Elon Musk's future at Tesla may hang in the (very expensive) balance

The iconic electric vehicle's board must convince shareholders it's worth awarding their tech titan CEO a $50 billion pay compensation package — or he might walk

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

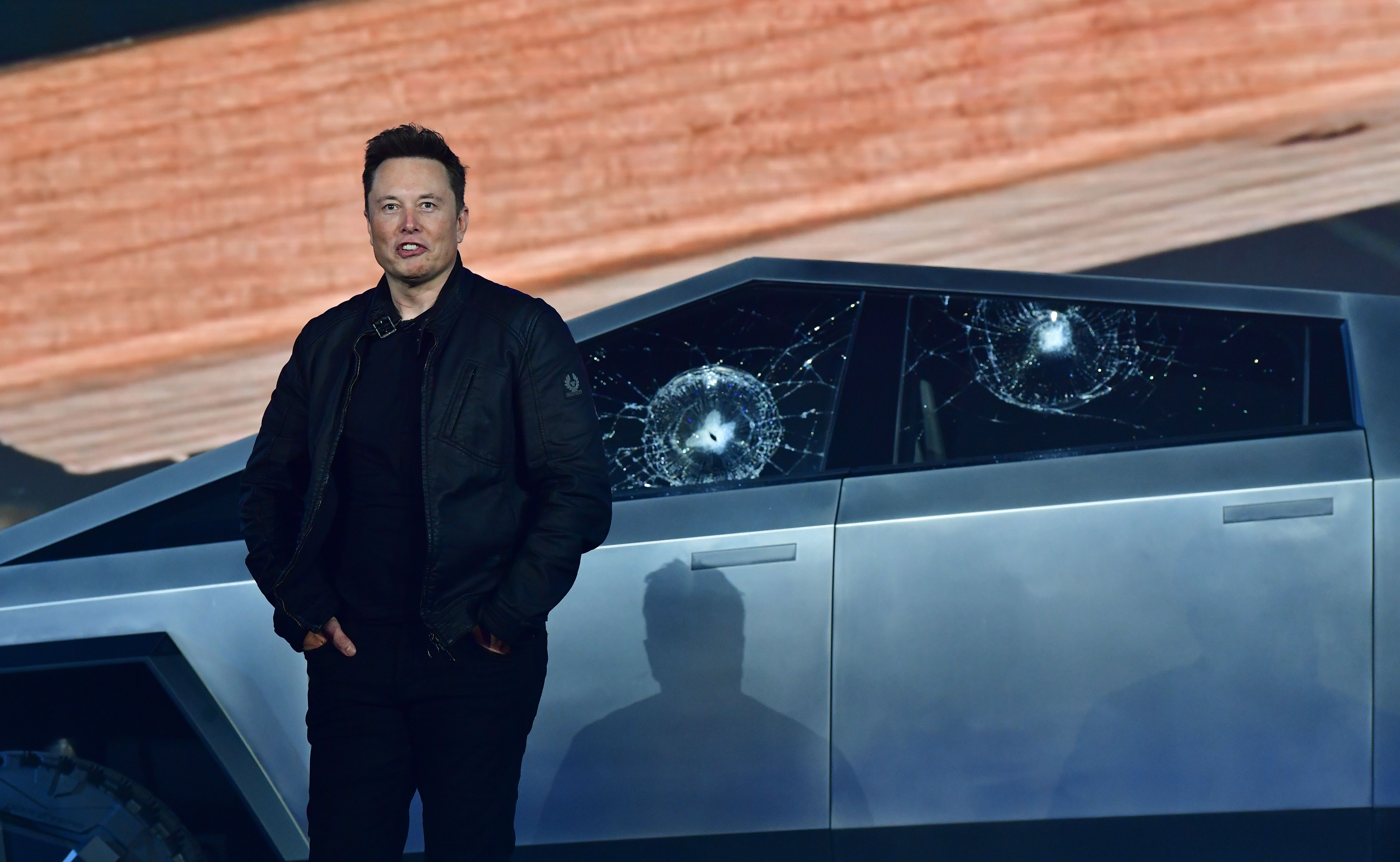

Depending on which way the fickle finger at the end of Adam Smith's infamous "invisible hand" is pointing on any given day, tech titan Elon Musk is one of — if not the — richest men in the history of the human race. Whether through the rockets and satellites of his SpaceX company, his moderation of global conversations on X, formerly Twitter, or his legion of devoted Tesla drivers, Musk unilaterally wields influence formerly reserved for kings and nation-states. At the same time, his erratic and occasionally bigoted behavior has created significant turbulence for his various companies, threatening both their corporate reputations and financial bottom lines. Nevertheless, with a net worth upwards of $200 billion dollars, Musk remains perhaps the most potent force in the business world, and one of the most potent in the world at large.

