The daily business briefing: March 22, 2022

Biden urges CEOs to prepare for Russian cyberattacks, Powell says the Fed would hike rates faster if necessary to curb inflation, and more

- 1. Biden urges CEOs to prepare for Russian cyberattacks

- 2. Powell says Fed could accelerate rate hikes to fight inflation

- 3. Stock futures edge higher after Powell comments

- 4. Switzerland seizes vacation home of Russian oligarch

- 5. Berkshire Hathaway agrees to buy insurer Alleghany for $11.6 billion

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Biden urges CEOs to prepare for Russian cyberattacks

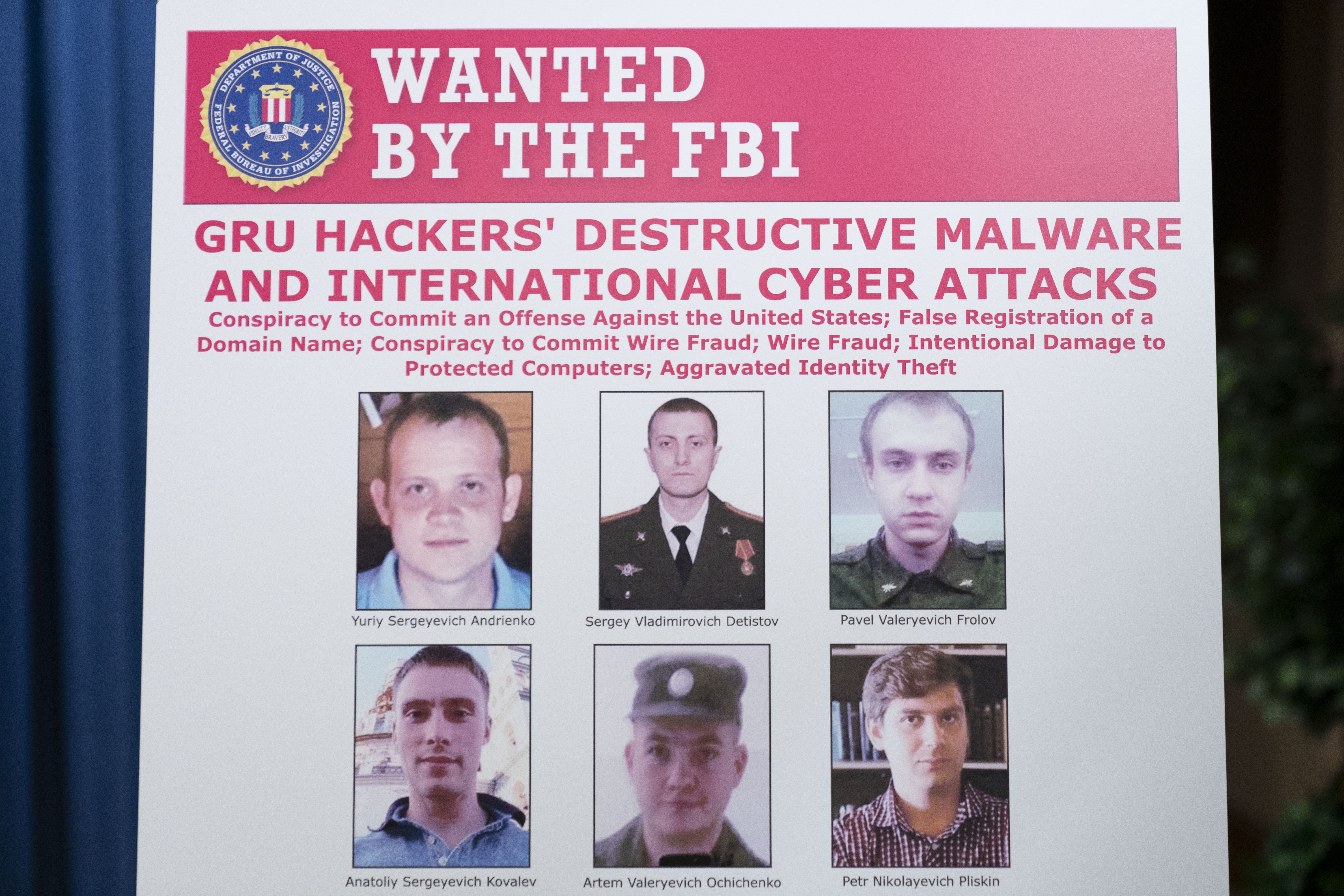

President Biden on Monday told leaders of U.S. companies they had a "patriotic obligation" to invest in bolstering their defenses against cyberattacks that Russia could launch as it continues to face harsh sanctions over its invasion of Ukraine. Biden warned that the United States has "evolving intelligence" that "Russia may be planning a cyberattack against us. ... The magnitude of Russia's cyber capacity is fairly consequential, and it's coming." Biden told members of the Business Roundtable that federal assistance was available to companies if they needed it. He added that his administration, which has faced Russian cyberattacks before, was "doing its part" to prepare for a fresh wave of such attacks.

2. Powell says Fed could accelerate rate hikes to fight inflation

Federal Reserve Chair Jerome Powell said Monday that the central bank would speed up its interest-rate hikes if necessary to bring down high inflation, which has reached its highest pace in 40 years. "There is an obvious need to move expeditiously to return the stance of monetary policy to a more neutral level, and then to move to more restrictive levels if that is what is required to restore price stability," Powell said to a conference of business economists. The Fed last week hiked rates for the first time since 2018. It raised them a quarter-point from near zero, where it has kept them since the start of the coronavirus pandemic sent the economy into a recession. The Fed also signaled at the end of last week's two-day meeting that it would raise rates six more times this year.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Stock futures edge higher after Powell comments

U.S. stock futures rose slightly early Tuesday after Federal Reserve Chair Jerome Powell said the central bank would consider raising interest rates more aggressively if necessary to fight rising inflation. Futures tied to the Dow Jones Industrial Average were up 0.5 percent at 6:45 a.m. ET. Futures for the S&P 500 and the tech-heavy Nasdaq were up 0.4 percent. Monday trading was volatile after Powell's comments, which came less than a week after the Fed raised interest rates for the first time since 2018 and signaled six more rate hikes this year. The Dow fell 0.6 percent on Monday, snapping a five-day winning streak. The S&P 500 closed less than 0.1 percent lower after gaining as much as 0.4 percent during the session. The tech-heavy Nasdaq fell 0.4 percent, after dropping as much as 1.5 percent.

