Crypto crash: bitcoin drops to lowest point since November

Virtual currency falls 30% this week to $8,000

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Bitcoin suffered its third price crash in two weeks this morning, falling below the $8,000 (£5,700) per coin mark.

The cryptocurrency’s value has dropped by a total of 30% this week and is at its lowest price since November, Reuters reports. Other digital currencies, such as Ripple and Ethereum, have also suffered “double-digit declines in the last 24 hours”.

It is believed that Facebook’s decision to ban all cryptocurrency adverts from its network, and “a growing regulatory backlash” from countries such as China and South Korea, have led to mass sell-offs by investors over the past two weeks, the news site says.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The price crash is “a jarring turnaround” for the cryptocurrency market, says The Verge. Bitcoin reached an all-time high of $20,000 (£14,100) per coin in December.

However, according to The Independent, bitcoin is “still up 2,520% over the last year”, with the recent price crash “simply undoing all of the incredibly fast surge traders saw at the end of last year”.

Crypto crash: bitcoin and Ethereum plummet in value

The cryptocurrency market has dropped sharply over the past two days, with the value of popular coins including bitcoin and Ethereum dropping by up to 20%.

The crash has been attributed to the South Korean government’s new plans to “crack down” on virtual currency trading, which has led to “a sell-off across the market globally”, says BBC News.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Bitcoin’s value, which hit $20,000 (£14,500) per token in December, tumbled as low as $10,000 (£7,300) on Wednesday morning.

Ethereum and the bank-focused coin Ripple also plunged in value, says Reuters, as the news from South Korea fuelled “worries of a wider regulatory crackdown”.

Shuhei Fujise, an analyst at Alt Design, told the news site: “Cryptocurrencies could be capped in the current quarter ahead of G20 meeting in March, where policymakers could discuss tighter regulations.”

China and Germany have also indicated they are preparing crackdowns on digital currencies, The Daily Telegraph reports.

This is by no means the first crash to hit virtual coins. A similar slump occurred in September when China banned start-up cryptocurrencies - known as initial coin offerings (ICOs).

The market then rebounded, with digital tokens reaching record prices between December and the first week of January.

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

Why Trump pardoned crypto criminal Changpeng Zhao

Why Trump pardoned crypto criminal Changpeng ZhaoIn the Spotlight Binance founder’s tactical pardon shows recklessness is rewarded by the Trump White House

-

Bitcoin braces for a quantum computing onslaught

Bitcoin braces for a quantum computing onslaughtIN THE SPOTLIGHT The cryptocurrency community is starting to worry over a new generation of super-powered computers that could turn the digital monetary world on its head.

-

The noise of Bitcoin mining is driving Americans crazy

The noise of Bitcoin mining is driving Americans crazyUnder the Radar Constant hum of fans that cool data-centre computers is turning residents against Trump's pro-cryptocurrency agenda

