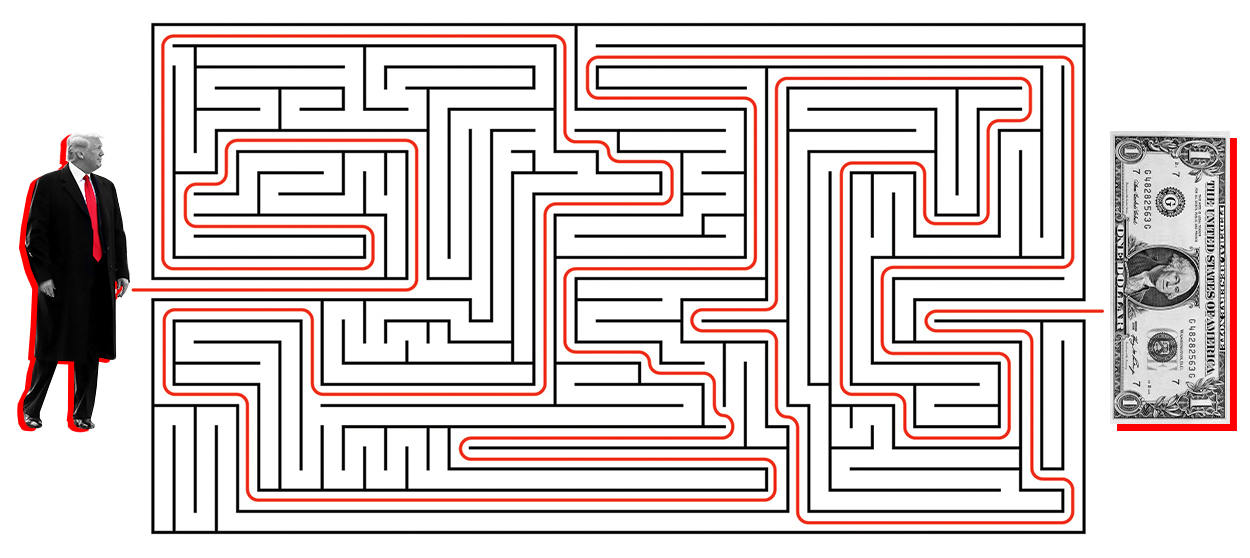

Trump's tax cut forgot a basic rule of politics

Keep it simple, and take credit

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

President Trump may lambast The New York Times as "fake news." But even the Gray Lady is arguing that Trump's 2017 tax cut deserves more love. According to a recent Times survey, just under 40 percent of Americans believe they're paying lower taxes thanks to the GOP's bill. Yet over two-thirds of Americans actually saw their tax burden drop in 2018.

A big reason for that gap is that the Trump administration forgot a key rule of politics: Keep it simple, stupid.

Obviously, the first priority of policy changes should be to actually make people's lives better. But entangled with that is the need for politicians and parties to get credit when they help people. It's not just about political self-interest, either: If the voters want to get people into office who will improve their lives and support their values, it's rather important that voters be able to spot when a politician or party has actually improved their lives. Complexity is the enemy of that goal. If a policy works through byzantine bureaucratic mechanisms, it can be hard for voters to tell when it's benefiting them — and harder still for them to figure out who to reward for those benefits with their votes.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

When it comes to tax cuts, people tend to focus on their refunds. As plenty of Trump's defenders point out, this doesn't make much sense: A big refund suggests you overpaid the government in the first place. But it's also a big single check that people notice, and that they associate with the taxes they pay. Instead, the Trump administration worked their tax cut's benefits directly into people's regular paychecks. That's much more logical, but more likely to go unnoticed. It also required less withholding, which meant lower refunds.

Now, the benefits that Trump's tax cut doled out for most everyday Americans weren't that big regardless. The reform focused most of its firepower on the top 1 percent and wealthy corporate shareholders. Even if all the money for the bottom two-thirds or so of households had flowed into big single checks, Americans still might not have been that impressed. But the Trump administration did themselves no favors by burying the pocketbook impact of their tax cut in the complexities of the tax code and the withholding system.

As it turns out, the Obama administration got tripped up by much the same problem: They cut taxes in the depths of the Great Recession, and they also concentrated on increasing people's paychecks rather than their refunds. As a result, no one noticed, and Obama's White House got zero political credit for the move.

Writing in the journal Democracy in 2017, Jack Meserve compared that episode to yet another tax cut in a recession, carried out by the Bush administration back in 2001. In that instance, the tax cut was designed to send Americans one big check they couldn't miss, usually for an average of $600. On top of that, the White house literally included a note with the check: "We are pleased to inform you that the United States Congress passed and President George W. Bush signed into law the Economic Growth and Tax Relief Reconciliation Act of 2001, which provides for long-term tax relief for all Americans who pay income taxes." They weren't shy about making the results of the tax cut blindingly obvious, or about telling Americans who they should thank for it.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Obama administration had its reasons: They were trying to boost the country out of a massive economic collapse, and social science suggested more money in people's paychecks was more likely to be immediately spent. Meanwhile, like the Trump administration after it, the Bush administration's check for working Americans was cover for the fact that the great bulk of their tax cut went to the wealthy. But the political effects were unmistakable: Bush's tax cuts remained popular for seven years, while the tax cuts of both Obama and Trump were consigned to indifference.

Meserve noted that this problem of kneecapping yourself with policy complexity seems to be a bigger vice for Democrats. The insurance plans and subsidies that ObamaCare provided, for instance, are buried under a haze of paperwork and mind-numbing bureaucratic complexity. Democrats also tend to be big fans of tax-advantaged savings plans, like 401(k)s and Roth IRAs and such, which again require the mental energy to sort through a lot of red tape.

Modern Democrats also often prefer to use tax credits to give Americans assistance. They use them to provide ObamaCare's subsidies, to give poor Americans a boost to their paychecks, to give the elderly some extra income support, to help families pay for their kids' education, and to encourage people to use green energy. Now Democrats are rallying around yet another tax credit idea, this time to help families with child care expenses. Tax credits can result in big one-time checks — the Earned Income Tax Credit (EITC) comes to mind — but you have to go through the rigmarole of filing your taxes to get them. And the number of people who are eligible for benefits like EITC but don't get them is pretty big for exactly that reason.

Meserve compared this mess to programs like Social Security, passed under the Roosevelt administration. Not only is Social Security a straight check sent to you by the government, no yearly paperwork hassle required, but Roosevelt plastered posters up everywhere to let people know Social Security was available.

Ironically, the GOP seems to have done a better job remembering Roosevelt's lesson, the Trump administration's recent stumble notwithstanding, even if only to obscure the fact they're robbing the country blind for the benefit of the rich. What's holding back the Democrats is more difficult to discern. Presumably, they want to help people. But they seem to think it's improper or unsportsmanlike if voters actually notice they're being helped and reward the Democrats accordingly. The Party would do well to take Meserve's advice: "Keep it simple and take credit."

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

Pentagon spokesperson forced out as DHS’s resigns

Pentagon spokesperson forced out as DHS’s resignsSpeed Read Senior military adviser Col. David Butler was fired by Pete Hegseth and Homeland Security spokesperson Tricia McLaughlin is resigning

-

Colbert, CBS spar over FCC and Talarico interview

Colbert, CBS spar over FCC and Talarico interviewSpeed Read The late night host said CBS pulled his interview with Democratic Texas state representative James Talarico over new FCC rules about political interviews

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred