WTO reports sharp downturn in global trade forecasts

Slowdown blamed primarily on US-China trade war, as well as Brexit and changes in monetary policy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The World Trade Organization cut its global trade forecasts yesterday, blaming political uncertainty around the US-China trade war, the threat of a no-deal Brexit and shifting monetary policy.

The WTO said in a statement that it expected the total volume of traded goods to rise 1.2% globally this year - less than half the 2.6% increase it had forecast in April this year. It also cut the 2020 forecast from 3% to 2.7%.

“Trade conflicts pose the biggest downside risk to the forecast but macroeconomic shocks and financial volatility are also potential triggers for a steeper downturn,” Director-General Roberto Azevêdo said in the statement.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“The darkening outlook for trade is discouraging but not unexpected… trade conflicts heighten uncertainty, which is leading some businesses to delay the productivity-enhancing investments that are essential to raising living standards," wrote Azevêdo, who suggested that further tariffs “could produce a destructive cycle of recrimination”.

Chad Bown, senior fellow at the Peterson Institute of International Economics, agrees that uncertainties surrounding the US-China trade war are the leading factor in the global slowdown.

“Rather than bet wrong on the policies of someone like President Trump, some companies are putting off investment decisions. Others are being forced to reckon with the consequences of higher costs,” he said.

The BBC quotes analysts who say that a “swift resolution to many of the trade conflicts was unlikely, pointing to previous trade disputes that often lasted years”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"History suggests it can take a long time for trade conflicts to end and for tariffs to be removed, even for smaller conflicts that go through the official channels," analysts for Goldman Sachs wrote in a report issued last week.

–––––––––––––––––––––––––––––––For a round-up of the most important business stories and tips for the week’s best shares - try The Week magazine. Get your first six issues free–––––––––––––––––––––––––––––––

Talks between the US and China are scheduled to resume in Washington later in October, aimed at putting a stop to - or even rolling back - some of the tariff hikes.

Later on Tuesday, a closely watched gauge of American manufacturing revealed that factories had slowed in September, marking the second straight month of decline,” reports The New York Times. “The reading on the Institute for Supply Management’s manufacturing index was the lowest since June 2009, the month that marked the official end of the Great Recession.”

US President Donald Trump, who has a long-standing disagreement with his central bank over monetary policy, took advantage of another opportunity to pile pressure on Federal Reserve chair Jay Powell to reduce interest rates.

However, writes Chris Giles in The Financial Times, “Manufacturing activity has been weakening across the world since Mr Trump began to ramp up trade tensions in early 2018 — regardless of currency movements.”

“The WTO also highlighted a hard, no-deal Brexit as another potential threat to trade levels, especially in Europe,” writes Sergei Klebnikov in Forbes. “And with ongoing uncertainty over different central banks’ monetary policy, too, macroeconomic shocks and financial volatility were listed as “potential triggers for a steeper downturn.”

William Gritten is a London-born, New York-based strategist and writer focusing on politics and international affairs.

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

What will the US economy look like in 2026?

What will the US economy look like in 2026?Today’s Big Question Wall Street is bullish, but uncertain

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

Coffee jitters

Coffee jittersFeature The price of America’s favorite stimulant is soaring—and not just because of tariffs

-

What a rising gold price says about the global economy

What a rising gold price says about the global economyThe Explainer Institutions, central banks and speculators drive record surge amid ‘loss of trust’ in bond markets and US dollar

