How Brexit could affect your investments and pension

Most economists reckon a vote to Leave would result in a hit to the economy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The EU referendum is only a few days away now. So, what are the experts saying a vote to leave could mean for your investments?

What could a vote to leave mean?

The main concern for investors is that markets hate uncertainty. A vote to leave would mean at least two years of uncertainty while our exit from the European Union is negotiated.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“For a number of years, the decision of Brexit will create so much uncertainty that it will hurt real investment in the UK and Europe,” Daniel Pinto, JP Morgan’s chief executive for corporate and investment bank told CNBC.

If overseas companies move operations out of the UK or cut investments here, or UK businesses suffer as a result of reduced access to the single market, a vote to leave could also affect employment in the UK.

All of this would have a knock on affect on the stock market.

Should I be panicking about my portfolio?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

While a vote to leave could cause market volatility, it may not mean total doom and gloom and there is plenty you can do to protect your portfolio.

Some noted investors do not even believe it should be the main concern.

“Brexit is less of a concern than the US presidential election,” says Richard Woolnough, a fund manager at M&G, in Moneywise. “Although Brexit fears are likely to cause volatility, investors should focus more on the possibility of Donald Trump becoming the next US president.”

A good idea would be to take steps to rebalance your portfolio ahead of the vote. Make sure you have a mixed pot of assets and geographical regions in order to minimise your exposure to one particular region, so you aren’t subject to major losses if there is a market shock.

Some also reckon that currency gyrations and a hit to markets in the wake of a potential Brexit make it worth hedging using the likes of gold, or fixed income bond investments.

Of course, if we vote to stay and stocks surge you don't want to be too defensive. Moreover, if you're a long-term investor most of the above is generally good advice anyway and your portfolio should already be well diversified, meaning you'd be best placed sitting tight and riding out the short-term waves.

Do finance experts think we should leave the EU?

Most economists, including many big names including the IMF and the governor of the Bank of England, have come out to say they believe we should stay in the EU.

Mark Carney, governor of the Bank of England, told the BBC he thinks one of the risks of a vote to leave “could possibly include a technical recession.” The Chancellor George Osborne has also made his stance very clear: he believes Brexit could lead to a great deal of financial problems, budget cuts and tax rises.

Sir Richard Branson is also just one of many big businessmen who believes a vote to leave the EU would be “devastating” for the UK.

But the view is much more split among smaller business owners - and there are experts think we should leave too.

“Yes, there is uncertainty, but democracy is a messy business,” says The Guardian’s Money Editor Patrick Collinson. “If the risk is that wages may stabilise in places, if the risk is that rents may fall – then they are risks I’m happy to take.”

“The long-term effects of a Brexit are difficult to predict, given the number of variables that are involved. But I would say in passing that for me the key to prosperity over the very long term is good governance, and the key to good governance is full-blooded democracy – not the half-baked variety that EU membership imposes on us,” says Richard Evans, deputy personal finance editor at The Telegraph.

What about my pension?

The effect Brexit could have on your private pension is the same as the effect on all investments in the stock market. If you are worried take the time to rebalance your portfolio ahead of the vote to reduce your exposure to UK and European investments.

One issue could be a potential need for the Bank of England to cut rates even closer to zero to stimulate demand in the event of a Brexit, which would pile further pressure on private pension funds. This could be short-lived, however.

As for the state pension it is protected by the triple lock system. This means it is pegged to inflation, average earnings or a minimum annual rise of 2.5 per cent. So, if the nation votes to leave, sterling falls and inflation rises the state pension would rise too.

George Osborne did, though, controversially suggest that pensions might have to be cut to pay for a tax receipt shortfall if we vote to leave and economists' fears of a big hit to the economy are realised.

