the workplace, it suggests bringing worker representatives onto corporate boards. It calls for turning student debt relief into a jobs benefit and for more employer-sponsored trainings. And it also recommends instituting capital gains taxes that begin at the highest current income tax rate of 39.6 percent, then fall the longer the asset is held.

As for enforcement, the report is willing to recommend using the brute force of law in some cases — for example, changing financial regulations to squash the flood of stock buybacks and to require worker representation on corporate boards. But other ideas rely on nudges and carrots: Altering accounting standards and changing the tax code to make investment in workers look as appealing as physical capital, or offering tax breaks to incentivize worker equity, training, and college debt repayment, for instance.

And that's really the problem with the "New Capitalism" report. Turning business into "a mutual enterprise" is a worthy goal, but even the report's most ambitious proposals lack teeth. They ultimately rely on coaxing businesses to do the right thing, and businesses' openness to being coaxed.

This is not particularly surprising when you consider the fact that the "New Capitalism" report was explicitly and conscientiously a bipartisan effort. It was headed up by Sen. Mark Warner (D-Va.) and former Republican governor of Indiana and current president of Purdue University Mitch Daniels — a centrist liberal and a centrist conservative, respectively. That makes sense: Bipartisan proposals probably have a far better chance at getting passed. And as Pollack pointed out, the proposal shows that "people with different ideological backgrounds can come to together and define the problem, and define it in a way where you're admitting that capitalism isn't really working. That by itself is really significant."

But bipartisanship also means some approaches will get vetoed right out of the gate. The policies that really effect aggregate demand and the jobs supply are going to be "big government" employment and spending ideas that conservatives generally don't like. That means deficit-financed Keynesian stimulus, extra-loose monetary policy, expanded welfare state spending to juice aggregate demand, and more public employment — policies that stand no chance of finding conservative support. It's not obvious there's a way to frame the failures of capitalism that gets around this political problem.

So centrist proposals are often left trying to coax, nudge, and prod corporations into treating workers as equal peers and partners in business. One big example of this is the 401(k) revolution, which used tax incentives to get businesses to set up retirement portfolios for their workers. That's been a grossly inadequate failure. The U.S. also relies on carrots in the tax code to get employers to provide health coverage, but the number of jobs in the economy that offer such benefits has been dropping anyway. And generally speaking, when companies do offer benefits to workers — be they retirement or health coverage or paid leave or whatever — they're most generous to the upper-class workers who need the help the least. So it's not obvious that coaxing corporations into sharing the wealth can actually work, or at least work at the scale it needs to. It's quite possible that the only time owners and financiers will concede workers an equal place at the table is when they literally cannot afford to do otherwise.

And if this more optimistic and bipartisan vision of reform isn't how it works, that raises the scariest question of all: Is American politics even capable of fixing American capitalism?

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

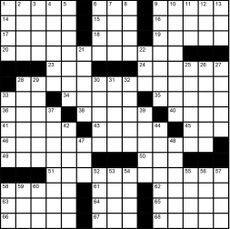

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine printables - April 26, 2024

Magazine printables - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published