4. Switzerland seizes vacation home of Russian oligarch

Swiss authorities came under increasing pressure by Ukrainian President Volodymyr Zelensky and leaders of Poland over the last several days to do more to confiscate assets of people believed to be supporting Russian President Vladimir Putin's war in Ukraine. Authorities in long-neutral Switzerland reportedly have seized a luxury mountain home believed to belong to a Russian oligarch, Petr Aven, a close confidant of Putin's and a big shareholder in a group that owns Alfa, Russia's biggest private bank. The property is a three-bedroom apartment in a luxury golf resort in Bernese Oberland, a picturesque area surrounded by snow-capped peaks. Aven, 67, did not immediately comment, but he said last month that he would fight any European Union sanctions that Switzerland enforces.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Berkshire Hathaway agrees to buy insurer Alleghany for $11.6 billion

Berkshire Hathaway announced Monday that it had agreed to buy insurer Alleghany Corp. for about $11.6 billion. Billionaire investor Warren Buffett's conglomerate will pay $848.02 per share of Alleghany, a 16 percent premium on the company's average stock price over the last 30 days and a 25.3 percent premium over its Friday closing price of $675.75. The deal will boost Berkshire Hathaway's insurance arm, which includes Geico. It will be Buffett's biggest purchase since 2016. Berkshire Hathaway made no large acquisitions in 2021, ending the year with $146.7 billion in cash, cash equivalents, and short-term Treasury bills. The deal is expected to close in the fourth quarter. Alleghany will have a 25-day "go-shop" period to seek a better offer.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

SiriusXM hopes a new Howard Stern deal can turn its fortunes around

SiriusXM hopes a new Howard Stern deal can turn its fortunes aroundThe Explainer The company has been steadily losing subscribers

-

How will the Warner Bros. bidding war affect the entertainment industry?

How will the Warner Bros. bidding war affect the entertainment industry?Today’s Big Question Both Netflix and Paramount are trying to purchase the company

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

How could worsening consumer sentiment affect the economy?

How could worsening consumer sentiment affect the economy?Today’s Big Question Sentiment dropped this month to a near-record low