Nations ‘must unite now to counter global slowdown’

New IMF chief Kristalina Georgieva delivers a sharp warning about protectionist trade practices

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Nations must end protectionist trade conflicts and unify to stop the “synchronised slowdown” of the global economy, warned the new head of the International Monetary Fund (IMF), Kristalina Georgieva, during her inaugural speech on Tuesday.

Speaking in Washington, the Bulgarian economist, managing director of the IMF since 1 October, said: “In 2019, we expect slower growth in nearly 90% of the world. The global economy is now in a synchronised slowdown. This means that growth this year will fall to its lowest rate since the beginning of the decade.”

“We are decelerating, we are not stopping, and it’s not that bad. And yet, unless we act now, we are risking a potential more massive slowdown,” she said.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

However, “while the need for international cooperation is going up, the will to engage is going down”, she warned, adding that the disintegration of established global structures could last a generation, leading to “broken supply chains, siloed trade sectors, a ‘digital Berlin Wall’ that forces countries to choose between technology systems.’”

–––––––––––––––––––––––––––––––For a round-up of the most important business stories and tips for the week’s best shares - try The Week magazine. Get your first six issues free–––––––––––––––––––––––––––––––

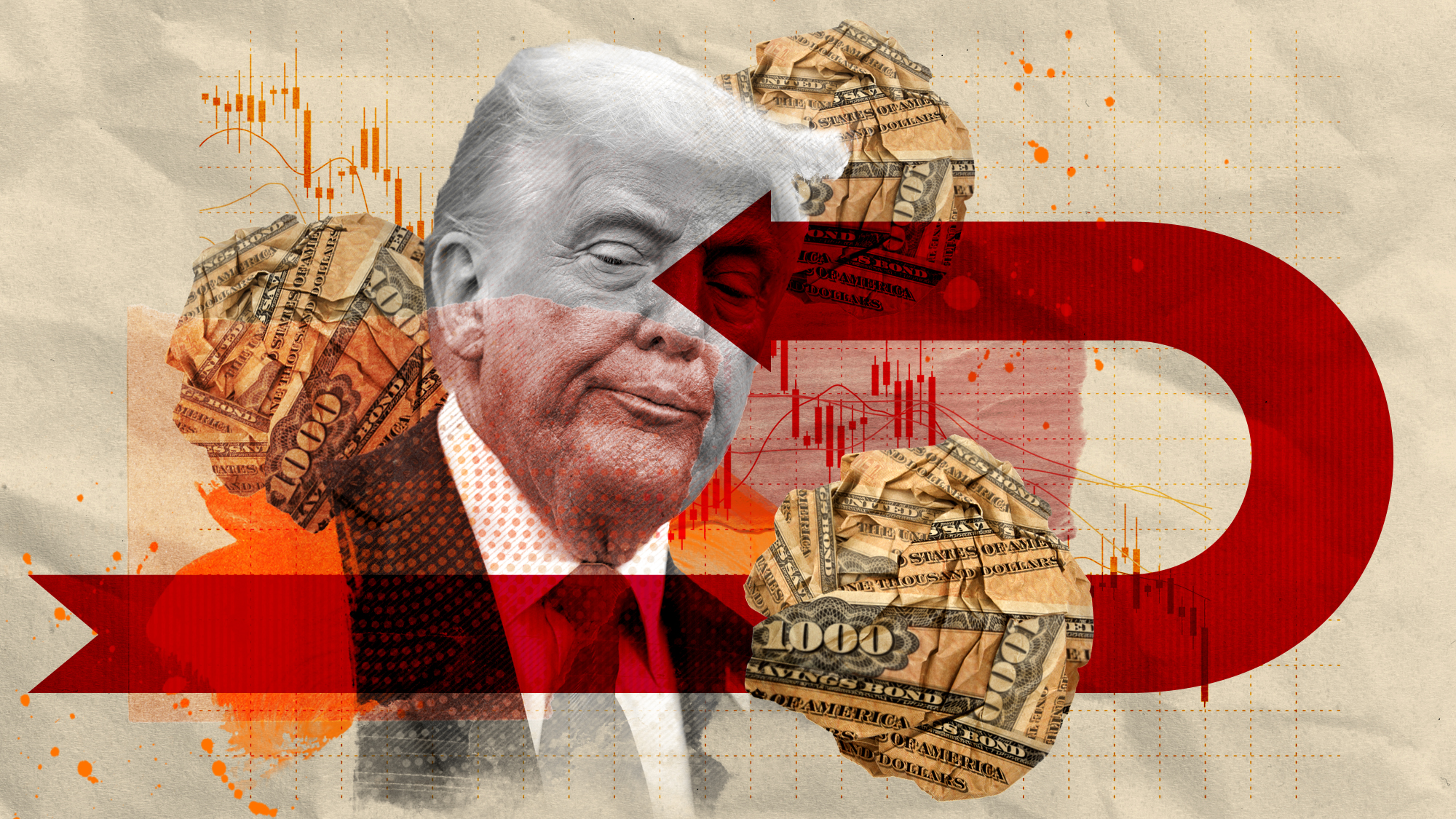

Georgieva also addressed the impact of the US’s trade war with China, which she said could cost the global economy around $700 billion by 2020 .

“In this scenario, the whole economy of Switzerland disappears,” she added, previewing new Fund research to be unveiled during IMF and World Bank annual meetings next week.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

“The warning comes at a potential turning point in the trade conflict between the world’s two largest economies,” reports The New York Times. “American and Chinese negotiators are meeting in Washington this week to try to resolve a trade war that has begun to inflict economic pain in both countries.”

The IMF chief also spoke about the perils of Brexit. “It is very obvious that this [Brexit] is going to be painful,” she told the BBC, saying UK politicians will have to work out how to protect people from its worst side effects. “The choices are not that many - you either borrow or you look at the [tax] increase,” she said.

