Labour’s progressive property tax explained

Party proposes replacing council tax with new levy paid by landlords rather than tenants

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Labour is considering replacing council tax with a new “progressive” property tax that would be set nationally and paid by property owners rather than tenants.

The proposals are part of a raft of policy recommendations in a Labour-commissioned report on land use. The aim is to reduce the tax paid by the majority of households and discourage the use of homes as financial assets.

The report - written by a group of academics, economists and land experts and titled Land For The Many - calls on the party to make a string of “radical but practical changes in the way land in the UK is used and governed” if it wins the next election.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“We recommend that a Labour government replace the regressive and unpopular council tax with a progressive property tax based on contemporary property values,” it says. “Unlike council tax, this tax would be payable by owners, not tenants. This would result in significant administrative savings, lower levels of arrears and less court action”, the authors say.

The market value of land in the UK is believed to have quadrupled over the past two decades, contributing to a rise in house prices. A recent study of 14 advanced economies found that an estimated 81% of house price increases between 1950 and 2012 were down to rising land prices.

As well as introducing a progressive property tax, the report calls for the valuation of properties for tax purposes to be updated annually. It also argues that empty homes and second homes should automatically be taxed at a higher rate.

In addition, Labour is considering introducing “compulsory sale orders” giving public authorities the right to seize land left vacant or derelict and to sell it at auction, says The Times.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The new report also suggests abolishing the Stamp Duty Land Tax for people buying homes they intend to live in; abolishing inheritance tax; and the introduction of a lifetime gifts tax levied on the recipient.

“Dig deep enough into many of the problems this country faces, and you will soon hit land,” writes George Monbiot, one of the report authors, in The Guardian.

“Since 1995, land values in this country have risen by 412%. Land now accounts for an astonishing 51% of the UK’s net worth. Why? In large part because successive governments have used tax exemptions and other advantages to turn the ground beneath our feet into a speculative money machine,” he says.

Labour’s shadow Cabinet Office minister Jon Trickett said his party would be “studying these recommendations in detail”.

He added: “So much of this can be traced back to the broken system of land ownership. Concentration of land in the hands of a few has led to unwanted developments, unaffordable house prices, financial crises and environmental degradation.”

But not everyone is convinced. “This is confirmation that Labour would bring the policies of Venezuela to Britain,” Tory MP Priti Patel told the Daily Mail.

Housing Secretary James Brokenshire describing them as a “tax bombshell”. He said: “These proposals are extraordinary and deeply damaging in equal measure. Labour will stop at nothing to hammer families with more tax and make home ownership a pipe dream for future generations.

“Plans to seize land into public ownership also show Labour’s true colours of more and more state control.”

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

The week’s best photos

The week’s best photosIn Pictures An explosive meal, a carnival of joy, and more

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

How long can Keir Starmer last as Labour leader?

How long can Keir Starmer last as Labour leader?Today's Big Question Pathway to a coup ‘still unclear’ even as potential challengers begin manoeuvring into position

