The daily business briefing: November 30, 2021

Twitter announces Jack Dorsey is resigning as CEO, a federal labor official calls for a new union vote at an Amazon factory, and more

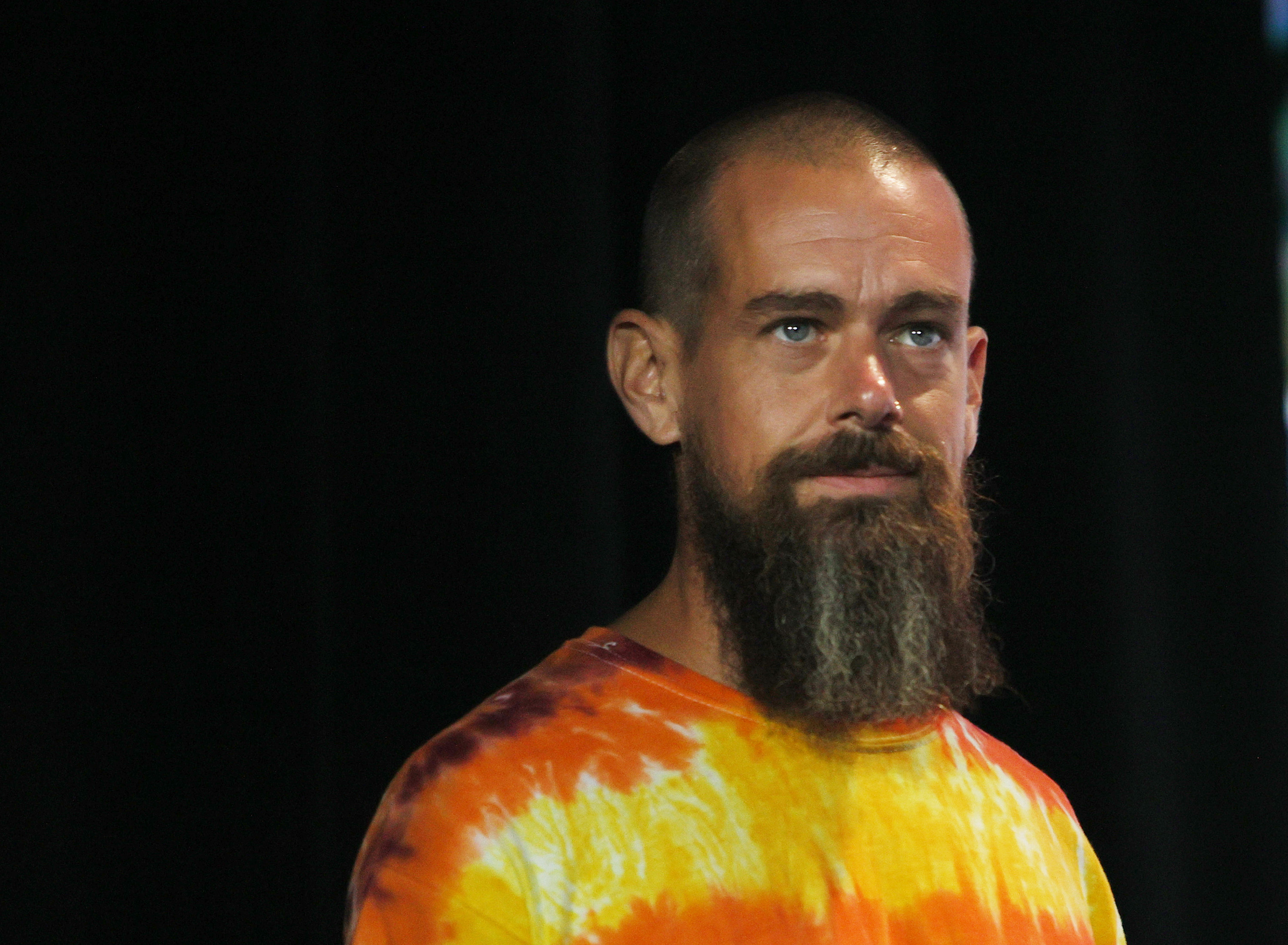

- 1. Twitter announces Jack Dorsey's resignation as CEO

- 2. Federal labor official calls for new union vote at Amazon warehouse

- 3. Stock futures fall as concerns over Omicron variant continue

- 4. Eurozone inflation rises to 4.9 percent, highest on record

- 5. U.K. competition regulator tells Meta to sell Giphy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Twitter announces Jack Dorsey's resignation as CEO

