Why car sales are falling in the U.S.

GM retook the sales crown, but in a rough year for automakers

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

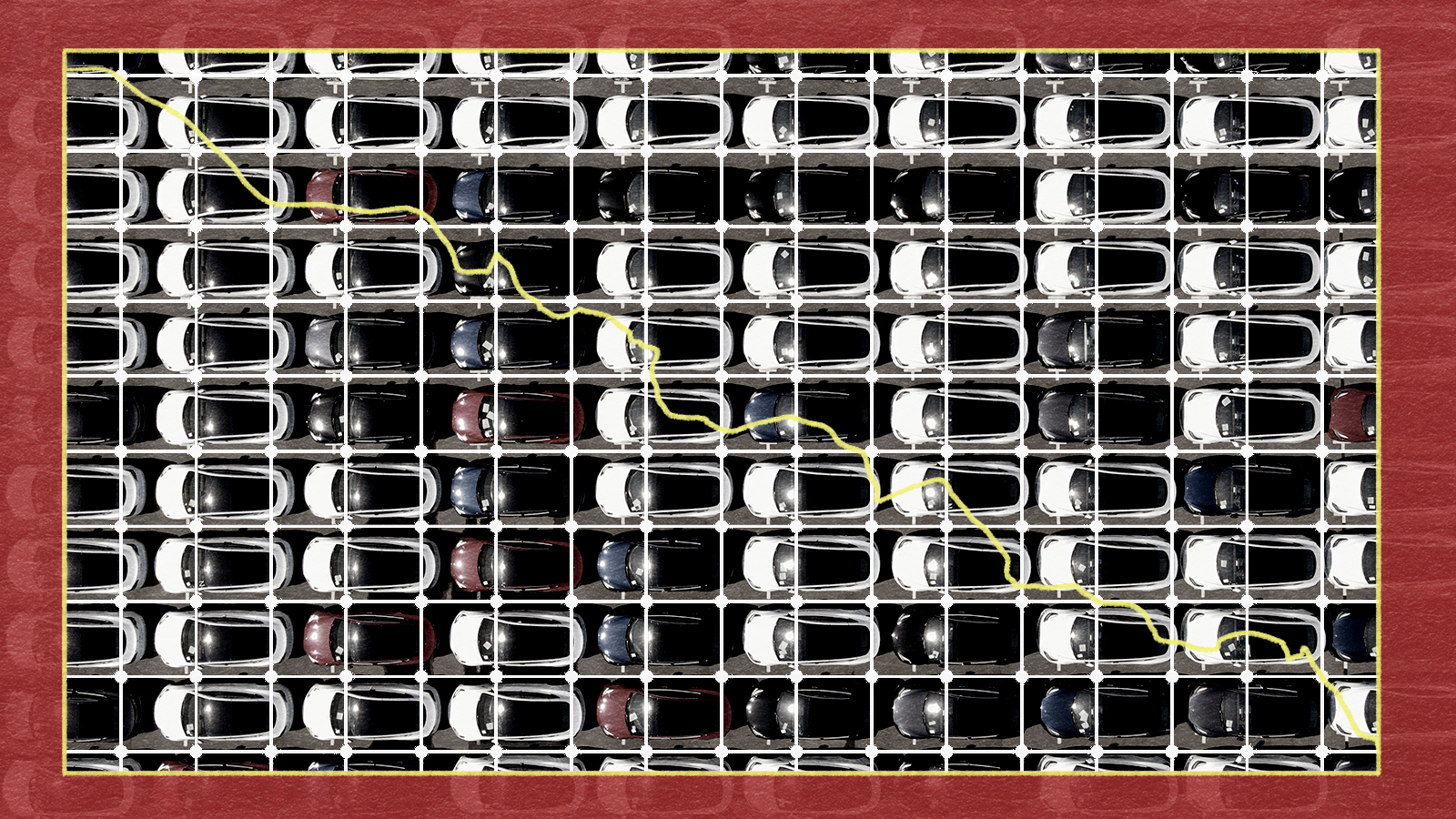

GM has reclaimed its title as America's top carmaker. A year after Toyota topped the domestic car sales charts — the first time a foreign company did that — Detroit returned to the top of the heap. But the victory comes during a tough year for the U.S. auto industry. "Supply chain issues, high interest rates, and low inventory meant that 2022 was a difficult year for car sales," Jalopnik reports. In fact, when all the sales are tallied up, 2022 might end up being the worst year for American car sales in more than a decade: Roughly 13.7 million new vehicles were sold, down about 8 percent. Why are car sales down? And how did GM get its sales crown back? Here's everything you need to know:

How did GM reclaim the top sales position?

This is partly a GM victory and partly a Toyota loss. GM's sales did improve during 2022 — a growth of 2.5 percent from the previous year, according to Reuters — but Toyota's sales fell by nearly 10 percent. Why? A year ago, Toyota won the race because it had stockpiled parts and chips after the Japanese tsunami of 2011, a decision that allowed it to weather the 2021 supply chain crisis better than its rivals. But in 2022, Reuters reports, "Asian brands were hit hardest" by the rising cost of raw materials and the ongoing shortage of computer chips that have affected the entire industry. GM "was able to better meet strong demand for cars and trucks despite industry-wide supply disruptions."

Why are car sales falling overall?

Those supply chain problems are making it hard for automakers to meet demand — and they're making cars more expensive. "U.S. consumers forked out an average of $45,622 for a new vehicle in September 2022, up $3,462 compared with the previous year," J.P. Morgan researchers report. "This marked the fourth highest price of any month on record." And rising interest rates have made it more expensive for would-be buyers to borrow money to buy those increasingly expensive vehicles, The New York Times reports. For the last decade or so, "low rates from the Fed … made those attractive offers for zero-percent financing and 72-month loans possible, but with the higher rates, it's a pretty unfriendly market for people buying a car," one analyst told the paper.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Does that mean there's still a car shortage?

