Dow Jones suffers worst single-day point loss in history

Wall street plunged almost 1,600 points before staging late recovery

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

US stocks went into “free fall” yesterday, sparking large scale sell-offs on Asian markets this morning.

The Dow Jones suffered its largest single-day point decline in history, plunging by almost 1,600 points before buyers bought back in to “limit the damage”, says CNN.

At the closing bell, the Dow was still down by 1,175 points, a drop of 4.6% that erased all of the gains made by US markets so far this year. It’s the biggest fall in percentage terms since “Black Monday” in August 2011.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Other US indices reflected the drop in the Dow, with the S&P 500 index falling by 4.1% and the Nasdaq by 3.7%.

Investors reacting to recent global equity losses, and concerns that a number of central banks look likely to raise interest rates to curb inflationary pressures from surging global economies contributed to the drop.

“Economic news from the US has been stronger than anticipated,” David Kuo, chief executive of financial services advisory Motley Fool, told the BBC. “So, perversely, the market correction has been caused by positive economic news.”

Asian markets followed suit, with Japan’s Nikkei hit particularly hard, losing more than 6.6% of its value. Hong Kong shares also suffered losses of almost 5%t, and Australian shares fell by more than 3%.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Why is crypto crashing?

Why is crypto crashing?Today's Big Question The sector has lost $1 trillion in value in a few weeks

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

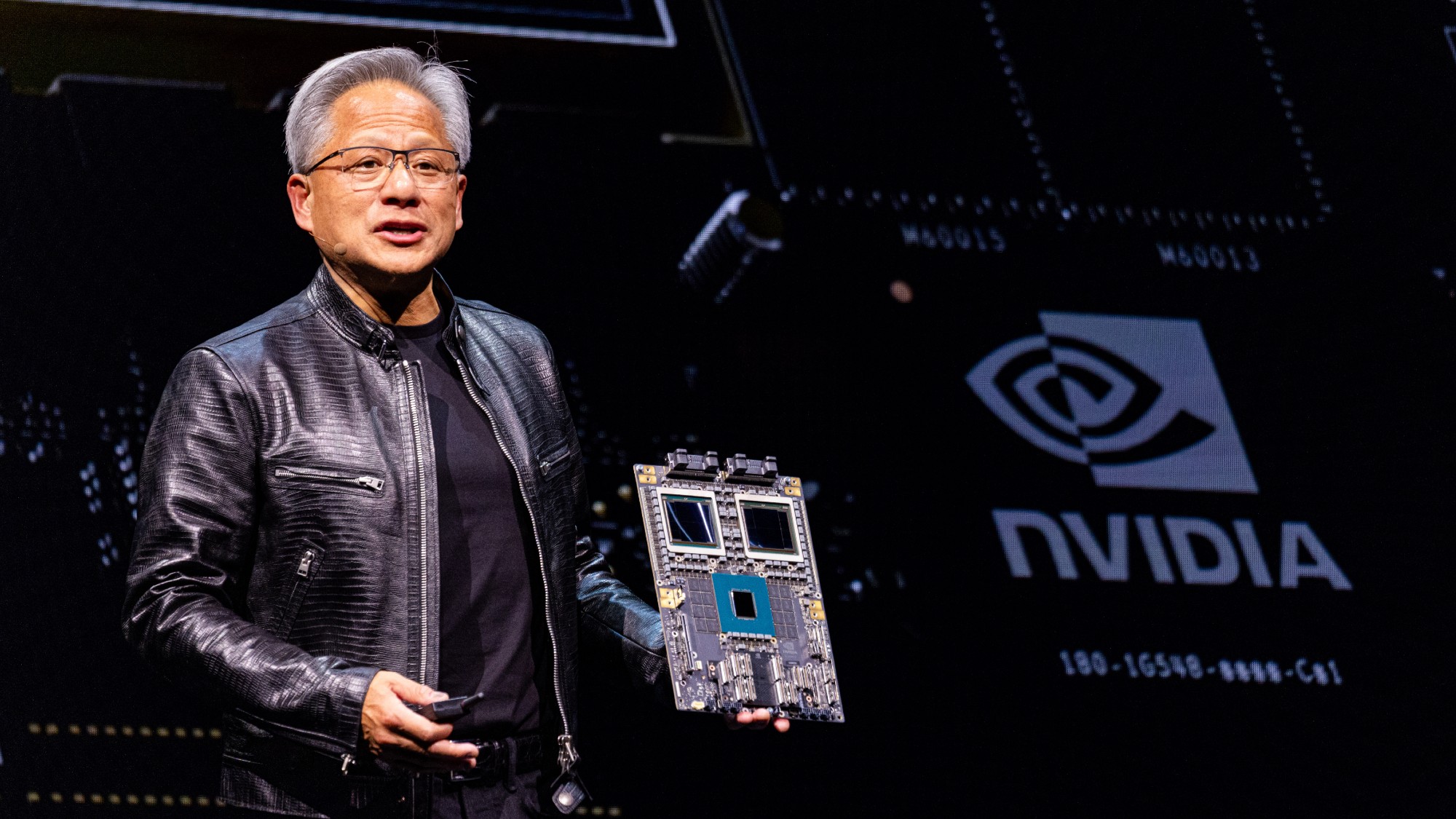

Nvidia: unstoppable force, or powering down?

Nvidia: unstoppable force, or powering down?Talking Point Sales of firm's AI-powering chips have surged above market expectations –but China is the elephant in the room

-

DORKs: The return of 'meme stock' mania

DORKs: The return of 'meme stock' maniaFeature Amateur investors are betting big on struggling brands in hopes of a revival

-

Tesla reports plummeting profits

Tesla reports plummeting profitsSpeed Read The company may soon face more problems with the expiration of federal electric vehicle tax credits

-

Trump's threats to fire Jerome Powell are unsettling the markets

Trump's threats to fire Jerome Powell are unsettling the marketsTalking Points Expect a 'period of volatility' if he follows through