Wall Street 'fear gauge' at lowest level for 24 years

Vix Index drops as geopolitical pressures lift, but analysts warn investors against being too complacent

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Global markets hit another all-time high yesterday, with the receding threat of political instability in the EU boosting investors' confidence.

On Monday, the CBOE Volatility Index, dubbed the Vix Index and considered Wall Street's "fear gauge", fell to its lowest level since 1993, bolstered by last weekend's French presidential election result and solid corporate earnings, says Reuters.

Volatility in the US equity market "has dissipated as stock investors whistled past geopolitical unknowns from populist politics to heightened threats from North Korea", says Bloomberg.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

While trade agreements, tax reform and the future of financial regulation may hang in the balance, "investors have instead focused on one of the best global earnings seasons in a decade and signs of economic growth".

However, not everyone has welcomed this newfound confidence. Adrienne Murphy, chief market analyst at online traders AvaTrade, told the Daily Telegraph that with nationalism and populism still spreading, she was "surprised the Vix was so low".

Piers Curran, head of trading at Amplify Trading, also said the current volatility level "was not sustainable", while George Goncalves, a fixed income strategist at Nomura, issued a note of caution to his clients.

He said: "Complacency has returned in such quick fashion that it's starting to feel like 2005-06, when nothing seemed to faze the broader markets."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

With Emmanuel Macron's victory over Marine Le Pen in the French elections, "the EU and the euro have dodged a bullet, but geopolitical risks are continuing to proliferate", says Nouriel Roubini, an economist known as "Dr Doom", in The Guardian.

As examples, he cites the continuing populist backlash against globalisation, Russia's expansionist agenda and North Korea threatening a military conflict on the Korean peninsula.

"It is worth asking if investors are underestimating the potential for one or more of these conflicts to trigger a more serious crisis, and what it would take to shock them out of their complacency if they are", he adds.

-

The environmental cost of GLP-1s

The environmental cost of GLP-1sThe explainer Producing the drugs is a dirty process

-

Greenland’s capital becomes ground zero for the country’s diplomatic straits

Greenland’s capital becomes ground zero for the country’s diplomatic straitsIN THE SPOTLIGHT A flurry of new consular activity in Nuuk shows how important Greenland has become to Europeans’ anxiety about American imperialism

-

‘This is something that happens all too often’

‘This is something that happens all too often’Instant Opinion Opinion, comment and editorials of the day

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Why is crypto crashing?

Why is crypto crashing?Today's Big Question The sector has lost $1 trillion in value in a few weeks

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

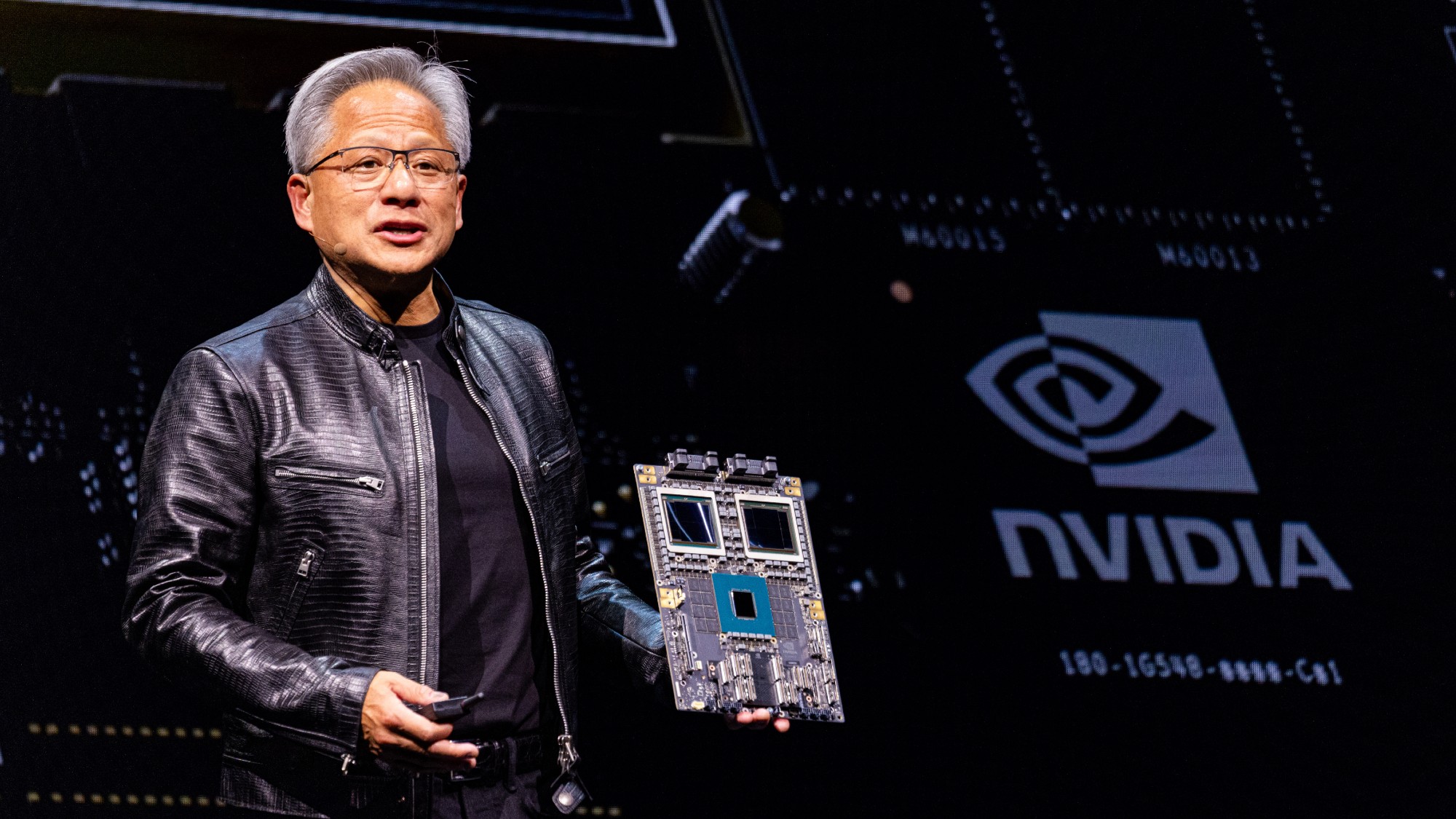

Nvidia: unstoppable force, or powering down?

Nvidia: unstoppable force, or powering down?Talking Point Sales of firm's AI-powering chips have surged above market expectations –but China is the elephant in the room

-

DORKs: The return of 'meme stock' mania

DORKs: The return of 'meme stock' maniaFeature Amateur investors are betting big on struggling brands in hopes of a revival

-

Tesla reports plummeting profits

Tesla reports plummeting profitsSpeed Read The company may soon face more problems with the expiration of federal electric vehicle tax credits

-

Trump's threats to fire Jerome Powell are unsettling the markets

Trump's threats to fire Jerome Powell are unsettling the marketsTalking Points Expect a 'period of volatility' if he follows through