-

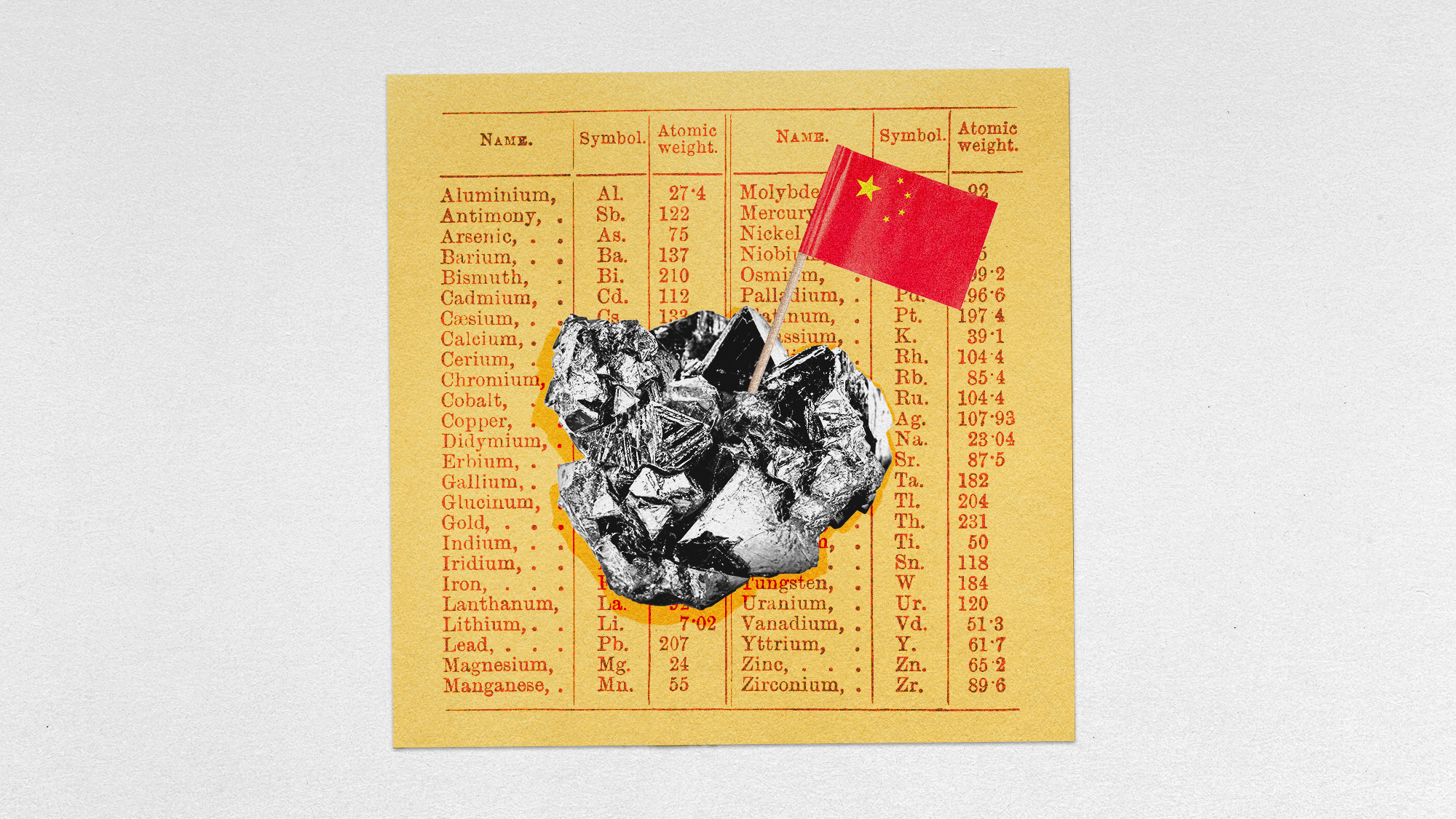

China’s rare earth controls

China’s rare earth controlsThe Explainer Beijing has shocked Washington with export restrictions on minerals used in most electronics

-

Fed cuts interest rates a quarter point

Fed cuts interest rates a quarter pointSpeed Read ‘The cut suggests a broader shift toward concern about cracks forming in the job market’

-

Why are global postal services cutting off package delivery to the US?

Why are global postal services cutting off package delivery to the US?Today's Big Question 'Uncertainty' around new tariff rules halts small-dollar imports

-

Switzerland could experience unique economic problems from Trump's tariffs

Switzerland could experience unique economic problems from Trump's tariffsIn the Spotlight The current US tariff rate on Switzerland is among the highest in the world