Biden expected to block Japanese bid for US Steel

The president is blocking the $14 billion acquisition of U.S. Steel by Japan's Nippon Steel, citing national security concerns

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

What happened

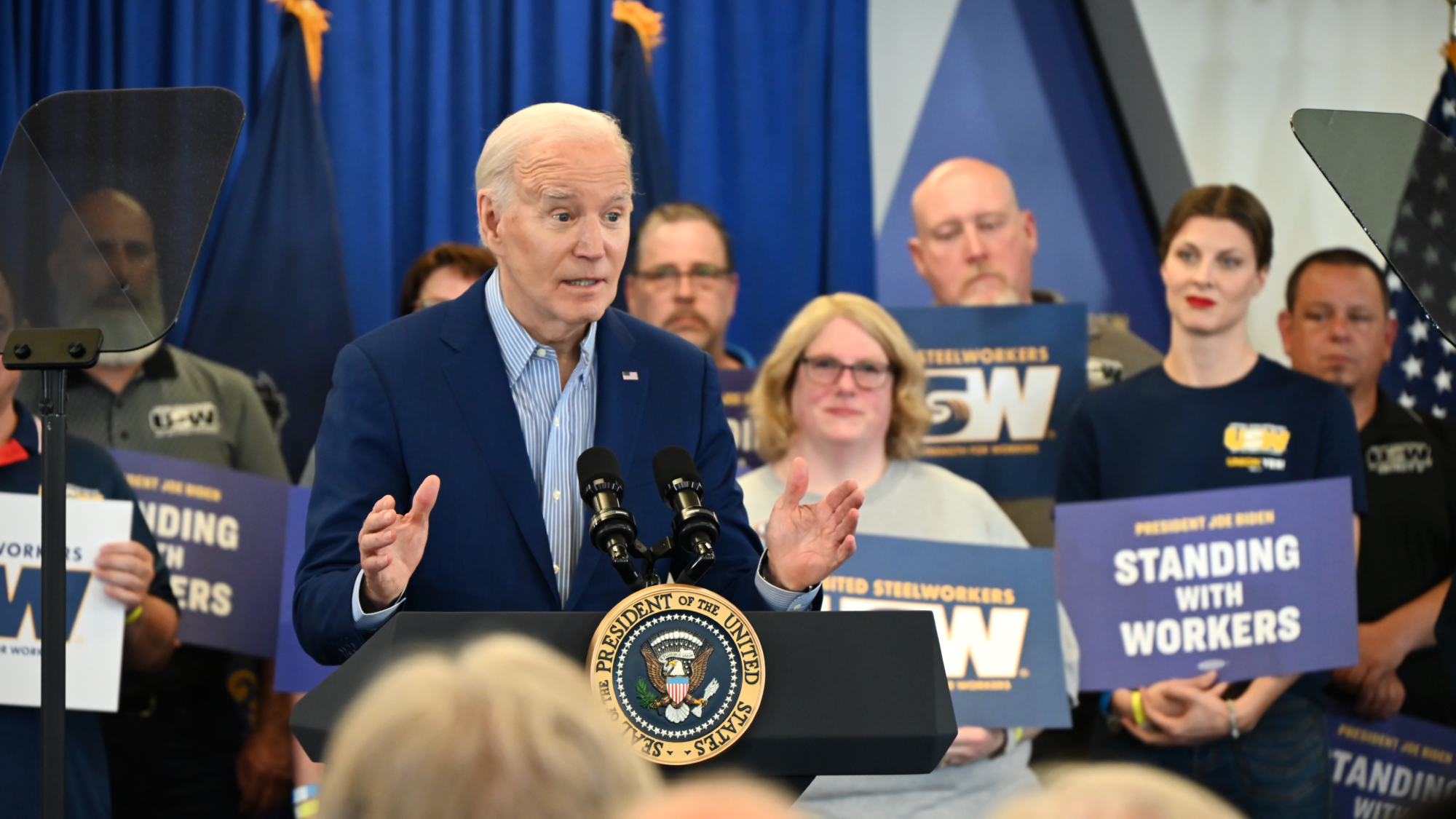

President Joe Biden has decided to block the $14 billion acquisition of U.S. Steel by Japan's Nippon Steel, citing national security concerns, The Washington Post and The New York Times said Friday morning.

Who said what

Biden's move deals a "probably fatal blow to the contentious merger plan," Reuters said, especially since President-elect Donald Trump has also "vowed to block the deal." Opposition to Nippon Steel's purchase of America's No. 3 steelmaker "blended election-year politics, nostalgia for a vanished era of American industrial supremacy" and competition with China, the Post said. The United Steelworkers union opposed the deal, but some of Biden's senior advisers "warned that rejecting a sizable investment from a top Japanese corporation could damage U.S. relations with Japan," a key ally.

Blocking the deal "would be an extraordinary use of executive power," especially for an outgoing president, the Times said, and the "departure from America's long-established culture of open investment" could have "wide-ranging implications for the U.S. economy."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What next?

Nippon Steel and U.S. Steel have "vowed to pursue legal action" if the government blocks the deal, the Post said. U.S. Steel could also "resume its search for a buyer," like No. 2 U.S. producer Cleveland Cilffs, or it could "opt to proceed as a stand-alone company."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Political cartoons for February 14

Political cartoons for February 14Cartoons Saturday's political cartoons include a Valentine's grift, Hillary on the hook, and more

-

Tourangelle-style pork with prunes recipe

Tourangelle-style pork with prunes recipeThe Week Recommends This traditional, rustic dish is a French classic

-

The Epstein files: glimpses of a deeply disturbing world

The Epstein files: glimpses of a deeply disturbing worldIn the Spotlight Trove of released documents paint a picture of depravity and privilege in which men hold the cards, and women are powerless or peripheral

-

Why quitting your job is so difficult in Japan

Why quitting your job is so difficult in JapanUnder the Radar Reluctance to change job and rise of ‘proxy quitters’ is a reaction to Japan’s ‘rigid’ labour market – but there are signs of change

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Will Trump’s 10% credit card rate limit actually help consumers?

Will Trump’s 10% credit card rate limit actually help consumers?Today's Big Question Banks say they would pull back on credit

-

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

How prediction markets have spread to politics

How prediction markets have spread to politicsThe explainer Everything’s a gamble

-

What will the US economy look like in 2026?

What will the US economy look like in 2026?Today’s Big Question Wall Street is bullish, but uncertain

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform