U.S. regulators reportedly set to reject 'living wills' of several too-big-to-fail banks

As early as this week, the Federal Reserve and FDIC will inform at least half of the U.S. banks deemed systemically important that their "living wills" are inadequate to assure an orderly bankruptcy without a taxpayer bailout, The Wall Street Journal reports, citing "people familiar with the matter." It isn't clear how the dissolution plans of the four banks — J.P. Morgan Chase, Bank of New York Mellon, State Street, and Bank of America — fall short, or how much change is needed to satisfy regulators that the banks aren't "too big to fail." Citigroup is expected to get the green light, The Journal said, and the status of the living wills at Goldman Sachs, Morgan Stanley, and Wells Fargo are not known.

The systemically important U.S. banks had to file their living wills under the 2010 Dodd-Frank financial reform law, and the Fed and FDIC gave general public feedback — most of it negative — in 2014. The banks refiled their plans in 2015, and this round of public feedback will likely be specific and detailed about each bank, The Journal says. The firms whose wills are rejected will have a chance to resubmit them, perhaps in a year, and if they are still found lacking, the regulators could sanction the banks by, for example, raising their capital requirements, which can lower profitability. After two years of sanctions, regulators can force banks to sell off assets. All of the banks have told regulators they believe their living wills are credible.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Warren Buffet announces surprise retirement

Warren Buffet announces surprise retirementspeed read At the annual meeting of Berkshire Hathaway, the billionaire investor named Vice Chairman Greg Abel his replacement

-

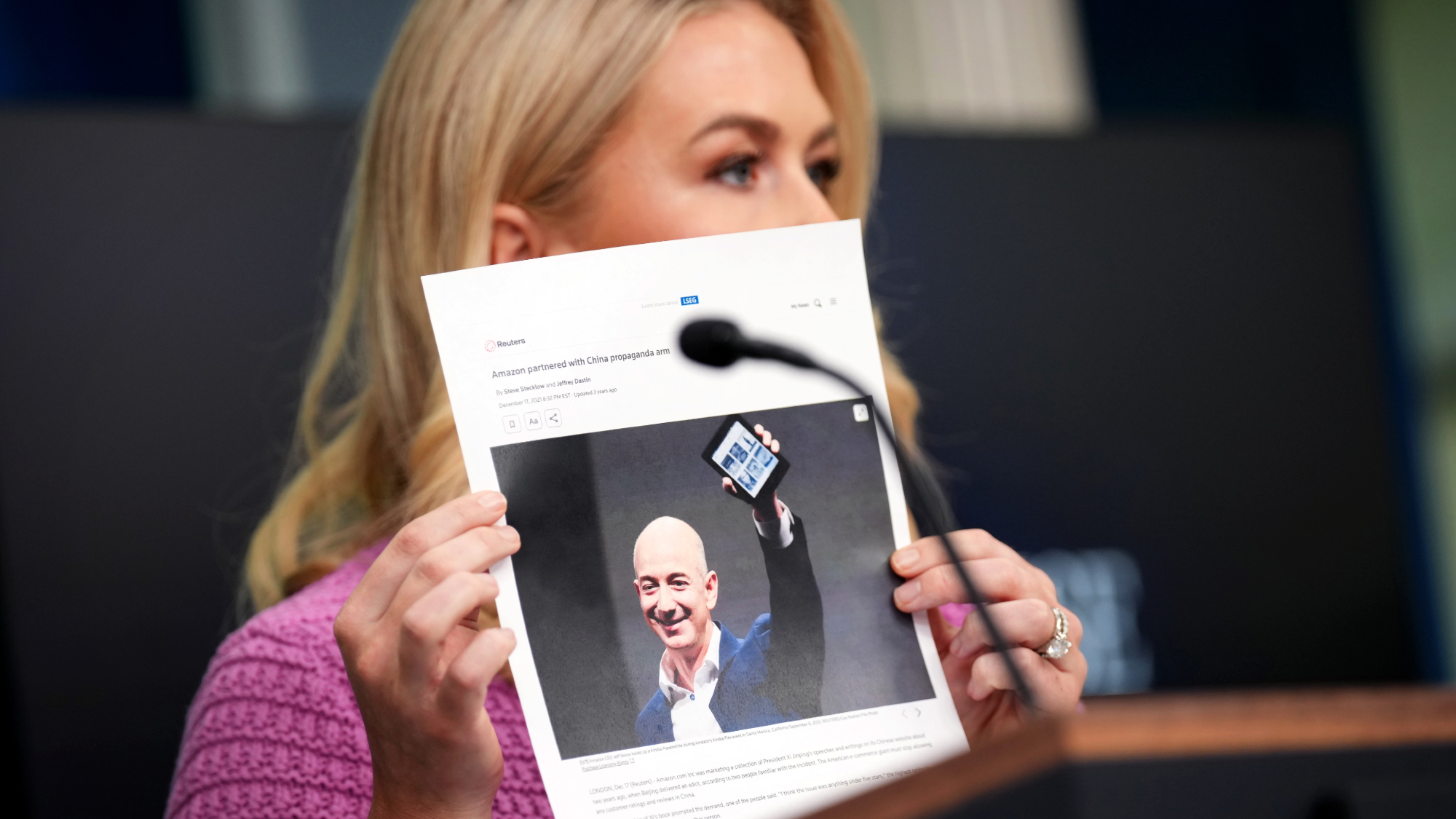

Trump calls Amazon's Bezos over tariff display

Trump calls Amazon's Bezos over tariff displaySpeed Read The president was not happy with reports that Amazon would list the added cost from tariffs alongside product prices

