The daily business briefing: June 7, 2016

Yellen's reassurances lift stocks, Buzzfeed ends a GOP ad deal over Trump's rhetoric, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Yellen's take on the economy soothes investors

U.S. stocks jumped on Monday after Federal Reserve Chair Janet Yellen gave a speech downplaying Friday's disappointing jobs report, and saying the Fed still might raise interest rates soon. Yellen said the employment data were "concerning," but increases in employment, household incomes, and consumer confidence together indicate that the economy is improving. The S&P 500 index gained 10.28 points or 0.5 percent to end Monday's trading at 2,109.41, its best close of the year. European stocks also rose early Tuesday.

2. BuzzFeed scraps GOP ad deal over Trump's controversial remarks

BuzzFeed told employees on Monday that it was terminating a deal to run Republican National Committee ads in the fall due to the controversial rhetoric of the party's presumptive presidential nominee, Donald Trump. "The Trump campaign is directly opposed to the freedoms of our employees in the United States and around the world and in some cases, such as his proposed ban on international travel for Muslims, would make it impossible for our employees to do their jobs," the company said. The deal was worth $1.3 million.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Valeant cuts guidance again

Valeant Pharmaceuticals has made another sharp cut to its guidance in the latest sign of trouble as the Canadian drug maker tries to bounce back from what it called a "significant disruption." The company said it now expects earnings per share up to $7 this year, down from its previous guidance of up to $9.50. Valeant's stock has plunged by nearly 90 percent since its August peak as it faced concerns over investigations by Congress, accounting practices, and a reputation for buying drugs and hiking their prices.

The Wall Street Journal MarketWatch

4. General Mills launching its first new cereal brand since 2001

General Mills announced Monday that it is releasing its first new cereal brand in 15 years — Tiny Toast — this month. The cereal, which will come in blueberry and strawberry varieties, will be free of high fructose corn syrup, and artificial flavors and colors. The company makes popular brands such as Cheerios and Cinnamon Toast Crunch. Its new offering is appearing after a five-year stretch when cereal sales declined by 5 percent.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Playboy finds buyer for Playboy Mansion

The Playboy Mansion is under contract to be sold, a Playboy Enterprises spokesman said Monday. The famed, 20,000-square-foot Los Angeles home of Playboy founder Hugh Hefner was listed earlier this year for $200 million. Playboy bought the property in 1971 for $1.1 million, then the highest real estate price in L.A.'s history. The mansion, with its famous Playboy grotto and free-form swimming pool, was the scene of Hefner's legendary parties and the symbol of his men's magazine and entertainment empire. The buyer is Daren Metropoulos, a private equity executive.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Where to go for the 2027 total solar eclipse

Where to go for the 2027 total solar eclipseThe Week Recommends Look to the skies in Egypt, Spain and Morocco

-

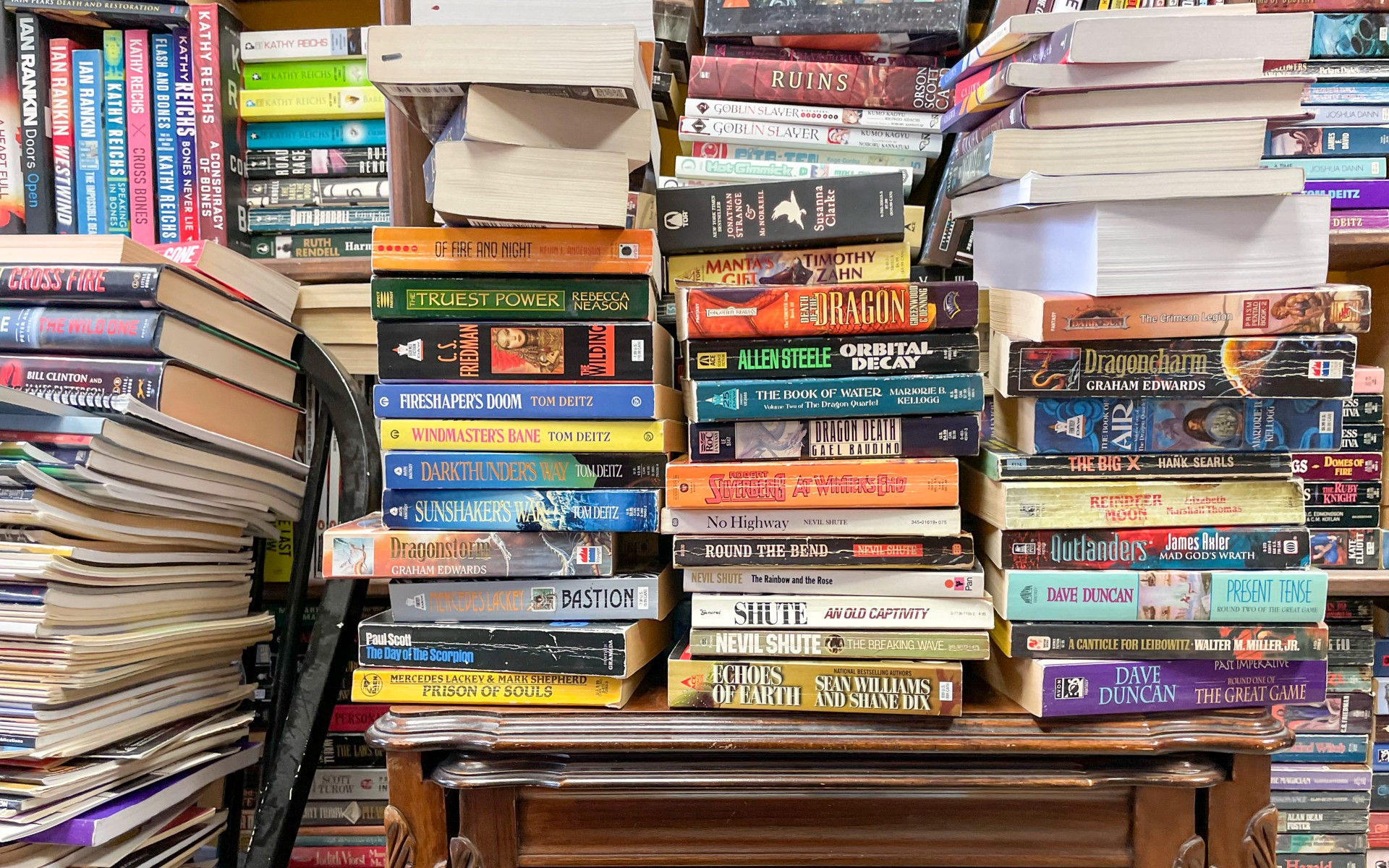

The end of mass-market paperbacks

The end of mass-market paperbacksUnder the Radar The diminutive cheap books are phasing out of existence

-

Political cartoons for February 22

Political cartoons for February 22Cartoons Sunday’s political cartoons include Black history month, bloodsuckers, and more

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military