The GOP tax bill's biggest boondoggles

Here's what experts have already uncovered

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

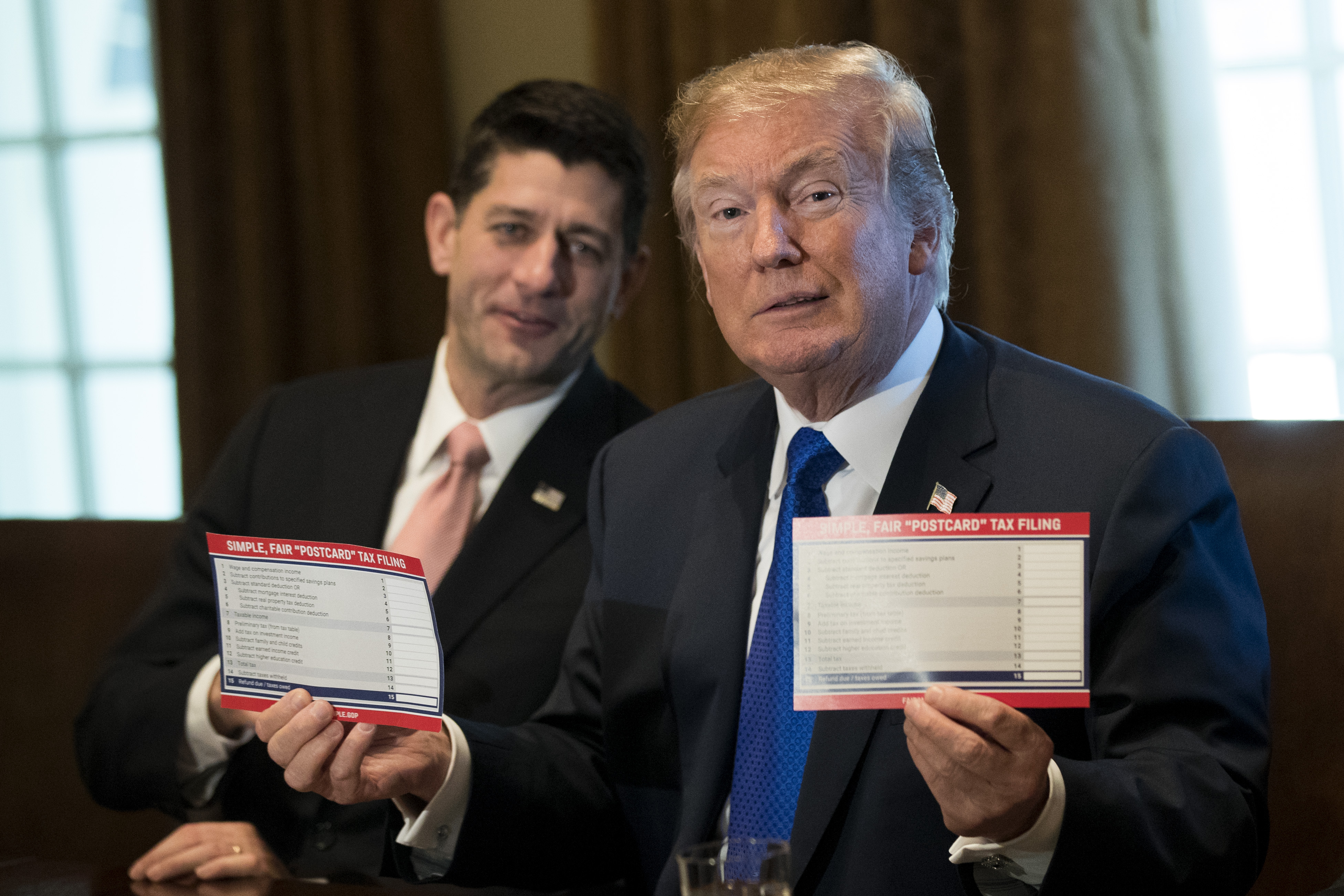

You'll be able to file your taxes on a postcard. That was the sales pitch the Republican Party made when it started out on tax reform. The whole idea was to make the tax code simpler and fairer. Now the House and Senate have hashed out a final compromise bill, which they plan to vote on this week.

