The U.S. spends more on its military than any other discretionary item. Interest on the national debt will soon top that.

In about five years, the U.S. federal government could starting spending more in interest on its debt than on the military — which accounts for more than half of discretionary spending — or domestic programs like Medicaid, The New York Times reports, citing Congressional Budget Office projections. "The run-up in borrowing costs is a one-two punch brought on by the need to finance a fast-growing budget deficit, worsened by tax cuts and steadily rising interest rates that will make the debt more expensive," the Times explains.

Years of record low interest rates have "allowed the government to take on more debt without paying more interest," says Marc Goldwein at the Committee for a Responsible Federal Budget. "That party is ending," and "by 2020, we will spend more on interest than we do on kids, including education, food stamps, and aid to families." Within 10 years, the U.S. will face more than $900 billion a year in interest payments, the CBO projects. Next year, when the federal deficit is forecast to top $1 trillion, interest costs will hit $390 billion, 50 percent more than in 2017.

Interest payments were already going to grow without the massive tax cut Republicans pushed through in December and higher spending approved by both parties in February. But the combination of the tax cuts, spending hikes, and rising interest rates puts the U.S. in the largely uncharted territory of stimulating an already booming economy, giving the government fewer tools for when a recession hits. "There's no guarantee that these forecasts will prove accurate," the Times cautions. "If the economy weakens, rates might fall or rise only slightly, reducing interest payments. But rates could also overshoot the budget office forecast." You can read more, and see some helpful charts, at The New York Times.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Markets notch worst quarter in years as new tariffs loom

Markets notch worst quarter in years as new tariffs loomSpeed Read The S&P 500 is on track for its worst month since 2022 as investors brace for Trump's tariffs

By Peter Weber, The Week US

-

Tesla Cybertrucks recalled over dislodging panels

Tesla Cybertrucks recalled over dislodging panelsSpeed Read Almost every Cybertruck in the US has been recalled over a stainless steel panel that could fall off

By Justin Klawans, The Week US

-

Crafting emporium Joann is going out of business

Crafting emporium Joann is going out of businessSpeed Read The 82-year-old fabric and crafts store will be closing all 800 of its stores

By Peter Weber, The Week US

-

Trump's China tariffs start after Canada, Mexico pauses

Trump's China tariffs start after Canada, Mexico pausesSpeed Read The president paused his tariffs on America's closest neighbors after speaking to their leaders, but his import tax on Chinese goods has taken effect

By Peter Weber, The Week US

-

Chinese AI chatbot's rise slams US tech stocks

Chinese AI chatbot's rise slams US tech stocksSpeed Read The sudden popularity of a new AI chatbot from Chinese startup DeepSeek has sent U.S. tech stocks tumbling

By Peter Weber, The Week US

-

US port strike averted with tentative labor deal

US port strike averted with tentative labor dealSpeed Read The strike could have shut down major ports from Texas to Maine

By Peter Weber, The Week US

-

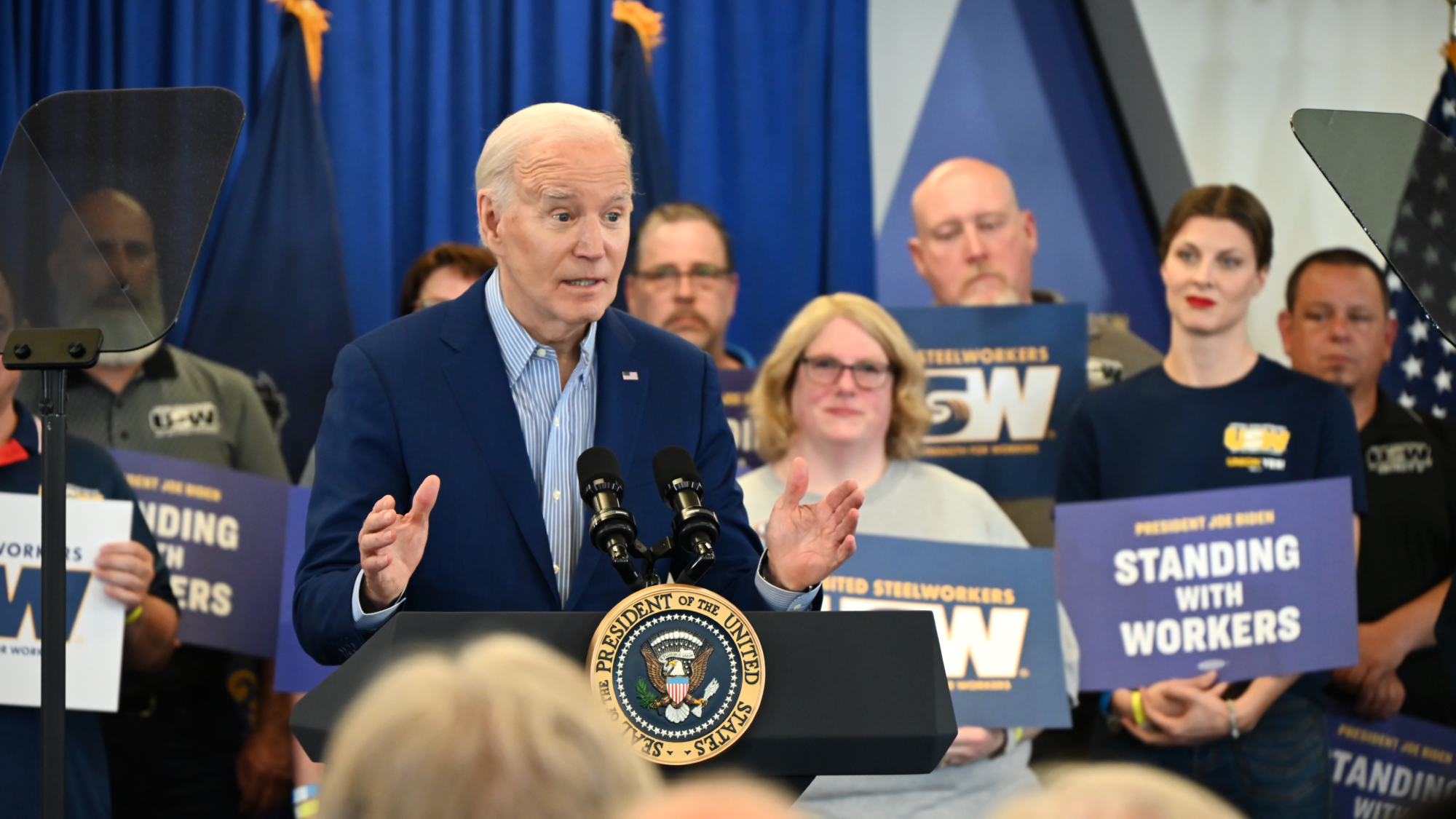

Biden expected to block Japanese bid for US Steel

Biden expected to block Japanese bid for US SteelSpeed Read The president is blocking the $14 billion acquisition of U.S. Steel by Japan's Nippon Steel, citing national security concerns

By Peter Weber, The Week US

-

Judges block $25B Kroger-Albertsons merger

Judges block $25B Kroger-Albertsons mergerSpeed Read The proposed merger between the supermarket giants was stalled when judges overseeing two separate cases blocked the deal

By Peter Weber, The Week US