-

Markets notch worst quarter in years as new tariffs loom

Markets notch worst quarter in years as new tariffs loomSpeed Read The S&P 500 is on track for its worst month since 2022 as investors brace for Trump's tariffs

-

Tesla Cybertrucks recalled over dislodging panels

Tesla Cybertrucks recalled over dislodging panelsSpeed Read Almost every Cybertruck in the US has been recalled over a stainless steel panel that could fall off

-

Crafting emporium Joann is going out of business

Crafting emporium Joann is going out of businessSpeed Read The 82-year-old fabric and crafts store will be closing all 800 of its stores

-

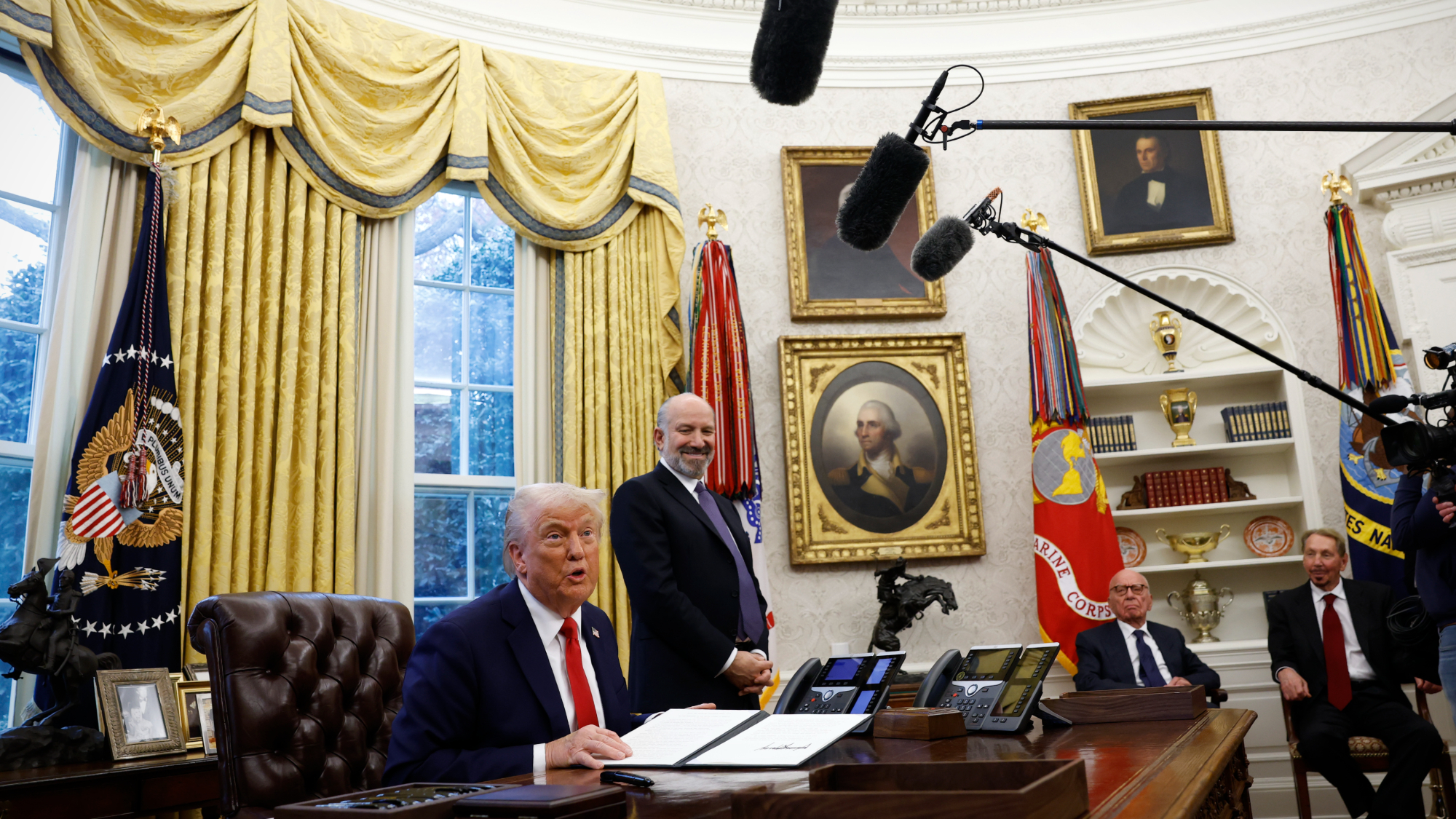

Trump's China tariffs start after Canada, Mexico pauses

Trump's China tariffs start after Canada, Mexico pausesSpeed Read The president paused his tariffs on America's closest neighbors after speaking to their leaders, but his import tax on Chinese goods has taken effect

-

Chinese AI chatbot's rise slams US tech stocks

Chinese AI chatbot's rise slams US tech stocksSpeed Read The sudden popularity of a new AI chatbot from Chinese startup DeepSeek has sent U.S. tech stocks tumbling

-

US port strike averted with tentative labor deal

US port strike averted with tentative labor dealSpeed Read The strike could have shut down major ports from Texas to Maine