The government's growing concern over a potential US Steel takeover

Japan's largest steelmaker, Nippon Steel, is attempting to buy the company

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

One of the largest steel producers in the world, Japan's Nippon Steel, is attempting to purchase the American-based U.S. Steel, but is facing pushback from the U.S. government due to concerns over the potential takeover's effect on the economy. U.S. Steel was once the preeminent steel conglomerate in the world, but is no longer in the top 10 of steel production companies anymore. As a result, the company has been looking to foreign lifelines, but regulators and politicians in the United States are expressing concern.

The deal, first announced last year, would see Nippon acquire U.S. Steel for $14.9 billion, if approved by regulatory agencies. However, there have been concerns raised that the purchase would create not only the aforementioned economic problems but also open the United States to additional national security risks. Despite this, both companies are attempting to go full-steam ahead with inking the deal.

Why is the government concerned about the takeover?

The Biden administration as well as the Harris and Trump campaigns have all opposed the deal due to economic and security concerns. As the potential closure of the takeover looms, President Joe Biden is "preparing to announce that he will formally block" the takeover, said The Washington Post. Biden's blocking of the acquisition is a "stunning move to kill a deal featuring a corporation from Japan, a close U.S. ally," said the Post.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Biden could not officially halt the deal until receiving a recommendation to do so from the Committee on Foreign Investment in the U.S. (CFIUS). But it appears this recommendation is looming, as the committee believes that the deal "would create national security risks because it could hurt the supply of steel needed for critical transportation, construction and agriculture projects," said Reuters. CFIUS also "cited a global glut of cheap Chinese steel and said that under Nippon, a Japanese company, U.S. Steel would be less likely to seek tariffs on foreign steel importers."

The White House "previously described Nippon's proposed acquisition as a security risk, which many foreign policy experts and some administration officials in private have ridiculed," said the Financial Times. Much of this ridicule is a result of Japan being the "most important U.S. ally in the Indo-Pacific and has been working very closely with Washington on a range of efforts to counter China." But concerns over the effects the deal would have regarding China remain: China's "persistent use of market-distorting government interventions has allowed the country to unfairly gain dominance in the global steel market, as it exports extensive surplus steel that artificially lowers international prices," said Reuters.

What have other responses been?

Both Nippon Steel and U.S. Steel have pushed back against claims that the deal would cause economic hardship or national security duress, with the latter claiming that blocking the deal would cost numerous jobs and could lead to U.S. Steel abandoning its Pittsburgh headquarters. Without the deal, U.S. Steel will "largely pivot away from its blast furnace facilities, putting thousands of good-paying union jobs at risk, negatively impacting numerous communities across the locations where its facilities exist and depriving the American steel industry of an opportunity to better compete on the global stage," the company said in a statement.

But while the "political sands are shifting beneath U.S. Steel's proposed sale," it is "perhaps too late for President Biden to change his mind about stopping the deal," said Axios. And beyond any economic consequences, the "political reaction was predictable: Don't let a foreign company buy an American icon, even if it's no longer the country's largest steelmaker."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Despite the controversy, the American steel industry "will be on much stronger footing because of Nippon Steel's investment in U.S. Steel," a spokesperson for Nippon Steel said to Fox Business. But questions over the deal remain, as "while the resilience of U.S. domestic steel capacity is clearly in the national interest, it is unclear how ownership by a firm domiciled in a major treaty ally would fundamentally threaten this," Sarah Bauerle Danzman, an international studies professor at Indiana University, said to CNBC.

Justin Klawans has worked as a staff writer at The Week since 2022. He began his career covering local news before joining Newsweek as a breaking news reporter, where he wrote about politics, national and global affairs, business, crime, sports, film, television and other news. Justin has also freelanced for outlets including Collider and United Press International.