Next Thursday, Tesla shareholders will vote on whether to award their CEO a compensation package worth approximately $50 billion dollars, six months after Delaware Chancery Court Chancellor Kathaleen McCormick blocked an earlier iteration of the deal. Initially negotiated in 2018, the gargantuan bonus is based on Tesla having achieved certain milestones under Musk's leadership, and would nearly double his equity share in the company from 13% to 22% — if, that is, it's approved next week.

'This is obviously not about the money'

Next week's vote is "one of the most important … in the history of our extraordinary company," Tesla Board Chair Robyn Denholm said in a letter to shareholders. To approve the compensation package is to "honor the collective commitment we made to Elon" in the service of "retaining Elon's attention and motivating him to focus on achieving astonishing growth for our company." Regardless of whether the package is approved, Musk would remain one of the wealthiest people on Earth, so "this is obviously not about the money," Denholm said. But if not money, what?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Upping his ownership in Tesla would bring his equity "close to the 25% voting rights threshold Musk has floated to fully develop artificial intelligence at the company," Forbes said. Already, Musk has diverted AI processors "earmarked for the EV giant" to his other artificial intelligence projects at X, Investors.com said. If he does not achieve his 25% voting rights milestone, shareholders should expect Tesla to "significantly slow down/curtail its direct investment in sensitive/advanced AI efforts" and instead expect them to be "concentrated within non-Tesla entities where Elon Musk has control," Morgan Stanley analyst Adam Jones said this week.

Ultimately, for as much as the "'will they or won't they' question has preoccupied the minds of investors," Barron's said, "the vote will likely be yes."

'Threats ring somewhat hollow'

Musk's proposed compensation package is "disproportionate in every way," The Wall Street Journal's Stephen Wilmot said. Not only would shareholders "pay for it through the dilution of their holdings," but Denholm and the Tesla board's efforts to "whip up support for Musk's pay" have become a "spectacle" which "highlights the corporate-governance problem" that fueled the Delaware Chancery Court's decision to nix the deal earlier this year. "With Tesla's board under Musk's thumb," Wilmot said, "shareholders have nobody to look after their interests but themselves."

Tesla should "install [a] new board of directors," Leo Koguan, one of Tesla's largest individual shareholders, said to Barron's. The board should also require the CEO "to spend [his] full time for Tesla," said Koguan, who claims to own more than 27 million shares of the company. Describing Musk as a "tyrant CEO," Koguan has already voted against the compensation package, Forbes said. "Influential proxy advisers Institutional Shareholder Services and Glass Lewis have both urged investors to vote against the 'excessive' and 'outsized' pay award," Financial Times said.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"The threats" of Musk abandoning Tesla should his package not be instated "ring somewhat hollow," the Journal said. Tesla still represents a "large proportion of his net wealth," meaning "Musk couldn't easily jump ship." Instead, think of next week's vote as "no more than a tactic" to challenge the Chancery Court's earlier ruling. Moreover, even if Musk's bonus is approved, it still "doesn't fully eliminate the threat of Musk's distraction arising from other business interests," Barron's said.

"Elon is not a typical executive," Denholm wrote in her letter to shareholders. One way or another, she is absolutely right.

Rafi Schwartz has worked as a politics writer at The Week since 2022, where he covers elections, Congress and the White House. He was previously a contributing writer with Mic focusing largely on politics, a senior writer with Splinter News, a staff writer for Fusion's news lab, and the managing editor of Heeb Magazine, a Jewish life and culture publication. Rafi's work has appeared in Rolling Stone, GOOD and The Forward, among others.

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

Companies are increasingly AI washing

Companies are increasingly AI washingThe explainer Imaginary technology is taking jobs

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

Trump wants a weaker dollar, but economists aren’t so sure

Trump wants a weaker dollar, but economists aren’t so sureTalking Points A weaker dollar can make imports more expensive but also boost gold

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Taxes: It’s California vs. the billionaires

Taxes: It’s California vs. the billionairesFeature Larry Page and Peter Thiel may take their wealth elsewhere

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Why is pizza in decline?

Why is pizza in decline?In the Spotlight The humble pie is getting humbler