Tax reform is stupid. Here's how to make it smart.

Replace tax breaks with better, more equal programs

President Trump is by all accounts desperate for some sort of accomplishment, and tax reform is next on the agenda. Yet the Trump administration is quickly finding it to be almost as headache-provoking as health care. When White House Press Secretary Sean Spicer announced that tax reform would abolish the 401(k) retirement tax benefit, for instance, he had to quickly reverse himself after a storm of outrage. As Aaron Blake pointed out at The Washington Post, this is exactly why real tax reform hasn't been passed in decades. It creates too many losers.

But what if that's because the traditional conception of tax reform is outdated and incomplete? Tax breaks work towards many important goals, however poorly. So if you really want to pursue tax reform, you can't just focus on rates and inefficiencies. You should couple it to replacement policies that are more equal and effective.

The usual idea of tax reform is to get rid of inefficient deductions, credits, and exemptions, and plow the money thus raised into lower rates. The conventional wisdom is that this would streamline the process of tax filing, and boost economic growth by getting rid of economic "distortions."

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Now, it is very likely that this sort of thing does not actually boost growth. Even according to traditional economic theory, the main thing holding back growth since 2008 (and arguably long before that) has been insufficient aggregate demand. This sort of structural change is supposed to increase the top speed of the economy. If it is to work, demand must be there to keep the gas pedal pressed to the floor, so to speak — and it has not been for quite some time.

Even that is probably over-generous. The very idea of "distortions" is an exercise in question-begging; it basically assumes a laissez-faire economy is the type of economy which grows fastest, even though the bulk of historical evidence suggests that is not remotely true and never has been. Wealthy, modern economies need a lot of government to keep moving.

However, it is unquestionably the case that various tax subsidies are horrendously inefficient in terms of the policy goals they are supposed to achieve. If you look at direct social spending (stuff like Medicare and Social Security) as a percentage of the economy, the United States comes in towards the bottom of our peer nations. But if you include tax subsidies (stuff like the employer tax exclusion for health insurance — which you should, because they are functionally identical to spending), we are actually towards the top, ranking above nations like Denmark and Finland.

That rather staggering fact — that America, with its millions of uninsured people and no paid leave, does more economic allocation via government than nations with awesomely generous benefit programs — is mostly down to the basic structure of tax subsides. The simplest form of tax break inherently benefits the rich the most, because the more you make, the more you pay in taxes. So if you set up a tax benefit to incentivize homeownership or retirement saving, it means tons of money being plowed into social programs for people who need them the least. Indeed, a couple years ago I added up the price of welfare for 1 percenters alone at over $133 billion, and over $355 billion for the top income quintile.

The 401(k) program is terrible for just this reason. Poor people get nothing, because they make little money (most low-class jobs don't even have retirement benefits), while most of the actual benefit goes to the very rich with lots of taxes to deduct and enough spare cash to hire accountants to maximally game the system. (Meanwhile, most middle-class people who manage to use the benefit fall victim to swindlers who heavily advertise their rip-off mutual funds.)

Of course, it's perfectly understandable why people who have worked hard to save for retirement would be infuriated at the idea of losing their tax benefit. The solution is not to bemoan the intransigence and selfishness of people, but propose a replacement policy that is more efficient and more equal.

So instead of just getting rid of the 401(k), replace it with a big increase in Social Security, across the board. Instead of just getting rid of the mortgage interest deduction, replace it with a universal housing voucher that could be used for rent or a house payment. That approach, applied across the whole policy universe, could make taxes simpler, more efficient, and dramatically improve the lives of the vast majority of American citizens.

Only the top 5-10 percent of people would come out behind, since they benefit disproportionately from the current system. But universal programs have the potential to activate a wide constituency to counterbalance certain enraged resistance from the rich. If we want to get tax reform done properly, that's where the necessary political support must be found.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Israel's plan for confining all Palestinians in 'humanitarian city'

Israel's plan for confining all Palestinians in 'humanitarian city'The Explainer Defence minister wants to establish zone in Gaza for displaced people – which they would not be allowed to leave – prompting accusations of war crimes

-

Secluded retreats for aspiring writers

Secluded retreats for aspiring writersThe Week Recommends These tranquil hideaways are the perfect place to put pen to paper

-

The Velvet Sundown: viral band that doesn't actually exist

The Velvet Sundown: viral band that doesn't actually existIn the Spotlight These AI-generated rock hits are brought to listeners by… no one

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: which party are the billionaires backing?