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

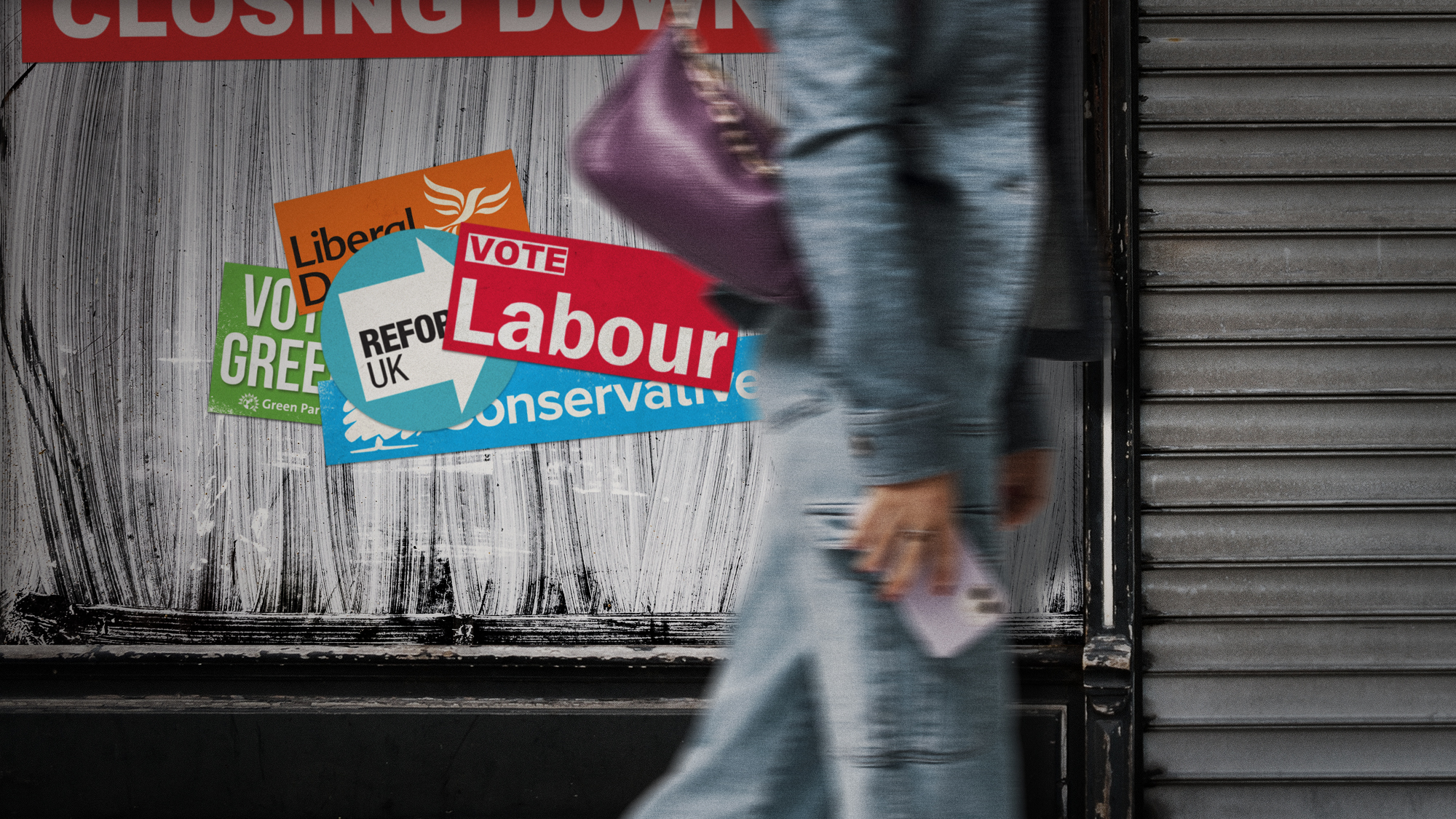

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK

-

Biggest political break-ups and make-ups of 2025

Biggest political break-ups and make-ups of 2025The Explainer From Trump and Musk to the UK and the EU, Christmas wouldn’t be Christmas without a round-up of the year’s relationship drama

-

‘The menu’s other highlights smack of the surreal’

‘The menu’s other highlights smack of the surreal’Instant Opinion Opinion, comment and editorials of the day

-

Is a Reform-Tory pact becoming more likely?

Is a Reform-Tory pact becoming more likely?Today’s Big Question Nigel Farage’s party is ahead in the polls but still falls well short of a Commons majority, while Conservatives are still losing MPs to Reform

-

Taking the low road: why the SNP is still standing strong

Taking the low road: why the SNP is still standing strongTalking Point Party is on track for a fifth consecutive victory in May’s Holyrood election, despite controversies and plummeting support

-

Is Britain turning into ‘Trump’s America’?

Is Britain turning into ‘Trump’s America’?Today’s Big Question Direction of UK politics reflects influence and funding from across the pond

-

What difference will the 'historic' UK-Germany treaty make?

What difference will the 'historic' UK-Germany treaty make?Today's Big Question Europe's two biggest economies sign first treaty since WWII, underscoring 'triangle alliance' with France amid growing Russian threat and US distance