-

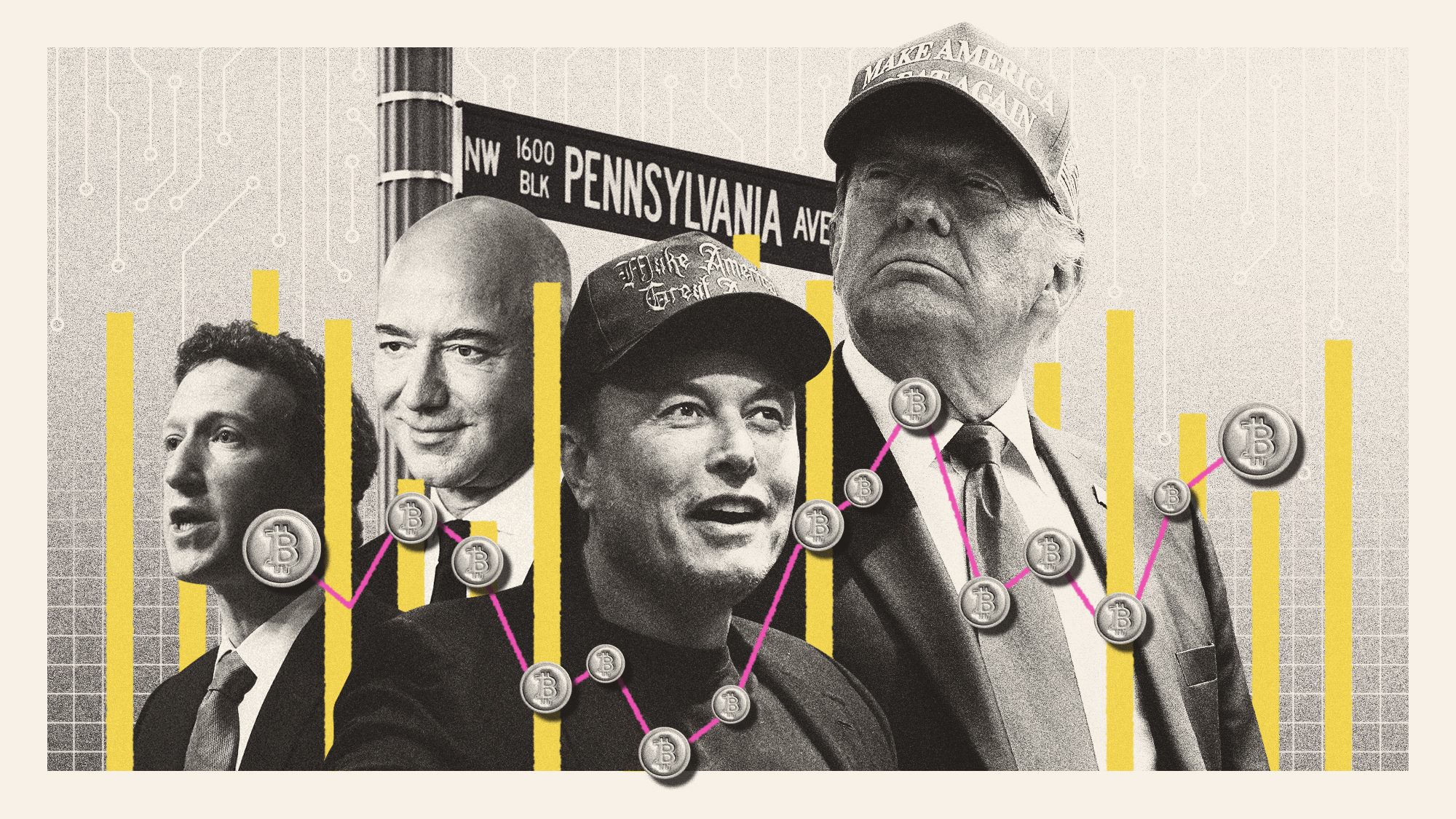

What Trump's win could mean for Big Tech

What Trump's win could mean for Big TechTalking Points The tech industry is bracing itself for Trump's second administration

-

Network states: the tech broligarchy who want to create new countries

Network states: the tech broligarchy who want to create new countriesUnder The Radar Communities would form online around a shared set of 'values' and acquire physical territory, becoming nations with their own laws

-

Paraguay's dangerous dalliance with cryptocurrency

Paraguay's dangerous dalliance with cryptocurrencyUnder The Radar Overheating Paraguayans are pushing back over power outages caused by illegal miners

-

2023: the year of crypto instability

2023: the year of crypto instabilityThe Explainer Crypto reached peaks — and valleys — throughout 2023

