Nine financial solutions to ease you into retirement

These nine companies could help boost your finances during your golden years

From purchasing holiday homes to investment opportunities, here are some interesting options for making your money work for you once you’ve retired.

1. Find your retirement haven in the South West

At South West Holiday Parks, holiday home ownership is so much more than buying a second home in a beautiful location. It’s about enjoying a new way of life that puts you in control; where you can sit back, relax and know everything has been taken care of for you. With three stunning parks located in some of the most beautiful coastal and rural areas of the South West peninsula, you’ll discover beaches, bays and stunning landscapes, right on your doorstep. With an exceptional range of luxury lodges for sale starting from £89,000 and limited plots available, don't miss out on a whole new world of leisure opportunities that are yours for the taking. Find out more at southwestholidayparks.co.uk and book your personal VIP tour by calling 01626 817516

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. Invest in sustainable assets with the help of experts

Sustainable real asset investments with Gresham House, the specialist alternative asset manager, include opportunities in forestry, housing, sustainable infrastructure and renewable energy. The company’s real asset strategies aim to provide clients with sustainable yield and long-term capital growth through investment in a variety of tangible assets. The team believes these investments can also provide the potential for returns uncorrelated to equity markets as well as diversified sources of income. Gresham House’s funds aim to actively contribute towards solutions to some of the largest environmental and societal challenges. Find out more at greshamhouse.com/real-assets.

For qualified investors only. Past performance is not an indicator of future performance. Capital at risk.

3. Invest in high-end watches from designer watchmakers

JS Watch Company Reykjavik – a collaboration of master watchmakers and a high-end designer – was established in 2005. Its dedication to the highest standards of horology means it’s now recognised as a company that creates desirable timepieces that combine superb movements and the highest-quality materials with top design. As a small business with a philosophy to create and sell only the very best, JS’s watches have risen in stature with watch collectors, enthusiasts and connoisseurs since its launch. It’s one of the world’s smallest watchmakers, located in a tiny shop in Iceland. Find out more at jswatch.com

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

4. Investing in the future of food

Faced with a growing world population and climate change, the food industry was already under strain even before Covid-19 struck. Looking ahead, however, the pandemic could actually help to revitalise it. If food producers and distributors move quickly to deploy advanced technology and innovation to meet the growing consumer appetite for healthier and more sustainable food, the industry will be fit to meet the demands of the 21st century. The Pictet-Nutrition fund directs capital to companies that help improve sustainability, access and the quality of food necessary for health and growth. To find out more about post-pandemic shifts in the food industry and the growing investment opportunity for investors, visit Pictet’s website

5. Invest in precious metals

As well as trading in bullion, Baird & Co offers CGT-exempt coins and produces its own bars in various sizes. Both can be used for investment purposes. Individual customers or businesses can purchase gold for an existing SIPP (self-invested personal pension) or SASS (small, self-administered scheme), which must be approved in advance by your pension’s administrator or trustee. The benefits to becoming a Baird & Co member include a loyalty scheme and price alerts. Customers can also take advantage of the Baird & Co buy-back scheme and buy and sell their allocation at competitive prices. With industrial products, numismatic coins and manufacturing materials such as casting grains, sheet, fancy wires, stampings and bespoke products, Baird & Co is one of the UK’s true all-round experts, and a one-stop shop for all your precious metal needs.

Baird & Co is the first gold refinery in the UK to bring 100% sustainable gold to market. It sources its feedstock from the secondary market, meaning that its bullion doesn't require additional extractive or environmentally damaging processes. In 2022, Baird aims to increase the proportion of its products that are 100% recycled and will be launching a sustainable bar range. In honour of the Queen’s Platinum Jubilee, Baird will be launching its Platinum Jubilee range. The company also won the prestigious Queen’s Award in 2018 for International Trade. Look out for the newly designed website, featuring an enhanced customer portal, stronger site security and improved customer support at bairdmint.com. You can also visit the store at 48 Hatton Garden, London EC1N 8EX or call 020 7474 1000

6. Move home with ease thanks to ERL

Do you feel your family home is now too large, but have no idea where to start on your moving journey? Enterprise Retirement Living (ERL) is pleased to offer a complimentary assisted move service available on spring reservations* to support you. ERL has teamed up with The Senior Move Partnership (TSMP) to help you and your family through the whole process, from organising or downsizing a lifetime of belongings to removals and arranging furniture for your new home. You just need to look forward to settling into your new home in an ERL retirement village. Learn more at erl.uk.com

*This complimentary package is based on up to 40 hours’ service by The Senior Move Partnership; any additional items (e.g. delivery costs, materials, other tradespeople’s charges) aren’t included; full terms and conditions available on request; ERL doesn’t receive any incentives or fees for third-party recommendations.

7. Boost your investments while avoiding risk

Oakmount & Partners has a simple aim – to optimise investment performance over the medium to long term without exposing customers to unnecessary risk. Offering compelling opportunities leading to 2025 and beyond, the company’s goal is to achieve a greater rate of return on investment for its clients while maintaining the same high level of personal and professional service it has continued to deliver for more than a decade. Oakmount & Partners provides premium-quality, asset-backed and secured investment opportunities with a strategic focus on clean energy, commodities, green mining, tech and IPOs. Contact the team for more information by calling 01279 874392. Subject to status, T&Cs apply. Visit oakmountpartners.com for more information

8. Find the right care for your loved ones

companiions is an award-winning mobile app that provides a simple, trusted and affordable way for busy people to arrange in-person, on-demand help and assistance for themselves and their loved ones. Finding the right person to support your children or parents can be inconvenient and time-consuming to manage, especially when balancing busy workloads and all the other responsibilities life brings. With companiions, you can choose from thousands of carefully vetted, rated and reviewed local helpers, who are ready and able to provide support when you can’t be there in person. From transportation and friendship to house tasks, the organisation’s companions are here to help your loved ones live a happy, independent life at home. Become an organiser at links.companiions.com/r6mh/TheWeek

9. Claim a stamp duty rebate with an expert team

If you’ve purchased a residential property within the past four years that was in very poor condition at the time of purchase, you may be entitled to a substantial refund from HMRC. Stamp Duty Claims could help you claim back money if you paid the Stamp Duty Land Tax surcharge. As HMRC reviews all applications for SDLT on a case-by-case basis, Stamp Duty Claims helps clients with an initial free consultation and can assess whether the property is likely to be considered uninhabitable for SDLT exemption or rebate purposes. A member of the team will then gather the evidence such as photographs, builders’ quotes, improvement notices and building surveys to build a strong application. Stamp Duty Claims has an expert team comprising tax consultants, chartered surveyors, accountants and legal advisers who specialise in SDLT refunds, no matter how complex. Find out more at stampdutyclaims.com

Investments can go down as well as up and past performance does not necessarily give a guide to the future. Your money may be at risk with some investments. Some products or services featured may not be regulated. You may wish to get independent advice before investing.

This content is brought to you by Living360, a new digital lifestyle destination keeping you up to date with health and fitness, food and drink, homes and gardens, beauty, travel, finance and lifestyle trends.

-

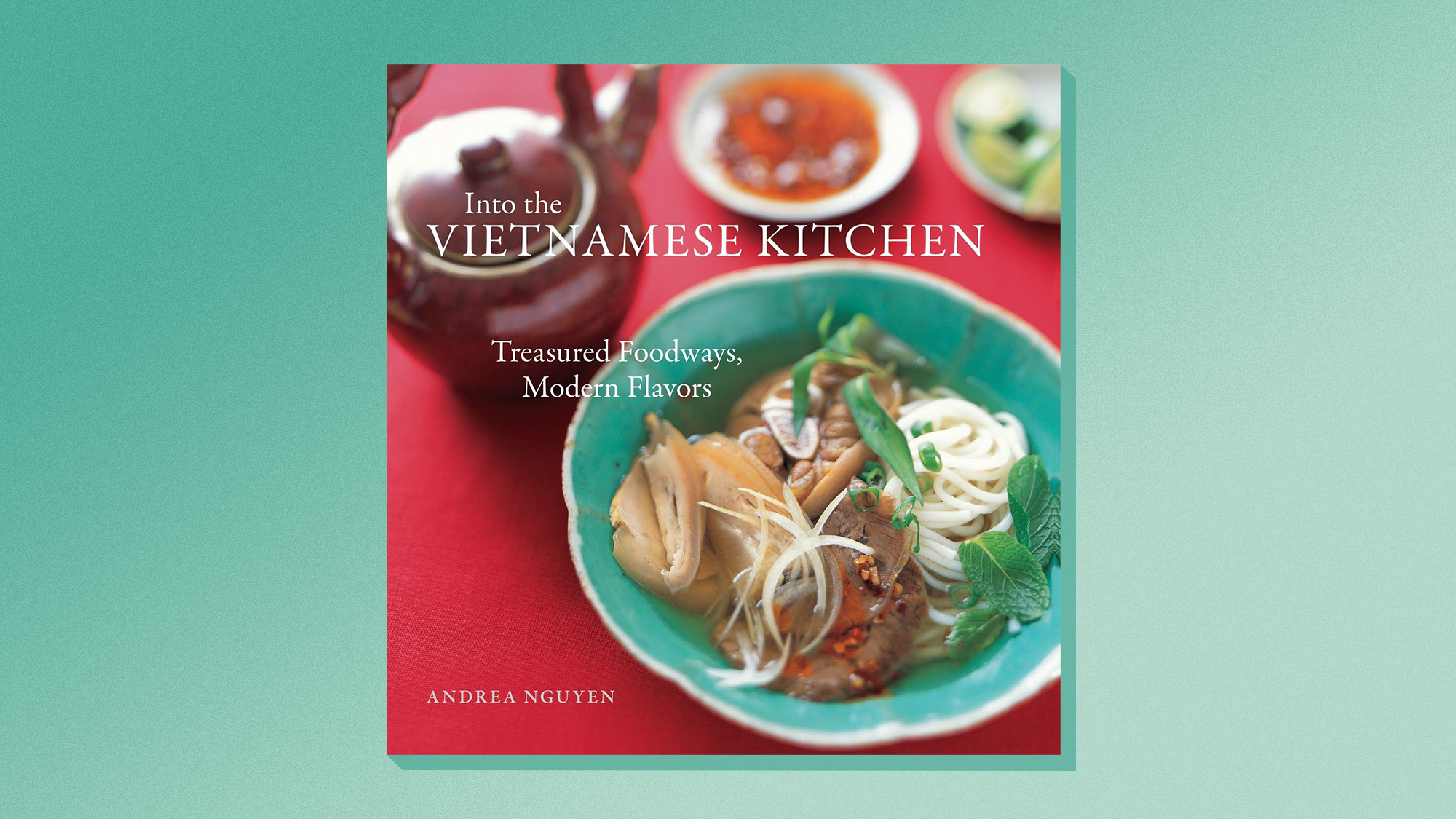

One great cookbook: ‘Into the Vietnamese Kitchen’

One great cookbook: ‘Into the Vietnamese Kitchen’the week recommends A world-class cuisine gets the proper treatment

-

‘Television and film can help model these safety measures’

‘Television and film can help model these safety measures’Instant Opinion Opinion, comment and editorials of the day

-

LS Lowry: The Unheard Tapes – a ‘fascinating’ portrait of an artist and his times

LS Lowry: The Unheard Tapes – a ‘fascinating’ portrait of an artist and his timesThe Week Recommends The programme stands as an ‘epitaph’ to the ‘vanished North’ of ‘industrial Manchester obliterated by the slum clearances’