Georgieva advised central banks to keep interest rates low as a form of stimulus “where appropriate”, but also warned that chronically low interest rates could produce similar conditions which led to the 2008 crash.

The Telegraph says “financial vulnerabilities are building as pension funds and insurers take on riskier investments to boost their returns, and companies pile on cheap debt for acquisitions instead of investing”.

Georgieva said the increase in risk-taking meant that if a major downturn occurs, corporate debt at risk of default would rise to $19 trillion, or nearly 40 percent of the total debt in eight major economies. This is above the levels seen during the financial crisis”.

William Gritten is a London-born, New York-based strategist and writer focusing on politics and international affairs.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

What a rising gold price says about the global economy

What a rising gold price says about the global economyThe Explainer Institutions, central banks and speculators drive record surge amid ‘loss of trust’ in bond markets and US dollar

-

Is Trump's tariffs plan working?

Is Trump's tariffs plan working?Today's Big Question Trump has touted 'victories', but inflation is the 'elephant in the room'

-

Trump is trying to jump-start US manufacturing. Is it worth it?

Trump is trying to jump-start US manufacturing. Is it worth it?Today's Big Question The jobs are good. The workers may not be there.

-

What is the dollar's future after Moody's downgrade?

What is the dollar's future after Moody's downgrade?Today's Big Question Trump trade wars and growing debt have investors looking elsewhere

-

How the US bond market works – and why it matters

How the US bond market works – and why it mattersThe Explainer Donald Trump was forced to U-turn on tariffs after being 'spooked' by rise in Treasury yields

-

Why does the US need China's rare earth metals?

Why does the US need China's rare earth metals?Today's Big Question Beijing has a 'near monopoly' on tech's raw materials

-

Who would win in a China-US trade war?

Who would win in a China-US trade war?Today's Big Question Tariff pain will be higher for China but Beijing is betting it can weather the storm

-

Are free trade zones and alliances the answer to Trump's tariffs?

Are free trade zones and alliances the answer to Trump's tariffs?Today's Big Question Temptation is to retaliate with trade barriers, but most agree nations should focus on targeted trade pacts and strengthening cooperation