Because of the supply shortages, new car dealerships haven't had many new cars to sell during the last couple of years. Some dealership lots were nearly barren of inventory to sell. The good news? That issue may be easing up. Kelly Blue Book reports that "America's new car dealers ended November with about 1.64 million cars in their inventory. As recently as July, they barely had 1 million in stock." Most car dealers like to keep about a 60-day supply of new vehicles, but "over the past year, some automakers have seen their average fall as low as seven days." As of November, the average is closer to 53 days.

What does all this mean for car prices?

Here's the feedback loop: The rise in prices helped slow sales. Now the slowing of sales may lead to lower car prices. "The slowdown in sales, combined with a rise in inventory, has led to a softening in prices," GOBankingRates reports via Yahoo Finance. Analysts say that new car prices could drop by as much as 5 percent in 2023. But it's used car buyers who should see some relief after a year of big price spikes: "Pre-owned" vehicle prices could decline by as much as 20 percent. "We've already seen prices start to fall on older cars and they'll continue to ease in 2023," said Pat Ryan, CEO of car shopping app Copilot. "Part of the decline is due to economic uncertainty, but it's primarily consumer resistance to those prices." One J.P. Morgan analyst adds: "There are some glimmers of normalization, with prices finally easing somewhat, though conditions remain far from normal."

What's next?

Probably continued slow sales. "Sales figures are expected to remain well below pre-pandemic levels," Jalopnik reports, although analysts say the number of new cars sold could rise to around 17 million. But the Detroit Free Press reports that industry experts "look for 2023 to deliver a dose of normalcy to consumers" and may restore some incentives to lure buyers back into the showrooms. Electric vehicles might see the biggest boost. Investors Business Daily notes that "tax credits of up to $7,500 should buoy demand for electric vehicles in 2023." (The tax credits go only to U.S.-made cars, "benefiting Tesla, GM and Ford at the expense of most foreign automakers.") Everything depends on the state of the economy, though. If a recession hits, car sales in America will have another tough year.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.