So how did they do at living up to their promise?

Not good.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Jammed through at incredible speed, with virtually no public hearings or debate, the tax bill is a complete mess of glitches, opaque wording, and complications. Despite the bill's rapid-fire pace, a group of tax experts was able to survey the tax code changes and compile at least some of the major problems. Not only will the Republicans' tax bill increase the ways the wealthy and connected can game the tax code and avoid paying their fair share — it will likely make the tax system vastly more complicated, not less.

Let's run through the highlights (or lowlights).

1. The GOP tax bill encourages shady tax shenanigans.

The existing tax code already has lots of ways rich people can lower their tax rate by classifying themselves as a corporation. For instance, if an individual taxpayer incorporates herself, her employer is then "contracting" with the new corporation for a fee rather than a paycheck. The "profits" from that "fee" are taxed at the corporate rate rather than the individual rate. If you're a shareholder in a corporation you run, you can also just pay yourself a low manager's salary and make up the difference with shareholder payouts. Then you're paying the corporate tax and the capital gains tax rather than the individual income tax.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Are these shenanigans worth it? If you can afford good accountants and lawyers, and end up with a lower effective tax rate, sure.

Right now, the corporate rate is 35 percent, and the top individual rate is 39.6 percent. Those aren't too far apart. So these sorts of shenanigans only make sense for a relatively small number of people. But the GOP's bill would cut the corporate tax rate to 21 percent, while leaving the top individual rate around 37 percent. Suddenly those two rates will be a lot further apart. And the instances where these shady games are worth playing will become a lot more numerous.

There are loads of examples of similar shenanigans the GOP tax bill will encourage: like allowing high-income Americans to reclassify themselves as a pass-through business with whom their employer contracts, resulting in a big tax break.

2. The GOP tax bill will deform important state and local property tax deductions.

Some versions of the bill would have largely done away with deductions for state and local property taxes. These deductions are really popular — particularly in high-tax states, and states with high property values — so news that they were being zapped caused a big uproar. Now the GOP seems to be compromising: Let people deduct up to $10,000 on their state and local property taxes, or on their state and local sales and income taxes. But the GOP decided that businesses should still be able to deduct state and local taxes.

Yet again, if individual taxpayers have the means to incorporate themselves, they can get the state and local deduction back — while their less fortunate fellow citizens can't.

This change could also inspire state and local governments to do some weird stuff. It'll be harder to raise revenue from the taxes that lost the deduction. Governments might shift away from those forms of taxation, and jack up employer-side payroll taxes instead, for example.

3. The GOP tax bill will screw up attempts to bring jobs and investment back to America.

Republicans want to lower or eliminate the taxes corporations pay on overseas profits. Ostensibly this is about simplification and encouraging companies to bring the money home and invest it. (They won't.) But Republicans didn't want to make the giveaway too brazen, so they created a kind of minimum tax of about 10 percent.

The problem is the tax only applies to income from "intangibles," like owning financial assets or trademarks or copyrights. Money from "tangible" stuff, like investments in plants and physical capital and the jobs that go with them, is still totally exempted. That could push companies to move more of that stuff offshore, and undercut Trumpism's supposed devotion to more jobs here in America.

A similar provision meant to give companies a break on export income could actually backfire and encourage something called "round-tripping" — a company sells a product abroad, pockets the export income tax break, then sells the product right back to the states. Or they could sell unfinished products abroad, then finish the supply chain in another country, and sell it to a U.S. customer.

Not surprisingly, it's the wealthy who disproportionately benefit from these opportunities. They can hire the lawyers and accountants to do all the paperwork; they can afford to delay getting some of their income because they're already rich; and they have the most to gain from dodging the individual income tax.

The bill did include some hiccups that could add to, rather than subtract from, the tax burdens of big business and wealthy owners. But those were mostly corrected. The Republican Party's devotion to the billionaire donor class is more or less absolute, and American conservatives have long operated on the ideological assumption that taxation is theft and thus intrinsically illegitimate. For years, Republicans have endeavored to gut funding for the IRS, and the agency likely won't have the manpower or the resources to police all the new avenues the GOP bill will create for tax avoidance.

So you have to ask: Are these all glitches and mistakes on the Republicans' part? Or are they the point?

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred