Mark Carney in talks to extend Bank of England tenure

Treasury concerned post-Brexit transition could lead to uncertainty and destabilise markets

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Mark Carney is in discussions with the Treasury to extend his tenure as governor of the Bank of England beyond his present departure date of June 2019.

The former Goldman Sachs banker is set to appear before MPs on the House of Commons Treasury committee later today to answer questions about his future.

It follows a Financial Times article revealing that that those “close to the governor” believed he was positive about an extension.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The BBC’s economics editor Kamal Ahmed, said the Treasury's overtures are “more to do with the next governor and who the Treasury think they can attract to the post given the present state of the Brexit negotiations, rather than whether Mark Carney staying will reassure the markets”.

Several members of the Treasury select committee have told The Guardian that keeping the governor in place would help smooth Britain’s departure from the EU on 29 March.

Regulators and traders on both sides of the Channel also believe that, despite being labelled a tool of ‘Project Fear’ by some Brexiteers for his interference in the Brexit debate, Carney will provide continuity during a period of Brexit transition.

“Markets do not like change and a new governor would contribute to uncertainty. Carney is a known quantity and would subsequently offer a degree of calm that could help to reinforce confidence at the margins,” said Anthony Gillham, head of investments at Quilter Investors.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

However, the FT says the difficulty with this argument is that the Brexit process is still likely to be uncertain in the summer of 2020.

The front-runner to succeed Carney is widely seen to be Andrew Bailey, the chief executive of Britain's Financial Conduct Authority and a former deputy governor at the BoE.

Yet, earlier this year, the Chancellor Philip Hammond said he might look abroad again for a successor to Carney, a Canadian.

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

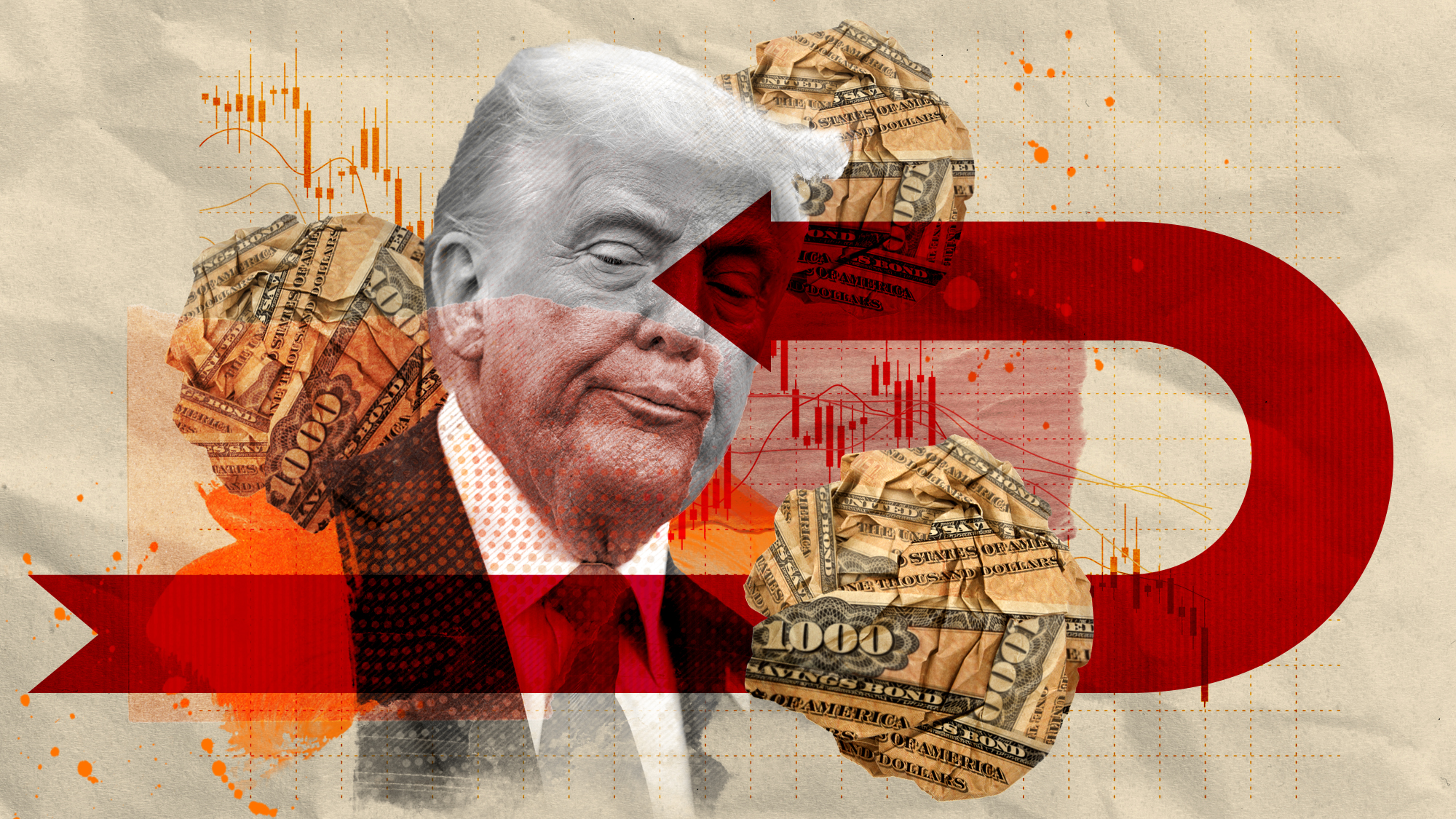

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Is the UK headed for recession?

Is the UK headed for recession?Today’s Big Question Sluggish growth and rising unemployment are ringing alarm bells for economists

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Should Labour break manifesto pledge and raise taxes?

Should Labour break manifesto pledge and raise taxes?Today's Big Question There are ‘powerful’ fiscal arguments for an income tax rise but it could mean ‘game over’ for the government

-

What are stablecoins, and why is the government so interested in them?

What are stablecoins, and why is the government so interested in them?The Explainer With the government backing calls for the regulation of certain cryptocurrencies, are stablecoins the future?

-

Is Rachel Reeves going soft on non-doms?

Is Rachel Reeves going soft on non-doms?Today's Big Question Chancellor is reportedly considering reversing controversial 40% inheritance tax on global assets of non-doms, after allegations of 'exodus' of rich people

-

Pocket change: The demise of the penny

Pocket change: The demise of the pennyFeature The penny is being phased out as the Treasury plans to halt production by 2026

-

How the US bond market works – and why it matters

How the US bond market works – and why it mattersThe Explainer Donald Trump was forced to U-turn on tariffs after being 'spooked' by rise in Treasury yields