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

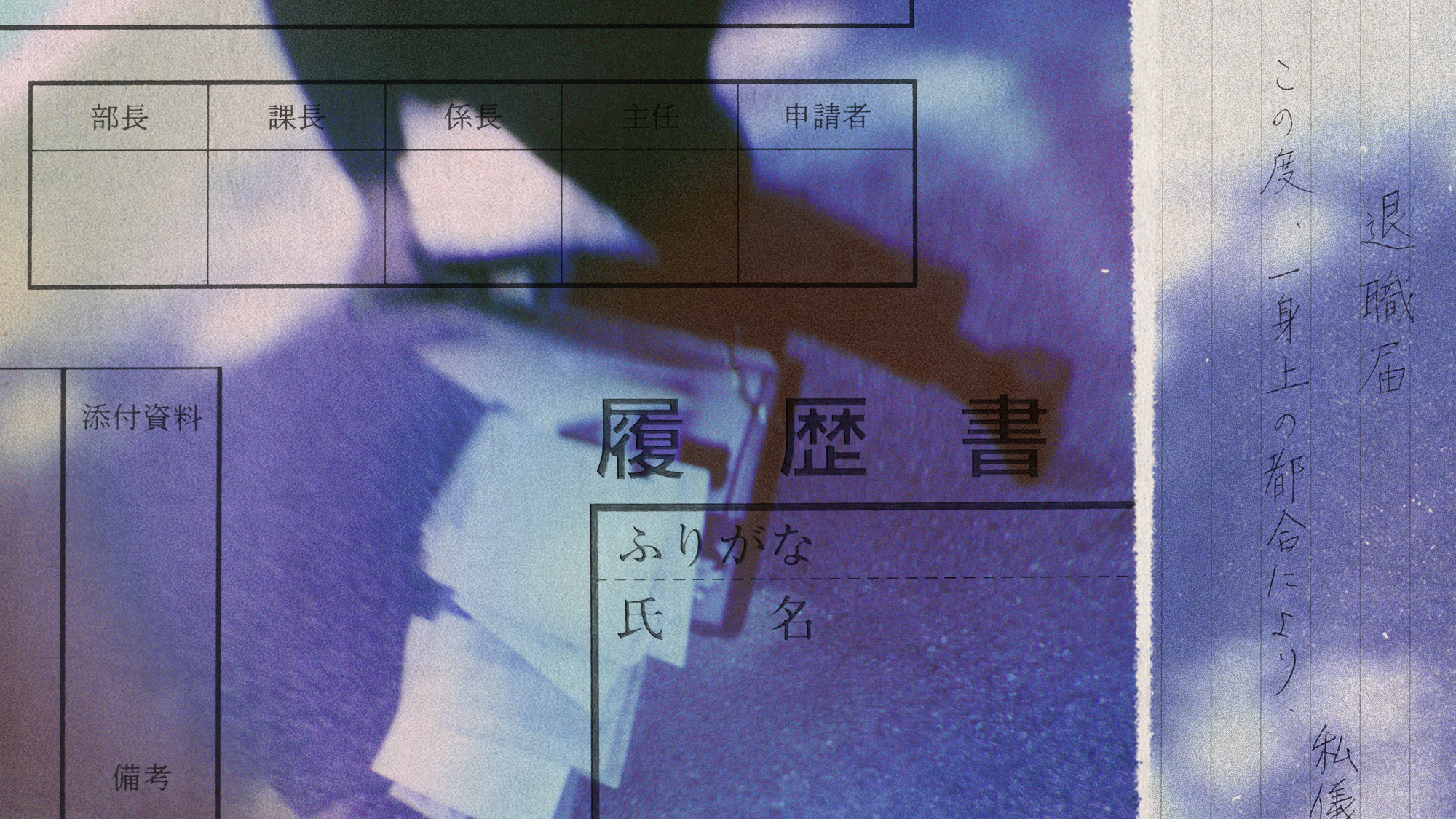

Why quitting your job is so difficult in Japan

Why quitting your job is so difficult in JapanUnder the Radar Reluctance to change job and rise of ‘proxy quitters’ is a reaction to Japan’s ‘rigid’ labour market – but there are signs of change

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Will Trump’s 10% credit card rate limit actually help consumers?

Will Trump’s 10% credit card rate limit actually help consumers?Today's Big Question Banks say they would pull back on credit

-

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

Why is pizza in decline?

Why is pizza in decline?In the Spotlight The humble pie is getting humbler

-

How prediction markets have spread to politics

How prediction markets have spread to politicsThe explainer Everything’s a gamble

-

What will the US economy look like in 2026?

What will the US economy look like in 2026?Today’s Big Question Wall Street is bullish, but uncertain

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain