Economy: As inflation booms, does recession loom?

Prices hit a new 40-year record

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The smartest insight and analysis, from all perspectives, rounded up from around the web:

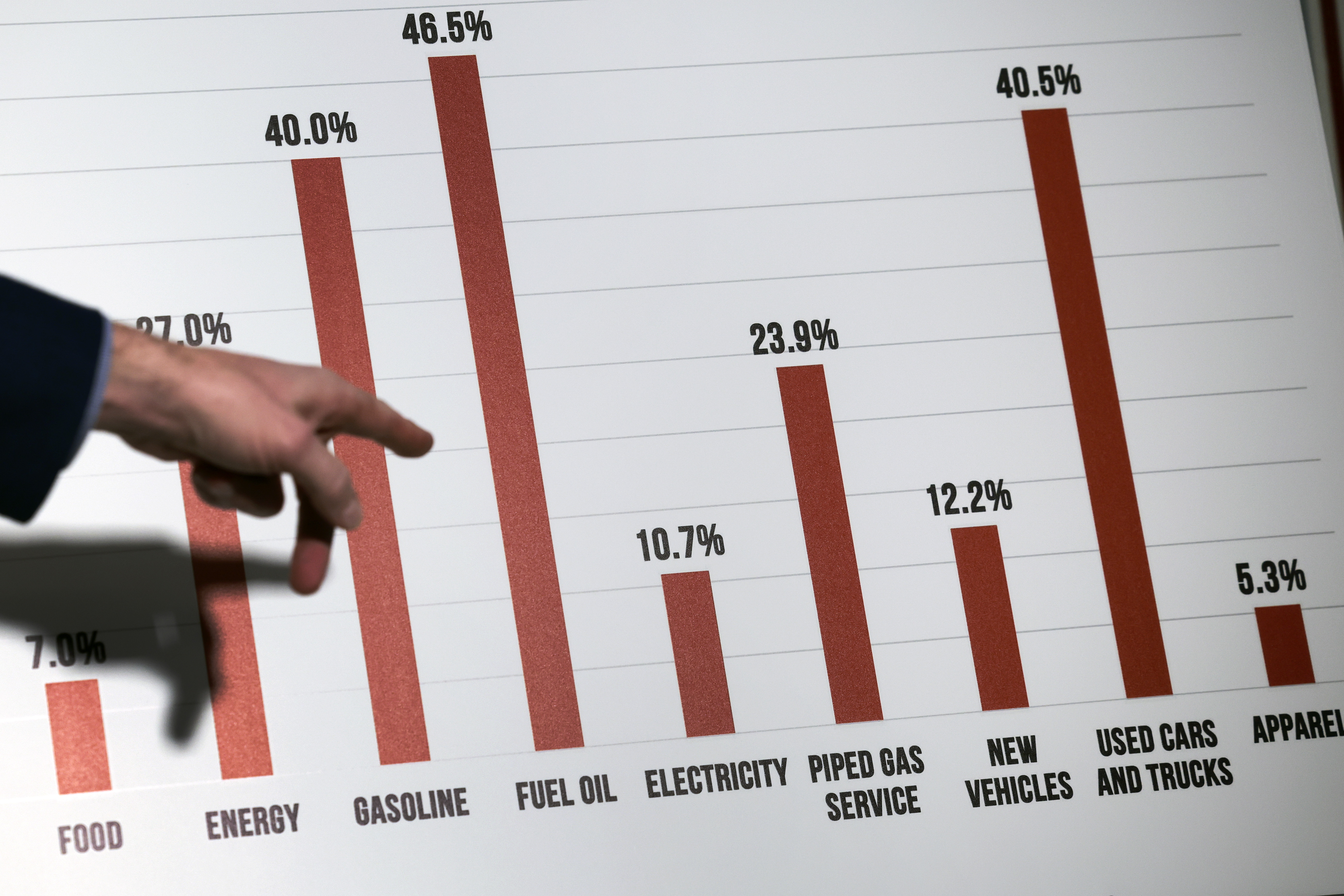

The time for debate is over, said the Financial Times in an editorial: The Federal Reserve must focus on getting inflation under control. Prices rose by a staggering 9.1 percent last month compared with a year ago, reaching a 40-year high. Until recently, it was possible to hope for a soft landing, a mild slowdown that would "tame the inflation problem and get the economy back to robust growth without too much pain." Now, though, "the decision seems straightforward: raise rates rapidly." Taking strong steps now, even if they mean a recession, is better than letting inflation turn into "a vicious cycle." If the Fed moves too fast, "it's easier to reverse course by loosening monetary policy than it is to bear down on an inflationary problem that has seeped into the groundwater."

Sticker shock is everywhere, said Leslie Patton in Bloomberg. Gasoline and milk prices get most of the attention, but "the price for a pound of white bread in the U.S. hit a record $1.69 in June, a 12 percent jump from a year earlier." The higher grocery bills are starting to produce cracks in demand, with food giants like PepsiCo and Conagra reporting declining sales volume. "I feel like the month just started, and I've spent $650 on groceries already," said Brownsburg, Indiana, resident Krista Hoffman, who says she has cut out items like juice boxes and is planning more meatless meals. Inflation optimists can discount the numbers for food and energy, which tend to be very volatile, said Justin Fox, also in Bloomberg. But more worrying is that "core inflation," which removes those prices, is "clearly accelerating."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Hold on, said Paul Krugman in The New York Times. The Fed has already moved to contain inflation. It takes time for increases in interest rates to affect inflation — more than the "scant three to four months" we've had since the central bank started raising interest rates in March. You'd think that the June inflation report would have sent the markets into a tumble. Markets, though, largely "shrugged off" the news. Why? Because the markets see signs that inflation is coming to heel that haven't made it into the headline data points, and the message they are sending is "Don't panic." Financial markets are saying that "inflation is not, in fact, out of control, though the pain many consumers are feeling right now is." The biggest danger may actually be that the Fed will let itself be "bullied into hiking rates too much and produce a gratuitous recession."

How bad are things really? asked Derek Thompson in The Atlantic. A highly cited University of Michigan index found that Americans' outlook on the economy fell to the lowest point in 70 years. Yet, many people "seem to be having a grand old time. Leisure travel is so strong that airports can barely keep up." Restaurants are packed, and hotel occupancy is back to normal. We seem to have adopted an "everything is terrible, but I'm fine" mentality. That might mean that things are better than the numbers show. Or — much worse — that Americans "intuitively sense that a recession is near, so they're getting in their last thrills.

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

SiriusXM hopes a new Howard Stern deal can turn its fortunes around

SiriusXM hopes a new Howard Stern deal can turn its fortunes aroundThe Explainer The company has been steadily losing subscribers

-

How will the Warner Bros. bidding war affect the entertainment industry?

How will the Warner Bros. bidding war affect the entertainment industry?Today’s Big Question Both Netflix and Paramount are trying to purchase the company

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

How could worsening consumer sentiment affect the economy?

How could worsening consumer sentiment affect the economy?Today’s Big Question Sentiment dropped this month to a near-record low