-

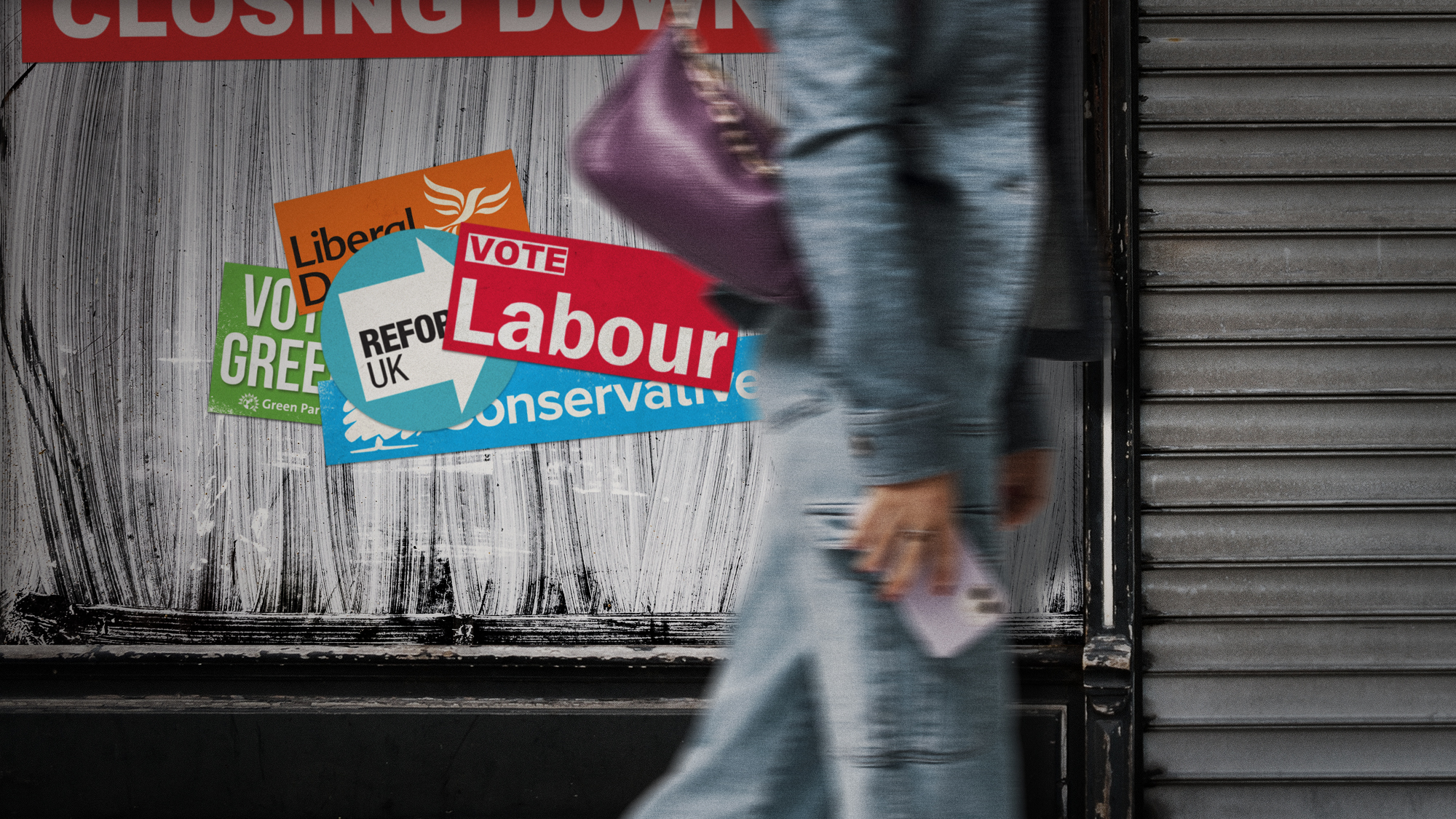

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK

-

Is a Reform-Tory pact becoming more likely?

Is a Reform-Tory pact becoming more likely?Today’s Big Question Nigel Farage’s party is ahead in the polls but still falls well short of a Commons majority, while Conservatives are still losing MPs to Reform

-

The launch of Your Party: how it could work

The launch of Your Party: how it could workThe Explainer Despite landmark decisions made over the party’s makeup at their first conference, core frustrations are ‘likely to only intensify in the near-future’

-

What does the fall in net migration mean for the UK?

What does the fall in net migration mean for the UK?Today’s Big Question With Labour and the Tories trying to ‘claim credit’ for lower figures, the ‘underlying picture is far less clear-cut’

-

Will Rachel Reeves’ tax U-turn be disastrous?

Will Rachel Reeves’ tax U-turn be disastrous?Today’s Big Question The chancellor scraps income tax rises for a ‘smorgasbord’ of smaller revenue-raising options

-

Will the public buy Rachel Reeves’s tax rises?

Will the public buy Rachel Reeves’s tax rises?Today’s Big Question The Chancellor refused to rule out tax increases in her televised address, and is set to reverse pledges made in the election manifesto