Google hit by another tax raid in Europe

Spanish police search internet giant's Madrid offices just weeks after French HQ comes under spotlight

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Google's tax headaches in Europe are mounting, with a second set of raids in a little more than a month, this time targeting its head office and a "tech incubator" in Madrid.

The Financial Times says the searches were authorised by a judge and "involved more than 30 officials and investigators". Authorities were seeking to "gather evidence about the sales booked by Google in Spain and whether they were more substantial than reported".

The paper adds: "One Madrid-based official said on Thursday that Google had paid only the 'tiniest' amount of tax in Spain despite having made 'billions' of euros in sales in the country."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Google's French headquarters were raided in the last week of May, as part of an ongoing investigation into €1.6bn (£1.3bn) of "tax fraud and money-laundering". It is also the subject of an ongoing tax inquiry in Italy.

All three cases essentially stem from the same issue: that by utilising a loophole in European and international tax law, Google is able to book sales from across the continent through a subsidiary in Ireland, where its pays very low rates of tax.

It has also been claimed that the company's tax bill is lessened even further through royalty-sharing arrangements with a Dutch unit and arms based in tax havens such as the British Virgin Islands.

Reuters notes that for Google to legally book revenues in Dublin, its staff there would have to be "concluding all sales contracts". Tax investigators in Spain aim to show the "international structure" that Google uses is "not real", the FT adds.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

UK tax authorities concluded their own investigation into Google In January, agreeing a settlement worth £130m. At first hailed by the government, it has since been widely derided.

Treasury figures have argued that laws applying to the tech giant and other multinationals have changed to require them to pay tax on a larger share of revenues arising in the UK. International tax laws are also changing to make it clearer where companies make generate their income.

Google's Paris HQ raided in £1.3bn tax probe

25 May

Google's Paris headquarters were raided yesterday as part of an inquiry into tax fraud and money-laundering.

French police and around 100 tax investigators entered the offices in what is "the latest regulatory headache for the American internet giant which is facing increasing questions about its complex tax arrangements", according to the Daily Telegraph.

Like many US technology companies, Google bases its European subsidiary in Ireland, which has a low corporation tax rate. This allows it to do business with customers across the continent while minimising its fiscal obligations, a technique known as "profit-shifting".

Profits are also allegedly lessened further through royalties paid to a Dutch subsidiary and then another Irish subsidiary based in a tax haven such as Bermuda or the British Virgin Islands.

"European regulators have increasingly pressed the firms to pay taxes in the jurisdictions in which they do business," says the Telegraph.

French authorities are thought to be chasing Google for back-taxes of as much as €1.6bn (£1.3bn) that they believe were illegally diverted and should have been paid in the country. Earlier this year, UK authorities faced intense criticism for agreeing a £130m settlement over similar allegations, despite Google generating many times more revenue here than over the channel.

Elsewhere, Italian tax authorities are demanding Google make up a tax shortfall of around £230m.

In April, the EU unveiled plans to force large companies to disclose more about their tax affairs. "Country-by-country reporting" would enable states to see more clearly the revenues being generated within their borders and to revise tax structures to force multinationals to pay a fairer share of tax.

The UK government claims it has already revised laws to force companies such as Google to pay more in future, while new rules agreed by the Organisation for Economic Co-operation and Development will also encourage country-by-country disclosure.

In addition, Europe's competition authorities have "been examining whether some deals struck by big companies with national tax authorities amount to illegal state aid", says the BBC, although in practice, if this were applied to Google, it would result in Ireland being forced to collect the back-taxes.

Google's back-tax bill for France is ten times what it paid in the UK

25 February

Anger over HMRC's £130m deal with Google to settle ten years of back-taxes has intensified after reports claimed French authorities are seeking ten times that amount.

An official who spoke anonymously to Reuters said the French tax watchdog is seeking €1.6bn (£1.3bn) to cover taxes the internet giant has avoided through the use of controversial cross-border arrangements. Forbes cites a 2012 report saying France was trying to apply a charge of €1bn and says this has been increased to reflect "late-payment interest fees".

Earlier this year, Google agreed to pay the UK £130m to settle tax bill shortfalls dating from 2005, a sum widely criticised, including by the Public Accounts Committee on Wednesday, as "disproportionately small".

The French deal would be embarrassing for both HMRC and the Conservative government, which initially hailed the agreement, not least because of the huge disparity but also because the internet company has a much smaller operation in France. It is not known how many years of unpaid taxes the French charge covers.

It remains to be seen, though, whether authorities across the channel can make the amount stick. The country's AFP news agency reports that Google might be able to negotiate and may not pay the full sum, says the BBC, while Reuters notes any eventual fine could still be challenged in court.

Google's tax structure means it operates in countries such as Britain and France without having a "fixed base", instead routing taxes through its European headquarters in lower-tax Ireland. From there, profits are also allegedly lessened again through royalties paid to a Dutch subsidiary and then another Irish subsidiary based in a tax haven such as Bermuda or the British Virgin Islands.

Reuters says EU laws protect companies against paying tax in countries where they do not have what is termed a "permanent establishment". If the European Commission were to intervene, it would be more likely to force Ireland to collect more taxes than grant an award to French authorities. There is also the chance that the structures were all technically legal.

Officials in the UK say tax rules have changed since the period the deal covered and that more sales will now have to be registered – and taxed – in the country where they are made.

Google Tax critics sharpen knives after bonus revelation

5 February

Neither Google nor the UK government seem unable to quell the disquiet over their deal to settle the back-tax claims of the world's largest company.