Twitter announced Monday that CEO Jack Dorsey is stepping down and will be replaced by the social media company's chief technology officer, Parag Agrawal, effective immediately. Dorsey, 45, has been serving as chief executive of both Twitter and his digital payments company Square. He will remain on Twitter's board until his term expires at the 2022 stockholders' meeting, the company said. Salesforce President and COO Bret Taylor will replace former Google executive Patrick Pichette as chairman of the board. Dorsey didn't reveal why he was resigning, but said he had "decided to leave Twitter because I believe the company is ready to move on from its founders." Twitter shares fell by 2.7 percent on Monday.

2. Federal labor official calls for new union vote at Amazon warehouse

A National Labor Relations Board official, Lisa Y. Henderson, has ordered a second union vote at the Amazon warehouse in Bessemer, Alabama, after determining that Amazon improperly pressured workers during the initial vote in the spring. Henderson, the NLRB's Atlanta region director, accused Amazon of "flagrant disregard" for making the union election free and fair, saying its placement of a U.S. Postal Service mailbox in front of the warehouse "essentially hijacked the process and gave a strong impression" the company controlled ballot counting. Amazon, which staunchly opposes unionization, noted that the factory's workers voted more than 2-to-1 against joining the Retail, Wholesale, and Department Store Union. "It's disappointing that the NLRB has now decided that those votes shouldn't count," Amazon spokesperson Kelly Nantel said.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Stock futures fall as concerns over Omicron variant continue

U.S. stock futures fell early Tuesday after Monday's rebound as concerns continued about the new Omicron coronavirus variant. Futures tied to the Dow Jones Industrial Average and the S&P 500 were down by 1.3 percent and 1.1 percent, respectively, at 6:30 a.m. ET. Futures for the tech-heavy Nasdaq were down by 0.6 percent. The main U.S. indexes made big gains on Monday, bouncing back from Friday's plunge, after President Biden said a new economic lockdown was off the table. Futures fell Tuesday after Moderna CEO Stephane Bancel told the Financial Times that existing vaccines would probably be less effective against the Omicron variant.

4. Eurozone inflation rises to 4.9 percent, highest on record

Inflation hit 4.9 percent across the Eurozone in November, the highest since records began in 1997, according to figures released Tuesday by Eurostat, the European Union's statistics agency. The figure, up from 4.1 percent in October, was higher than the 4.5 percent expected by economists surveyed by Reuters. The surge in consumer prices in the 19 countries that use the European common currency came largely because of a spike in energy costs. Increasing demand and supply-chain bottlenecks due to the recovery from the coronavirus recession also pushed up consumer prices. The data raised questions about how quickly the European Central Bank will tighten its monetary policy as inflation rises but pandemic concerns continue.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. U.K. competition regulator tells Meta to sell Giphy

British antitrust regulators on Tuesday told Meta to sell Giphy over concerns that the social media giant's recent purchase of the GIF-sharing platform would hurt competition. The U.K. Competition and Markets Authority said Meta's control of Giphy — a search tool for short, looping videos and animations — had already knocked one potential rival out of the advertising market, and concluded that the regulator's "competition concerns can only be addressed by Facebook selling Giphy in its entirety to an approved buyer." Meta, which owns Facebook, Instagram, and WhatsApp, said it disagreed with the decision and was considering "all options, including appeal." "Both consumers and Giphy are better off with the support of our infrastructure, talent, and resources," a Meta spokesperson said.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

SiriusXM hopes a new Howard Stern deal can turn its fortunes around

SiriusXM hopes a new Howard Stern deal can turn its fortunes aroundThe Explainer The company has been steadily losing subscribers

-

How will the Warner Bros. bidding war affect the entertainment industry?

How will the Warner Bros. bidding war affect the entertainment industry?Today’s Big Question Both Netflix and Paramount are trying to purchase the company

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

How could worsening consumer sentiment affect the economy?

How could worsening consumer sentiment affect the economy?Today’s Big Question Sentiment dropped this month to a near-record low