Senate Republicans pass massive GOP tax bill, send back to House for technical re-vote

Vice President Mike Pence's tiebreaking vote wasn't needed. After midnight on Wednesday, the Senate passed the GOP's $1.5 trillion tax plan along party lines, 51-48, sending the legislation back to the House for final approval. The House had passed the bill Tuesday, 227-203 — with 12 Republicans and all Democrats voting no — but because the bill violated arcane parliamentary rules in place due to Senate Republicans using a special veto-proof process, House Republicans will have to approve it again Wednesday.

Overall, the sweeping tax law slashes the corporate tax rate to 21 percent from 35 percent, lowers the top rate for the richest Americans, and gives more modest tax cuts to everyone else. The corporate tax rates don't expire, but the individual cuts sunset in 2026. There are lots of other provisions that collectively will affect every American. It is projected to add $1.46 trillion to the deficit over 10 years. Republicans cheered on the Senate floor after the vote, while a man with an eye patch in the Senate gallery shouted, "You have sentenced me to die!"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

The great global copper swindle

The great global copper swindleUnder the Radar Rising prices and easy access makes the metal a ‘more attractive target for criminals looking for a quick profit’

-

‘They’re nervous about playing the game’

‘They’re nervous about playing the game’Instant Opinion Opinion, comment and editorials of the day

-

Will Netanyahu get a pardon?

Will Netanyahu get a pardon?Today's Big Question Opponents say yes, if he steps down

-

Google avoids the worst in antitrust ruling

Google avoids the worst in antitrust rulingSpeed Read A federal judge rejected the government's request to break up Google

-

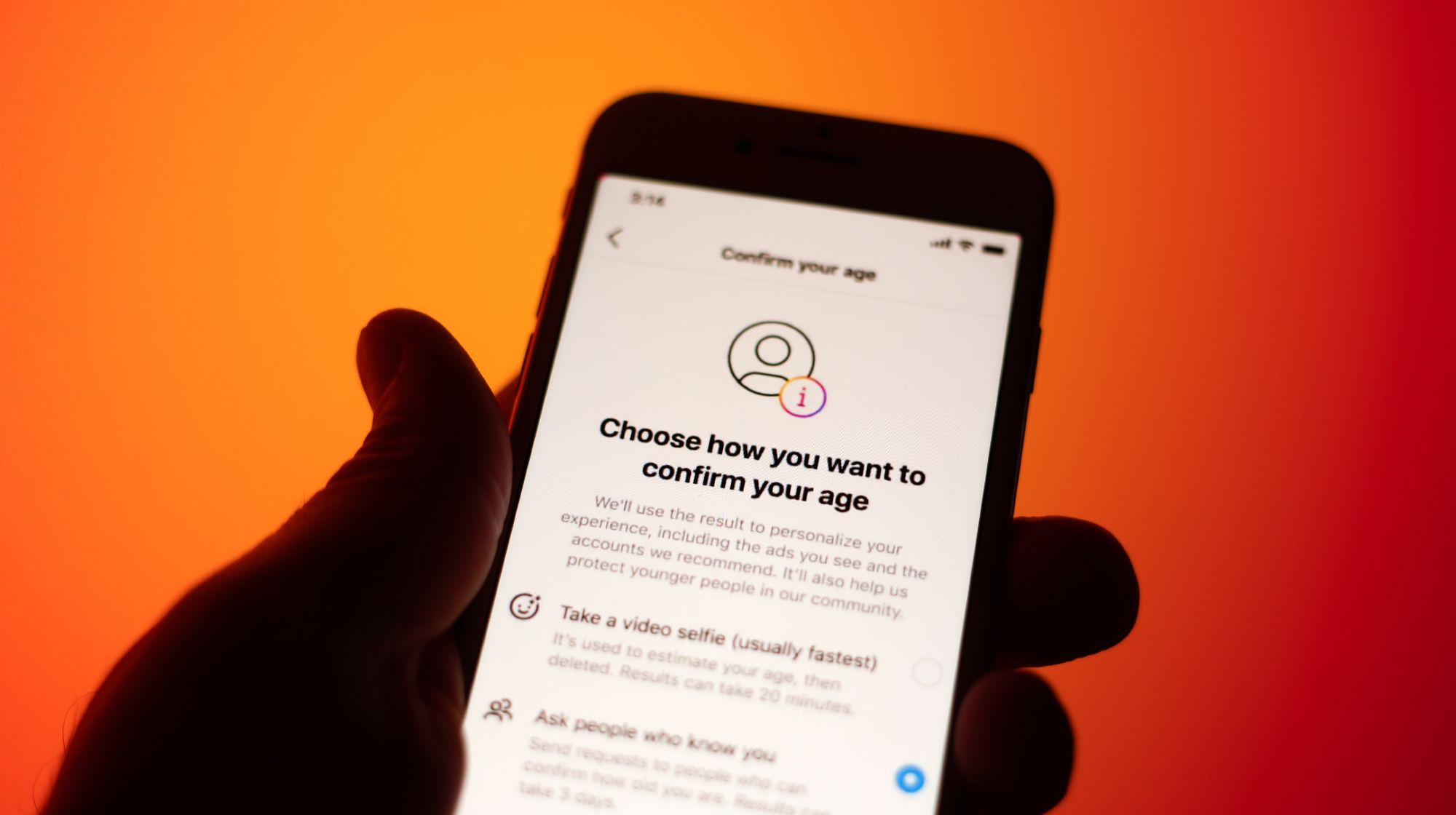

Supreme Court allows social media age check law

Supreme Court allows social media age check lawSpeed Read The court refused to intervene in a decision that affirmed a Mississippi law requiring social media users to verify their ages

