The daily business briefing: September 11, 2020

Senate Democrats block GOP "skinny" coronavirus relief package, Peloton reports 1st profit as home-fitness demand soars, and more

- 1. Democrats block Senate Republicans' 'skinny' coronavirus relief bill

- 2. Peloton reports quarterly revenue nearly tripled

- 3. 884,000 file new unemployment claims, more than expected

- 4. Citigroup picks Jane Fraser as next CEO

- 5. Stocks rise after falling in Thursday's volatile session

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Democrats block Senate Republicans' 'skinny' coronavirus relief bill

Senate Democrats on Thursday blocked Republicans' "skinny" coronavirus relief bill, keeping the proposed stimulus package from meeting the 60-vote threshold to overcome a filibuster. The bill's failure made it highly unlikely Congress would approve more aid before the November election. Senate Democrats said the $650 million package wasn't close to being enough. House Democrats originally wanted $3 trillion but have said they would accept $2.4 trillion. Republicans said the limited relief targeted the needs most lawmakers agreed about. All present Democrats and Republican Sen. Rand Paul (R-Ky.) voted no, and the vote fell short 52-47. "It's a sort of a dead end street, and very unfortunate," said Sen. Pat Roberts (R-Kan). "But it is what it is."

The Associated Press The New York Times

2. Peloton reports quarterly revenue nearly tripled

Peloton Interactive reported its first quarterly profit on Thursday, as revenue tripled thanks to surging demand for home fitness gear during the coronavirus crisis. Peloton said sales increased by 172 percent and its remote fitness class subscriptions reached 1.1 million in the most recent quarter, up from 886,100 at the end of March. Peloton said its $39-a-month subscriptions could nearly double in its 2021 fiscal year. The company said it had increased production of its stationary bicycles and treadmills to reduce wait times for deliveries, although it could take several months to get back to normal. The news sent Peloton shares rising by nearly 8 percent in after-hours trading.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. 884,000 file new unemployment claims, more than expected

The Labor Department on Thursday reported that 884,000 people filed initial applications for unemployment benefits last week, more than the 850,000 that economists surveyed by Dow Jones had expected. The total was unchanged from the previous week, although without adjusting for seasonal factors there was an increase of 20,140. The numbers signaled a possible slowdown in improvement in the labor market seen over the summer as many businesses reopened after spring coronavirus lockdowns. The pandemic triggered unprecedented job losses when it hit the U.S. Non-farm payrolls declined by 22 million at the start of the crisis, although half of those jobs have been recovered.

4. Citigroup picks Jane Fraser as next CEO

Citigroup announced Thursday that Jane Fraser, who helped steer the nation's third-largest bank after the financial crisis, will take over as CEO after Michael Corbat retires in February. Corbat said in a memo to employees that Fraser's appointment as the first female CEO of Citigroup, or any major Wall Street bank, was "a point of pride for all of us and groundbreaking in our industry." The bank named Fraser, described by a retired former Citigroup leader as "tough as nails" but "incredibly nice," as its president and put her in charge of its global consumer bank last year after rival Wells Fargo tried to poach her to fill its then-open top job. Corbat has run the bank since Vikram Pandit left abruptly in 2012, and he had been expected to stick around until 2022.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Stocks rise after falling in Thursday's volatile session

U.S. stock index futures rose early Friday after Thursday's volatile session ended in big losses. Futures for the Dow Jones Industrial Average were up by 0.8 percent several hours before the opening bell, while those of the S&P 500 and the tech-heavy Nasdaq gained about 1 percent. All three of the main U.S. indexes closed down by more than 1 percent on Thursday. Big tech shares, which have climbed during the coronavirus crisis as Americans shifted more work and entertainment online, continued to fight downward pressure. Facebook, Amazon, Netflix, Alphabet, and Microsoft all fell. Tesla closed up by 1.4 percent after trading up by more than 8 percent at one point.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Lawmakers say Epstein files implicate 6 more men

Lawmakers say Epstein files implicate 6 more menSpeed Read The Trump department apparently blacked out the names of several people who should have been identified