-

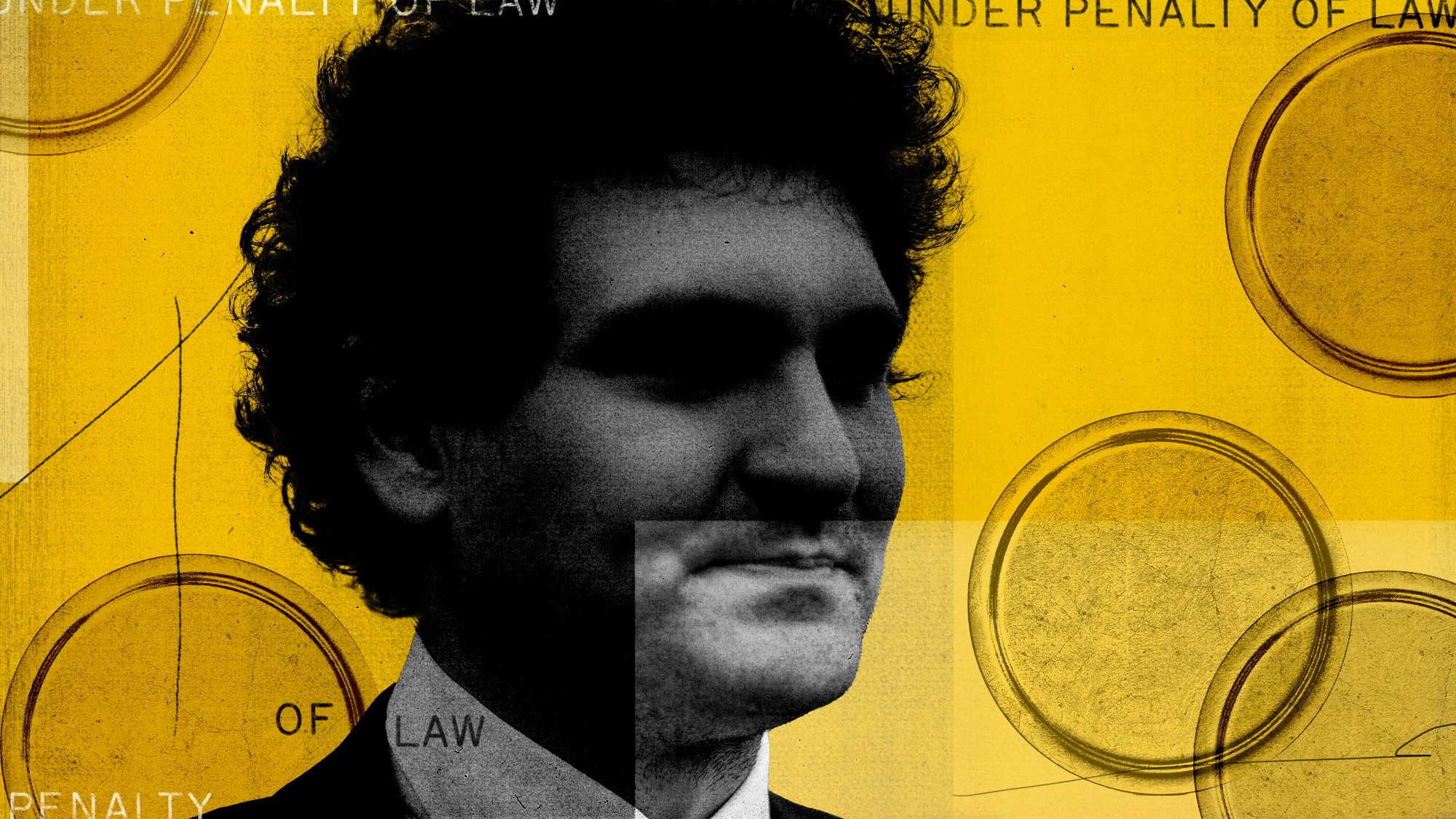

Sam Bankman-Fried found guilty: where does crypto go from here?

Sam Bankman-Fried found guilty: where does crypto go from here?Today's Big Question Conviction of the 'tousle-haired mogul' confirms sector's 'Wild West' and 'rogue' image, say experts