The daily business briefing: February 29, 2016

The G20 meeting ends, Starbucks aims for Italy, and more

- 1. G20 meeting in Shanghai concludes, no specific spending packages promised

- 2. NFL salary cap set at $155.27 million for 2016

- 3. Starbucks to open first store in Italy

- 4. Stock prices down slightly in Europe and Asia

- 5. Harvard Business Review argues it's time to stop paying CEOs performance bonuses

1. G20 meeting in Shanghai concludes, no specific spending packages promised

The Group of 20 meeting of finance ministers and central bankers from the world's top economies has concluded without recommending any specific spending package to prevent another global financial crisis. The G20, which met for two days in China, did indicate that governments need to do more than promote low interest rates to improve the faltering global economy, and that countries must work together more on foreign exchange policy. Some analysts interpreted this as a criticism of Chinese economic decisions. The county's rapid devaluation of the yuan in recent months has angered many other countries — including the U.S. — because the move gives China an economic advantage.

2. NFL salary cap set at $155.27 million for 2016

The NFL Players Association confirmed that the 2016 salary cap has been set at $155.27 million. That's a nearly $12 million increase from last year. The bump is due to several developments, including a new Thursday night TV package and a recent arbitrator's ruling that the league had earlier failed to apply certain revenues to the cap. The salary cap limits the total amount of money that individual teams can spend on player salaries.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Starbucks to open first store in Italy

Starbucks announced Sunday that it will open a store in Milan in 2017. While the company's CEO, Howard Schultz, decided to bring espresso drinks to the U.S. after visiting Milan and Verona in the 1980s, until now the coffee chain had opened no stores in Italy. Starbucks said it was expanding to Italy with "with humility and respect." Only about 10 percent of the company’s stores are located in Europe, the Middle East, and Africa.

4. Stock prices down slightly in Europe and Asia

Stock prices fell moderately in Europe and Asia Monday after the G20 weekend meeting failed to result in a new plan to promote economic growth. Investors are also worried the U.S. Federal Reserve could raise interest rates before the end of the year. "Markets looked at the G20 meeting and found it a tad disappointing,” said Peter Lowman, CIO of Investment Quorum, a London-based wealth management firm.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Harvard Business Review argues it's time to stop paying CEOs performance bonuses

A recent article in the Harvard Business Review recommended that companies stop giving CEOs performance bonuses. "We argue in favor of abolishing pay-for-performance for top managers altogether, wrote London Business School professors Freek Vermeulen and Dan Cable. "Instead, most firms should pay their top executives a fixed salary." Vermeulen and Cable say that performance bonuses and stock options have been ineffective because such salary schedules tend to promote fraud, executives actually perform worse when they have explicit goals to reach, and performance is notoriously difficult to measure effectively.

Daniel Luzer is a senior editor at TheWeek.com. Previously, he worked as the news editor of Governing magazine and the web editor of the Washington Monthly. His work has appeared in publications including Mother Jones, Salon, the Boston Review, Pacific Standard, and Columbia Journalism Review. (It's pronounced Loot-zer.)

-

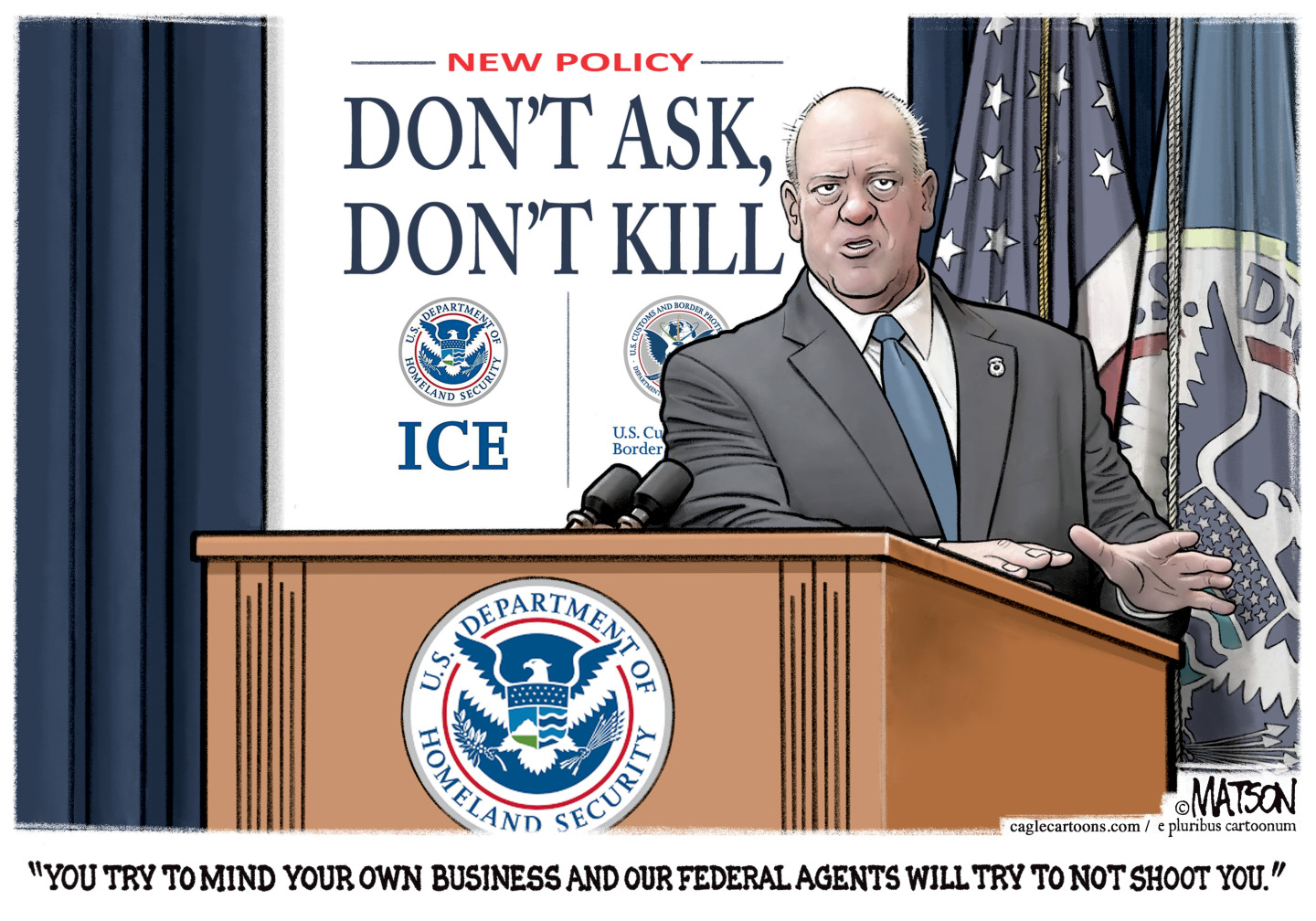

Political cartoons for February 1

Political cartoons for February 1Cartoons Sunday's political cartoons include Tom Homan's offer, the Fox News filter, and more

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Reforming the House of Lords

Reforming the House of LordsThe Explainer Keir Starmer’s government regards reform of the House of Lords as ‘long overdue and essential’

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military

-

How Bulgaria’s government fell amid mass protests

How Bulgaria’s government fell amid mass protestsThe Explainer The country’s prime minister resigned as part of the fallout

-

Femicide: Italy’s newest crime

Femicide: Italy’s newest crimeThe Explainer Landmark law to criminalise murder of a woman as an ‘act of hatred’ or ‘subjugation’ but critics say Italy is still deeply patriarchal