-

Maxwell pleads 5th, offers Epstein answers for pardon

Maxwell pleads 5th, offers Epstein answers for pardonSpeed Read She offered to talk only if she first received a pardon from President Donald Trump

-

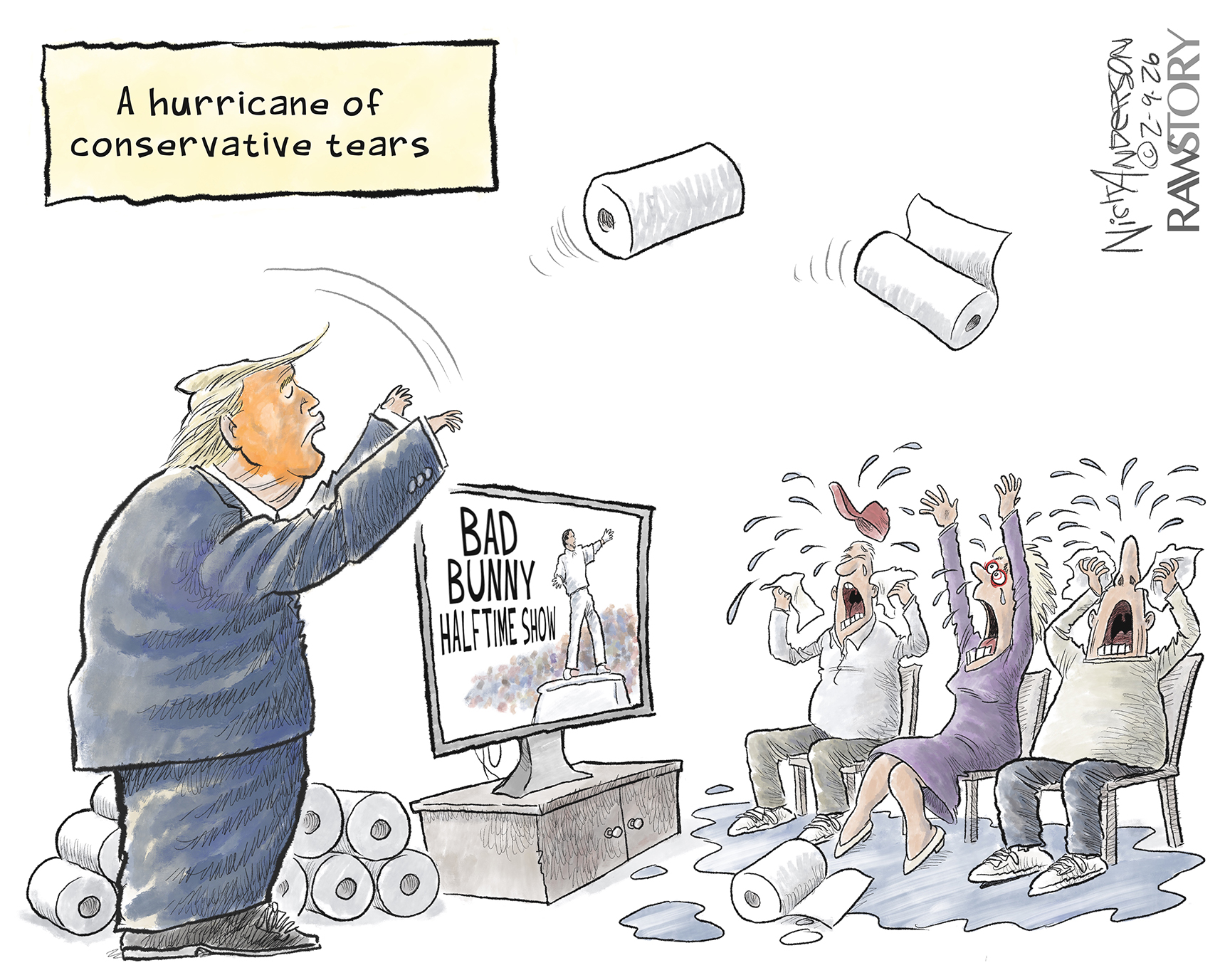

Political cartoons for February 10

Political cartoons for February 10Cartoons Tuesday's political cartoons include halftime hate, the America First Games, and Cupid's woe

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military