After a six-year probe into a decade of minimal corporation tax contributions, last weekend, the UK tax watchdog revealed Google would make a one-off payment of around £130m. Chancellor George Osborne just about had time to hail the deal as a "major victory" before criticism from all quarters began to rain on the parade.

Osborne's opposite number John McDonnell has called several times for full details of the confidential agreement, which has been labelled by some, including London Mayor Boris Johnson, as "derisory". The shadow chancellor renewed that call today, as The Guardian revealed the deal included around £33m relating to employee share awards the company had believed were exempt from UK tax.

This means that less than £100m relates to corporation tax in the years between 2006 and 2015. The original sum was deemed to equate to an effective rate of tax of three per cent, but that will now be revised even lower.

For its part, Google has always claimed it paid the correct level of tax in the UK. It says that under the rules that were in place at the time, it legitimately booked profits through its global arms – paying, for example, around £2.5bn of tax in the US – and that it paid the correct level of UK tax on the "added value" it generated here.

Both Google and Osborne also stress that the rules are now different. A "diverted profits" tax, coupled with wider international rule changes, means in practice more profit should be funnelled through units in the country where the sales took place, which will increase the tax take. What this will mean in terms of actual money raised is yet to be seen.

In the meantime, expect the criticism of this deal, at a time when "sweetheart" agreements in Europe are under the microscope and anger continues at the Conservative's austerity programme at home, to continue. This will only be enhanced by the fact Google is also locked in dispute over back taxes in France and Italy, which are seemingly holding out for a bigger payment.

"The French tax administration does not negotiate the amount of taxes owed. It applies the rules," French finance minister Michel Sapin told the Financial Times. He added that the UK deal seemed to be "more the product of a negotiation than the application of the law".

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

Kia EV4: a ‘terrifically comfy’ electric car

Kia EV4: a ‘terrifically comfy’ electric carThe Week Recommends The family-friendly vehicle has ‘plush seats’ and generous space

-

Google loses antitrust suit, declared 'monopolist'

Google loses antitrust suit, declared 'monopolist'Speed Read A federal court has ruled that Google illegally dominated the internet search industry

-

Lawmakers say tax prep companies illegally shared taxpayer data with Meta and Google

Lawmakers say tax prep companies illegally shared taxpayer data with Meta and GoogleSpeed Read

-

How ChatGPT breathed new life into the internet search wars

How ChatGPT breathed new life into the internet search warsSpeed Read The AI arms race is upon us

-

Search wars: Google's new challenge from AI

Search wars: Google's new challenge from AIfeature How will Microsoft even things up?

-

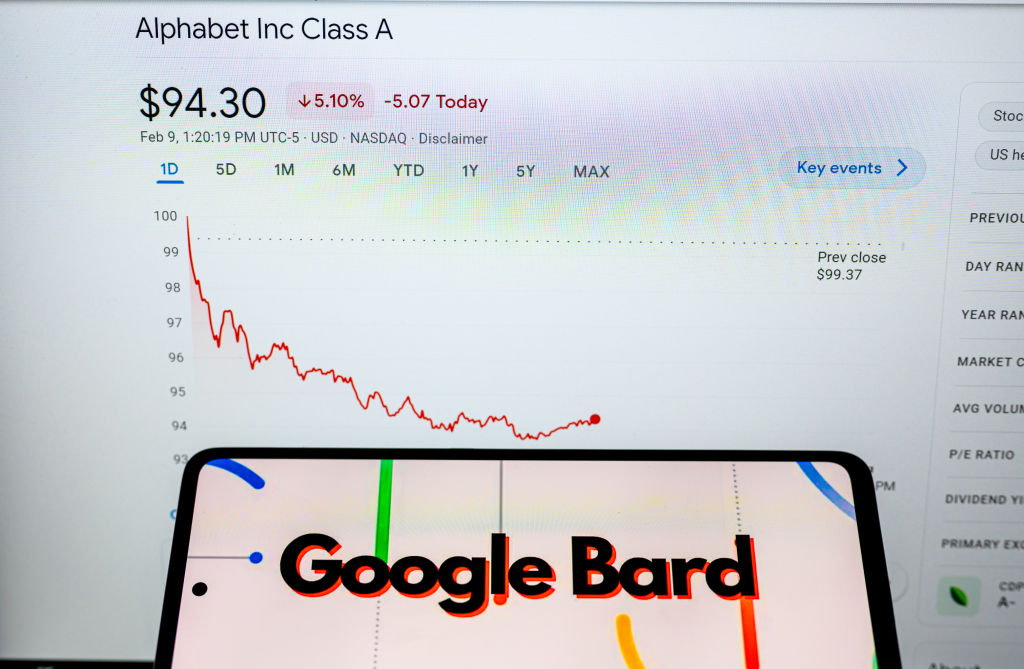

Google didn't believe Bard AI was 'really ready' for a product yet

Google didn't believe Bard AI was 'really ready' for a product yetSpeed Read

-

What Big Tech CEOs are saying about their companies' layoffs

What Big Tech CEOs are saying about their companies' layoffsSpeed Read Tech companies are cutting thousands of jobs. Are the top bosses owning up to mistakes or 'sidestepping the blame'?

-

Will China’s national security crackdown end Hong Kong’s status as a big tech hub?

Will China’s national security crackdown end Hong Kong’s status as a big tech hub?feature Facebook, Twitter and Google threaten to leave over proposed data legislation

-

Fake reviews: an industry within an industry

Fake reviews: an industry within an industryIn the Spotlight Amazon and Google are under investigation by UK watchdog the CMA