-

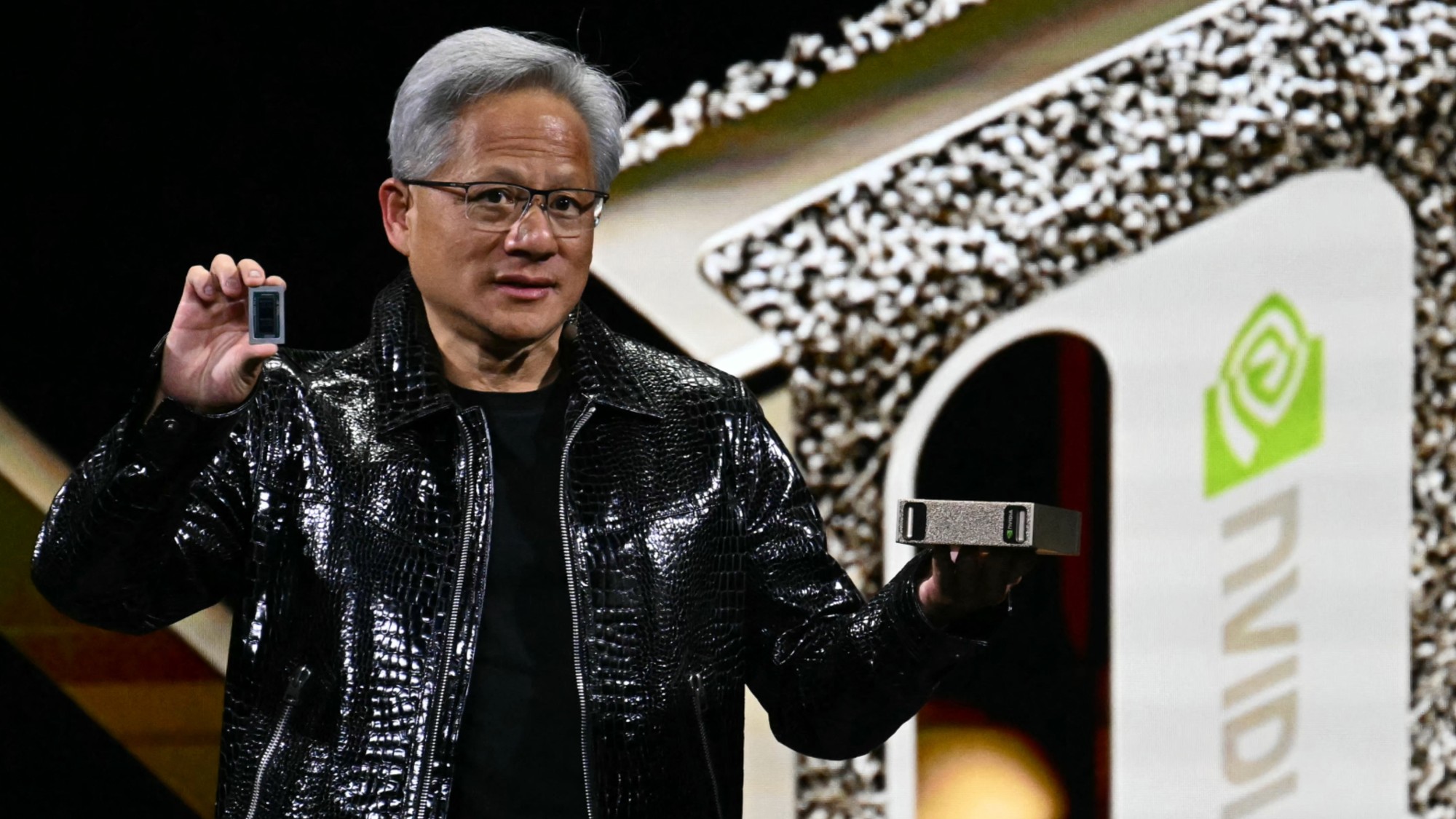

Nvidia hits $4 trillion milestone

Nvidia hits $4 trillion milestoneSpeed Read The success of the chipmaker has been buoyed by demand for artificial intelligence

-

X CEO Yaccarino quits after two years

X CEO Yaccarino quits after two yearsSpeed Read Elon Musk hired Linda Yaccarino to run X in 2023

-

Musk chatbot Grok praises Hitler on X

Musk chatbot Grok praises Hitler on XSpeed Read Grok made antisemitic comments and referred to itself as 'MechaHitler'

-

Disney, Universal sue AI firm over 'plagiarism'

Disney, Universal sue AI firm over 'plagiarism'Speed Read The studios say that Midjourney copied characters from their most famous franchises

-

Amazon launches 1st Kuiper internet satellites

Amazon launches 1st Kuiper internet satellitesSpeed Read The battle of billionaires continues in space

-

Test flight of orbital rocket from Europe explodes

Test flight of orbital rocket from Europe explodesSpeed Read Isar Aerospace conducted the first test flight of the Spectrum orbital rocket, which crashed after takeoff