Democrats vs. Republicans: which party are the billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

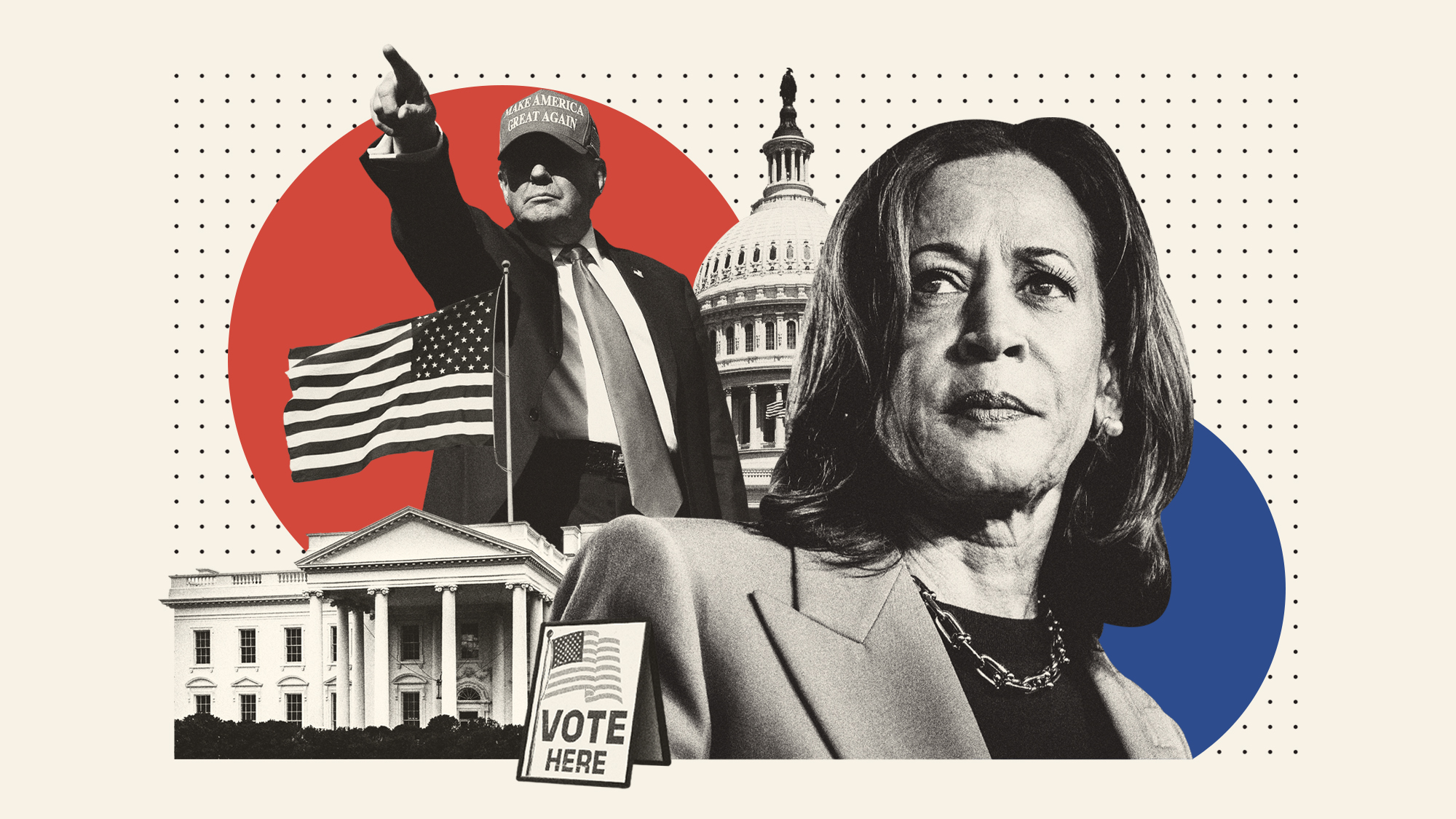

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event

-

The life and times of Kamala Harris

The life and times of Kamala HarrisThe Explainer The vice-president is narrowly leading the race to become the next US president. How did she get to where she is now?